Balducci’s New York LLC

KB US Holdings Bankruptcy Filing Case Summary

Mon 08/24/2020 13:28 PM

Relevant Documents:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Bid Procedures Motion

First Day Hearing Agenda

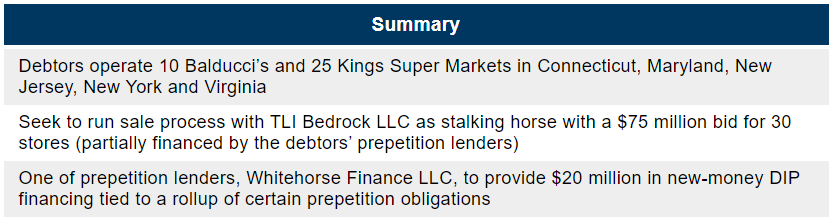

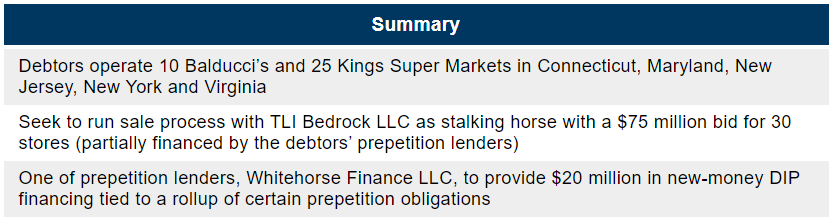

KB US Holdings Inc., the parent company of Balducci’s New York and Kings Food Markets, and several affiliates, which together operate 35 supermarkets across Connecticut, Maryland, New Jersey, New York and Virginia, filed for chapter 11 protection on Sunday night in the Bankruptcy Court for the Southern District of New York. The debtors seek to run a sale process, having chosen TLI Bedrock LLC as a stalking horse with a $75 million bid (which would be “partially financed by the Debtors’ prepetition lenders”) for 30 stores. The bid procedures provide for the sale of all of the debtors’ stores, whether or not a store is included in the stalking horse bid. The debtors say that they sought to engage with 98.6% equityholder GSSG Capital Corp. prepetition to obtain new capital or other alternatives to continue as a going concern that were not fruitful. However, one of the debtors’ prepetition lenders - Whitehorse Finance LLC - has agreed to provide $20 million in new-money DIP financing, plus $80 million of rollup last-out loans to refinance prepetition credit agreement outstanding amounts held by the DIP lenders. Continue reading for the First Day by Reorg team's comprehensive case summary of the KB US Holdings bankruptcy filing, and request a trial to access our coverage of thousands of other bankruptcy filings.

The stalking horse was unable to reach agreement under a required 30-day prepetition period with the debtors’ unions (representing 66% of the debtors’ employees at only the Kings’ stores) on a consensual deal with respect to labor and pension obligations. The APA requires the debtors to secure modification of collective bargaining agreements, either through negotiations or through Bankruptcy Code sections 1113 and 1114. Nonetheless, the debtors “remain hopeful” that a consensus can be reached.

The first day hearing has been scheduled for today, Monday, Aug. 24, at 4 p.m. ET.

As of July 25, the debtors’ unaudited consolidated financial statements reflect assets of $193.8 million and liabilities of $200.2 million, including $114.2 million in funded debt. The company’s prepetition capital structure includes:

The company attributes the bankruptcy filing to the “highly competitive” nature of the retail food industry in the New York and Washington metro areas, with pressure from local, regional, national and international supermarkets, “rapidly intensifying competition” from “well-capitalized online grocery giants,” such as Amazon and Target - which have “significant scale advantages over regional grocers” like the debtors - and local online grocers such as FreshDirect and meal-kit businesses such as Blue Apron and Hello Fresh. The company has also faced competitive challenges from “countless” full service, casual dining, fast casual and quick service restaurants, many of which offer free delivery. The density of the metro areas in which the debtors operate “further compound[s]” the competitive landscape of the debtors’ market, the first day declaration says. In addition, the debtors stress the competitive disadvantage they face due to their union exposure, with some of the company’s “most significant” competitors having no union obligations. The Covid-19 pandemic has further intensified the industry headwinds faced by the debtors, affecting the demand and supply sides of the business.

Prior to the Covid-19 pandemic, the debtors experienced historically low EBITDA as a result of the industry pressures discussed above. The reduced EBITDA increased the company’s leverage and imposed significant strains on liquidity and cash flows, the debtors say. The strain on the company’s liquidity has been exacerbated by the costs associated with labor and pension costs. “Although the Company’s liquidity has improved during the COVID-19 pandemic,” the debtors follow, “the Company recognizes that its current liquidity is only temporary, and that it must seek a permanent solution to address its historical liquidity constraints.”

Due to limited liquidity and excess leverage, multiple defaults under the prepetition credit agreement and an inability to pay cash interest to secured lenders, the debtors engaged Ankura Consulting Group and Proskauer Rose in November 2018, and in March 2019 the debtors, with the consent of majority equityholder GSSG, appointed two independent board members and began a marketing process through PJ Solomon.

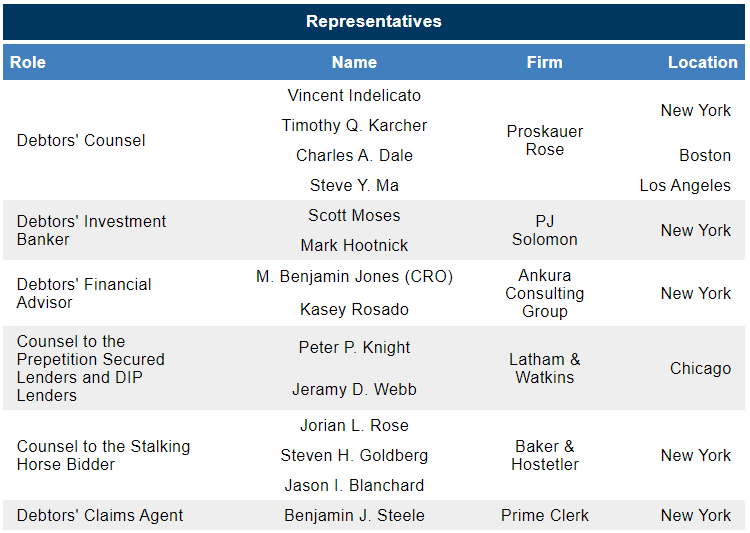

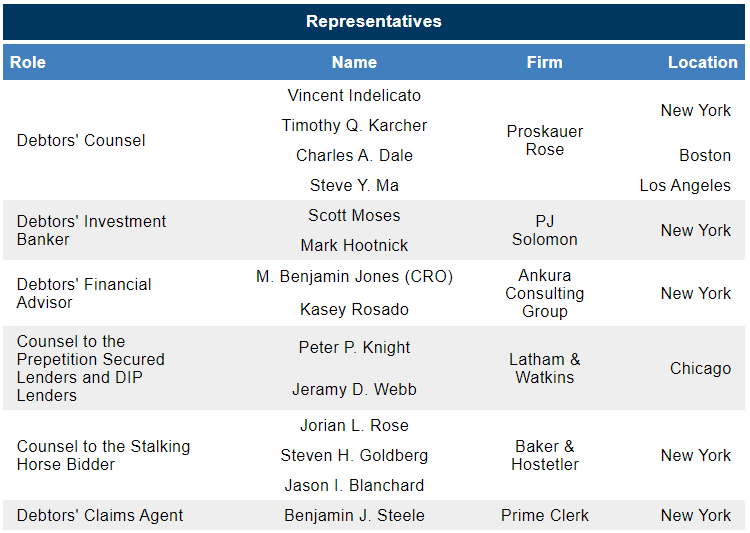

The debtors are represented by Proskauer Rose as counsel, Peter J. Solomon as investment banker and Ankura Consulting Group as financial advisor. M. Benjamin Jones and Kasey Rosado of Ankura are the chief restructuring officer and restructuring officer, respectively. Prime Clerk is the claims agent. The case has been assigned to Judge Sean H. Lane (case No. 20-22962).

Background

The debtors own the Kings Food Markets and Balducci’s upscale supermarket brands and operate 25 Kings locations and 10 Balducci’s locations in Connecticut, Maryland, New Jersey, New York and Virginia. Kings was founded in 1936 in Summit, N.J. In 2009, the company acquired Balducci’s, which was founded as a fruit-and-vegetable stand in Brooklyn, N.Y., in 1915.

The debtors have “over” 2,900 employees, of whom 66% are represented by unions. All of the debtors’ employees represented by unions are Kings employees (none of Balducci’s employees are represented by a union). The unions include United Food and Commercial Workers International Union Local 1245 (now known as Local No. 360), UFCW Local 464A, UFCW Local 1500, UFCW Local 342, and UFCW Local 371. The union wages and benefits have “historically driven down” the debtors’ profit margins. The debtors have multiemployer defined benefit pension plans (Local 1245 Labor-Management Pension Fund, UFCW Union Local 464A Pension Plan and UFCW Local 1500 Pension Fund) and a defined contribution retirement plans (UFCW Local 342 Savings and 40l(k) Plan and the Local 371 Annuity/401K Plan).

The debtors say that the following two plans are underfunded: Local 1245 Plan (with a $30.1 million withdrawal liability) and Local 150 Plan ($1 million withdrawal liability). The debtors’ aggregate contributions to the defined benefit pension plans total approximately $325,000 per month and for the defined contribution plans total $4,600 per month. The debtors also contribute to the following multiemployer health and welfare funds, for which aggregate contributions are $828,000 per month: the UFCW Local 342 Health Care Fund, Local 371 Health Fund, UFCW Local 464A Welfare Service Benefit Fund, Local 1245 Health Fund and UFCW Local 1500 Welfare Fund.

The debtors lease all of their stores from various third-party landlords, paying approximately $1.9 million per month in rent, real property taxes, common area maintenance and insurance.

For the 52 weeks ended July 25, the debtors generated $589.4 million of sales and gross profits of $236.4 million, with an adjusted EBITDA over the same period of $34.8 million and a loss of $8.6 million “as a result of depreciation, amortization, interest expense, and other operating costs associated with supporting their thirty-five (35) stores with a declining sales base prior to the beginning of the COVID-19 pandemic.”

Kings and Balducci’s are the latest supermarket chapter 11s after a pair of separate organic supermarket chains filed earlier this year: Lucky’s Market in January and Earth Fare in February. Lucky’s, which operated 10 locations in five states as of its petition date, cited profitability struggles after expanding into new markets where competing chains were also expanding, while Earth Fare, which ran 50 locations in 10 states as of the bankruptcy filing, noted “significant liquidity challenges” caused by unsuccessful remodeling and expansion efforts. In April, New York-based premium food and beverage products retailer Dean & DeLuca also filed chapter 11, which blamed the bankruptcy on “significant operating losses” and a liquidity shortfall following the brand’s acquisition by Pace Development in 2014. Although the consumer staples sector has seen a slight reduction chapter 11s in 2020 than in 2019 and 2018 year over year, year-to-date 2020 has 350% more consumer staples cases involving over $100 million in liabilities than in year-over-year 2019 and 3x as many as 2018.

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

Bid Procedures Motion

Through a prepetition process run by PJ Solomon that began in March 2019, the company contacted more than 114 potential buyers, of which 67 signed confidentiality agreements, four expressed a “serious interest” and two negotiated asset purchase agreements. Ultimately, the debtors chose TLI Bedrock as the stalking horse for 30 stores for $75 million. The stalking horse bid also includes one storage facility and one office at the company’s Parsippany, N.J., headquarters. None of the potential purchasers “has been willing to assume, in full, the Debtors’ pension liability obligations or other obligations related to the Debtors’ collective bargaining agreements.”

After entry into the stalking horse APA on July 13, the debtors stopped marketing the assets but say that the debtors will now continue to market the assets. The debtors propose a breakup fee of 3.5% ($2.625 million) and expense reimbursement up to $550,000 if the stalking horse bid is not the winning bid. In the alternative, the stalking horse would be entitled to an expense reimbursement up to $750,000 if the stalking horse purchase agreement is terminated in the event the sale order does not include certain findings of fact and conclusions of law related to the stalking horse bidder’s liability for union agreements and pension plans.

The stalking horse agreement and DIP financing is subject to the following milestones:

The debtors submitted the declaration of Scott Moses, managing director with PJ Solomon, in support of the bid procedures.

DIP Financing Motion

The debtors seek authority to enter into a DIP facility with Whitehorse Capital Management LLC as agent, consisting of a revolving credit facility in the aggregate principal not to exceed $20 million to be used to repay in full all outstanding prepetition first out obligations, excluding prepetition letters of credit, in an aggregate amount of $3 million. The facility also contemplates a sublimit of $5 million for the issuance of letters of credit used from and after the petition date and/or deemed replacement of any preposition letters of credit. On a final basis, the debtors propose a rollup of $80 million in prepetition term loan obligations.

The debtors say that “notwithstanding the Rollup Last Out Loans, the aggregate amount of senior secured debt will remain the same and all of the senior lenders will be eligible to, and are expected to, participate in the DIP Financing, including the Rollup Last Out Loans.”

The DIP financing bears interest at the eurodollar rate (subject to a 1% floor) plus 8% or the base rate (subject to a 1% floor) plus 7% per annum. The outstanding rollup last out loans bear interest at the eurodollar rate (subject to a 1% floor) plus 8% or the base rate (subject to a 1% floor) plus 7% per annum. The DIP facility bears a default interest rate of 2% and matures on Dec. 11.

According to the motion, the “Prepetition Secured Parties have consented to the Debtors incurring the DIP Facility and priming the Prepetition Liens.” The debtors propose a lien on avoidance action proceeds subject to the final order.

The facility includes various fees, including: (i) a closing fee for each DIP revolver lender equal to 2.5% of such DIP revolving lender’s commitment; (ii) an unused line fee equal to 1% per annum times the result of the DIP revolving loan commitment less the average daily balance of the DIP revolving loans that were outstanding during the immediately preceding month plus the average daily balance of the letter of credit usage during the immediately preceding month; (iii) letter of credit fee; (iv) agency fees of $50,000; and (v) reasonable fees and expenses of the DIP agent’s and DIP lenders’ attorneys, advisors, accountants and other consultants.

In support of the proposed DIP financing, the debtors filed the declaration of Mark Hootnick, managing director at PJ Solomon, in support of the DIP financing, who states that the DIP financing is critical in order to ensure that the debtors have sufficient liquidity to implement the proposed sale process to maximize value. Hootnick states that his team contacted approximately eight market participants to solicit proposals for a DIP facility. However, Hootnick reports that no offers were received other than from Whitehorse Capital. Hootnick states that considering the relatively small size and duration of the funding as well as the unlikelihood of the prepetition lenders consenting to the priming of their collateral, the proposed DIP is the best available.

The debtors also propose the consensual use of cash collateral. The company proposes adequate protection to its prepetition secured parties and DIP secured parties in the form of: (i) replacement liens; (ii) superpriority administrative claims; and (iii) adequate protection payments in cash consisting of the current payment of interest on the prepetition obligations at the applicable default rate and current payment in cash of reasonable and documented fees and expenses of the prepetition secured parties. In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b). The carve-out for professional fees are $500,000 for the debtors’ professionals and $100,000 for UCC professionals.

The UCC challenge period is 60 days from the entry of the final DIP order and 75 days for other parties in interest.

The proposed budget for the use of the DIP facility is HERE.

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Bid Procedures Motion

First Day Hearing Agenda

KB US Holdings Inc., the parent company of Balducci’s New York and Kings Food Markets, and several affiliates, which together operate 35 supermarkets across Connecticut, Maryland, New Jersey, New York and Virginia, filed for chapter 11 protection on Sunday night in the Bankruptcy Court for the Southern District of New York. The debtors seek to run a sale process, having chosen TLI Bedrock LLC as a stalking horse with a $75 million bid (which would be “partially financed by the Debtors’ prepetition lenders”) for 30 stores. The bid procedures provide for the sale of all of the debtors’ stores, whether or not a store is included in the stalking horse bid. The debtors say that they sought to engage with 98.6% equityholder GSSG Capital Corp. prepetition to obtain new capital or other alternatives to continue as a going concern that were not fruitful. However, one of the debtors’ prepetition lenders - Whitehorse Finance LLC - has agreed to provide $20 million in new-money DIP financing, plus $80 million of rollup last-out loans to refinance prepetition credit agreement outstanding amounts held by the DIP lenders. Continue reading for the First Day by Reorg team's comprehensive case summary of the KB US Holdings bankruptcy filing, and request a trial to access our coverage of thousands of other bankruptcy filings.

The stalking horse was unable to reach agreement under a required 30-day prepetition period with the debtors’ unions (representing 66% of the debtors’ employees at only the Kings’ stores) on a consensual deal with respect to labor and pension obligations. The APA requires the debtors to secure modification of collective bargaining agreements, either through negotiations or through Bankruptcy Code sections 1113 and 1114. Nonetheless, the debtors “remain hopeful” that a consensus can be reached.

The first day hearing has been scheduled for today, Monday, Aug. 24, at 4 p.m. ET.

As of July 25, the debtors’ unaudited consolidated financial statements reflect assets of $193.8 million and liabilities of $200.2 million, including $114.2 million in funded debt. The company’s prepetition capital structure includes:

- Secured debt:

- First lien prepetition credit agreement:

- Revolver (ACF Finco I LP as revolving agent): $3 million

- Term loan (Wilmington Trust as term loan agent): $111.2 million (including $10.7 million in interest)

- First lien prepetition credit agreement:

- Unsecured debt:

- Trade claims: $25 million ($4.2 million nonpriority)

- Equity: The debtors are privately held, and as of the petition date, KB US Holdings’ equity is held approximately 98.62% by a subsidiary of GSSG, with approximately 1.12% held by KB’s CEO Judith Spires and 0.26% held by former KB President and COO Richard Durante.

The company attributes the bankruptcy filing to the “highly competitive” nature of the retail food industry in the New York and Washington metro areas, with pressure from local, regional, national and international supermarkets, “rapidly intensifying competition” from “well-capitalized online grocery giants,” such as Amazon and Target - which have “significant scale advantages over regional grocers” like the debtors - and local online grocers such as FreshDirect and meal-kit businesses such as Blue Apron and Hello Fresh. The company has also faced competitive challenges from “countless” full service, casual dining, fast casual and quick service restaurants, many of which offer free delivery. The density of the metro areas in which the debtors operate “further compound[s]” the competitive landscape of the debtors’ market, the first day declaration says. In addition, the debtors stress the competitive disadvantage they face due to their union exposure, with some of the company’s “most significant” competitors having no union obligations. The Covid-19 pandemic has further intensified the industry headwinds faced by the debtors, affecting the demand and supply sides of the business.

Prior to the Covid-19 pandemic, the debtors experienced historically low EBITDA as a result of the industry pressures discussed above. The reduced EBITDA increased the company’s leverage and imposed significant strains on liquidity and cash flows, the debtors say. The strain on the company’s liquidity has been exacerbated by the costs associated with labor and pension costs. “Although the Company’s liquidity has improved during the COVID-19 pandemic,” the debtors follow, “the Company recognizes that its current liquidity is only temporary, and that it must seek a permanent solution to address its historical liquidity constraints.”

Due to limited liquidity and excess leverage, multiple defaults under the prepetition credit agreement and an inability to pay cash interest to secured lenders, the debtors engaged Ankura Consulting Group and Proskauer Rose in November 2018, and in March 2019 the debtors, with the consent of majority equityholder GSSG, appointed two independent board members and began a marketing process through PJ Solomon.

The debtors are represented by Proskauer Rose as counsel, Peter J. Solomon as investment banker and Ankura Consulting Group as financial advisor. M. Benjamin Jones and Kasey Rosado of Ankura are the chief restructuring officer and restructuring officer, respectively. Prime Clerk is the claims agent. The case has been assigned to Judge Sean H. Lane (case No. 20-22962).

Background

The debtors own the Kings Food Markets and Balducci’s upscale supermarket brands and operate 25 Kings locations and 10 Balducci’s locations in Connecticut, Maryland, New Jersey, New York and Virginia. Kings was founded in 1936 in Summit, N.J. In 2009, the company acquired Balducci’s, which was founded as a fruit-and-vegetable stand in Brooklyn, N.Y., in 1915.

The debtors have “over” 2,900 employees, of whom 66% are represented by unions. All of the debtors’ employees represented by unions are Kings employees (none of Balducci’s employees are represented by a union). The unions include United Food and Commercial Workers International Union Local 1245 (now known as Local No. 360), UFCW Local 464A, UFCW Local 1500, UFCW Local 342, and UFCW Local 371. The union wages and benefits have “historically driven down” the debtors’ profit margins. The debtors have multiemployer defined benefit pension plans (Local 1245 Labor-Management Pension Fund, UFCW Union Local 464A Pension Plan and UFCW Local 1500 Pension Fund) and a defined contribution retirement plans (UFCW Local 342 Savings and 40l(k) Plan and the Local 371 Annuity/401K Plan).

The debtors say that the following two plans are underfunded: Local 1245 Plan (with a $30.1 million withdrawal liability) and Local 150 Plan ($1 million withdrawal liability). The debtors’ aggregate contributions to the defined benefit pension plans total approximately $325,000 per month and for the defined contribution plans total $4,600 per month. The debtors also contribute to the following multiemployer health and welfare funds, for which aggregate contributions are $828,000 per month: the UFCW Local 342 Health Care Fund, Local 371 Health Fund, UFCW Local 464A Welfare Service Benefit Fund, Local 1245 Health Fund and UFCW Local 1500 Welfare Fund.

The debtors lease all of their stores from various third-party landlords, paying approximately $1.9 million per month in rent, real property taxes, common area maintenance and insurance.

For the 52 weeks ended July 25, the debtors generated $589.4 million of sales and gross profits of $236.4 million, with an adjusted EBITDA over the same period of $34.8 million and a loss of $8.6 million “as a result of depreciation, amortization, interest expense, and other operating costs associated with supporting their thirty-five (35) stores with a declining sales base prior to the beginning of the COVID-19 pandemic.”

Kings and Balducci’s are the latest supermarket chapter 11s after a pair of separate organic supermarket chains filed earlier this year: Lucky’s Market in January and Earth Fare in February. Lucky’s, which operated 10 locations in five states as of its petition date, cited profitability struggles after expanding into new markets where competing chains were also expanding, while Earth Fare, which ran 50 locations in 10 states as of the bankruptcy filing, noted “significant liquidity challenges” caused by unsuccessful remodeling and expansion efforts. In April, New York-based premium food and beverage products retailer Dean & DeLuca also filed chapter 11, which blamed the bankruptcy on “significant operating losses” and a liquidity shortfall following the brand’s acquisition by Pace Development in 2014. Although the consumer staples sector has seen a slight reduction chapter 11s in 2020 than in 2019 and 2018 year over year, year-to-date 2020 has 350% more consumer staples cases involving over $100 million in liabilities than in year-over-year 2019 and 3x as many as 2018.

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

Bid Procedures Motion

Through a prepetition process run by PJ Solomon that began in March 2019, the company contacted more than 114 potential buyers, of which 67 signed confidentiality agreements, four expressed a “serious interest” and two negotiated asset purchase agreements. Ultimately, the debtors chose TLI Bedrock as the stalking horse for 30 stores for $75 million. The stalking horse bid also includes one storage facility and one office at the company’s Parsippany, N.J., headquarters. None of the potential purchasers “has been willing to assume, in full, the Debtors’ pension liability obligations or other obligations related to the Debtors’ collective bargaining agreements.”

After entry into the stalking horse APA on July 13, the debtors stopped marketing the assets but say that the debtors will now continue to market the assets. The debtors propose a breakup fee of 3.5% ($2.625 million) and expense reimbursement up to $550,000 if the stalking horse bid is not the winning bid. In the alternative, the stalking horse would be entitled to an expense reimbursement up to $750,000 if the stalking horse purchase agreement is terminated in the event the sale order does not include certain findings of fact and conclusions of law related to the stalking horse bidder’s liability for union agreements and pension plans.

The stalking horse agreement and DIP financing is subject to the following milestones:

The debtors submitted the declaration of Scott Moses, managing director with PJ Solomon, in support of the bid procedures.

DIP Financing Motion

The debtors seek authority to enter into a DIP facility with Whitehorse Capital Management LLC as agent, consisting of a revolving credit facility in the aggregate principal not to exceed $20 million to be used to repay in full all outstanding prepetition first out obligations, excluding prepetition letters of credit, in an aggregate amount of $3 million. The facility also contemplates a sublimit of $5 million for the issuance of letters of credit used from and after the petition date and/or deemed replacement of any preposition letters of credit. On a final basis, the debtors propose a rollup of $80 million in prepetition term loan obligations.

The debtors say that “notwithstanding the Rollup Last Out Loans, the aggregate amount of senior secured debt will remain the same and all of the senior lenders will be eligible to, and are expected to, participate in the DIP Financing, including the Rollup Last Out Loans.”

The DIP financing bears interest at the eurodollar rate (subject to a 1% floor) plus 8% or the base rate (subject to a 1% floor) plus 7% per annum. The outstanding rollup last out loans bear interest at the eurodollar rate (subject to a 1% floor) plus 8% or the base rate (subject to a 1% floor) plus 7% per annum. The DIP facility bears a default interest rate of 2% and matures on Dec. 11.

According to the motion, the “Prepetition Secured Parties have consented to the Debtors incurring the DIP Facility and priming the Prepetition Liens.” The debtors propose a lien on avoidance action proceeds subject to the final order.

The facility includes various fees, including: (i) a closing fee for each DIP revolver lender equal to 2.5% of such DIP revolving lender’s commitment; (ii) an unused line fee equal to 1% per annum times the result of the DIP revolving loan commitment less the average daily balance of the DIP revolving loans that were outstanding during the immediately preceding month plus the average daily balance of the letter of credit usage during the immediately preceding month; (iii) letter of credit fee; (iv) agency fees of $50,000; and (v) reasonable fees and expenses of the DIP agent’s and DIP lenders’ attorneys, advisors, accountants and other consultants.

In support of the proposed DIP financing, the debtors filed the declaration of Mark Hootnick, managing director at PJ Solomon, in support of the DIP financing, who states that the DIP financing is critical in order to ensure that the debtors have sufficient liquidity to implement the proposed sale process to maximize value. Hootnick states that his team contacted approximately eight market participants to solicit proposals for a DIP facility. However, Hootnick reports that no offers were received other than from Whitehorse Capital. Hootnick states that considering the relatively small size and duration of the funding as well as the unlikelihood of the prepetition lenders consenting to the priming of their collateral, the proposed DIP is the best available.

The debtors also propose the consensual use of cash collateral. The company proposes adequate protection to its prepetition secured parties and DIP secured parties in the form of: (i) replacement liens; (ii) superpriority administrative claims; and (iii) adequate protection payments in cash consisting of the current payment of interest on the prepetition obligations at the applicable default rate and current payment in cash of reasonable and documented fees and expenses of the prepetition secured parties. In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b). The carve-out for professional fees are $500,000 for the debtors’ professionals and $100,000 for UCC professionals.

The UCC challenge period is 60 days from the entry of the final DIP order and 75 days for other parties in interest.

The proposed budget for the use of the DIP facility is HERE.

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case No. 20-22962.

- Motion to pay employee wages and benefits

- The debtors estimate that they owe approximately $2.3 million on account of unpaid wages and salaries, $590,000 with respect to payroll taxes, $25,000 to temp agencies CoSource, Accountemps and Aston Carter, $10,000 on account of independent contractor obligations, $25,000 with respect to reimbursable expenses, $35,000 under corporate credit card expenses, $825,000 under union benefit plans, $375,000 under non-union employee benefit plans, $325,000 on account of non-union medical plans, $15,000 on account of non-union dental plans, $700 on account of non-union vision plans premiums, $500 with respect to administrative fees related to flexible spending accounts and $325,000 on account of contributions under the UFCW Pension programs.

- Motion to pay critical vendors

- The debtors seek approval to pay up to $11 million on account of critical vendor claims, or 55% of the debtors’ total accrued payables. Approximately 94% of the critical vendor claims for which the debtors are seeking payment may be entitled to priority under section 503(b)(9).

- Motion to pay shipping and warehousing claims

- The company seeks to pay up to $175,000 on account of shipping charges, up to $1.6 million with respect to miscellaneous claims and approximately $5 million of PACA/PASA claims.

- Motion to use cash management system

- The company has 57 bank accounts with Bank of America. Of the 57 accounts, 35 are store deposit accounts for each store.

- Motion to maintain insurance programs

- Motion to maintain trust programs and release certain funds held in trust

- Motion to pay taxes and fees

- The debtors estimate that they owe approximately $650,000 with respect to sales and use taxes, $35,000 on account of franchise taxes, $25,000 of direct real property taxes that will be due within 21 days of the petition date, $25,000 with respect to personal property taxes that will be due within 21 days of the petition date and $70,000 on account of taxes classified as “other,” with $15,000 coming due within 21 days of the petition date.

- Motion to provide utilities with adequate assurance

- Motion to honor customer programs

- The company has approximately $661,000 in issued gift cards outstanding: $446,000 for Kings stores and $215,000 for Balducci’s stores.

- Motion to implement notice and case management procedures

- Motion to file consolidated creditors lists and redact certain personal identification information

- Motion to extend the schedules/statements deadline to Oct. 6

- Application to appoint Prime Clerk as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.