SAExploration Holdings

SAExploration Bankruptcy Filing Case Summary

Fri 08/28/2020 13:58 PM

Relevant Documents:

Voluntary Petition

First Day Declaration

Plan of Reorganization / Disclosure Statement

DS Approval Order

Cash Collateral Motion

Backstop Agreement Motion

Press Release

First Day Hearing Agenda

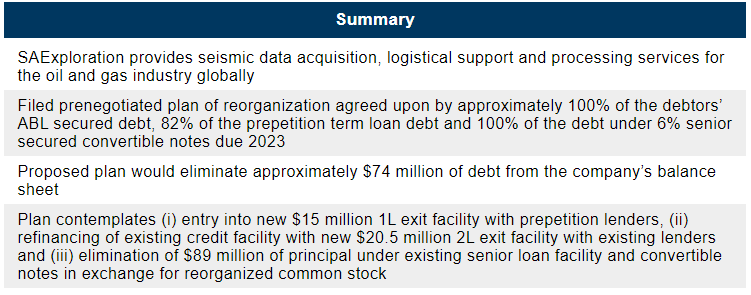

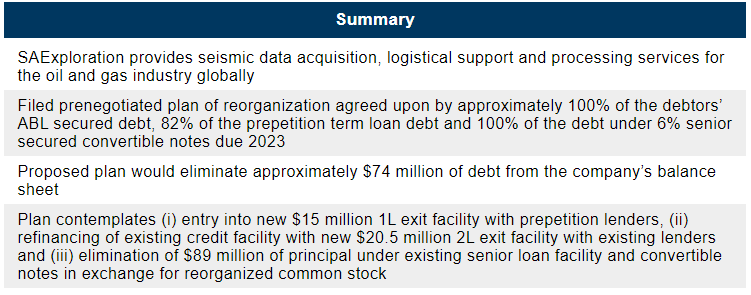

SAExploration Holdings, a Houston-based provider of seismic data acquisition, logistical support and processing services for the global oil and natural gas industry, and four affiliates filed for chapter 11 protection early this morning in the Bankruptcy Court for the Southern District of Texas. The prenegotiated cases would be effectuated through a plan of reorganization agreed to by holders of approximately 100% of the debtors’ ABL secured debt, 82% of the prepetition term loan debt and 100% of the secured debt under 6% senior secured convertible notes due 2023, pursuant to a restructuring support agreement. According to a press release, the parties to the RSA also hold in the aggregate approximately 67.4% of the outstanding equity interests of the company (including outstanding warrants, but excluding outstanding the convertible notes) on a fully diluted basis. The proposed plan of reorganization would eliminate approximately $74 million in debt from the company’s balance sheet. The debtors say that they intend to emerge from chapter 11 before the end of November.

Pursuant to the plan, the prepetition ABL lenders would exchange their debt for $20.5 million of principal amount of the second lien exit facility, have the option to purchase pursuant to a rights offering up to their pro rata share of 78% of the principal amount of the term loans under the first lien exit facility and the new first lien exit facility equity and payment in full in cash on the effective date of all accrued interest as of the effective date. The prepetition term loan lenders would exchange their debt for a pro rata share of 60% of the new equity under the plan, subject to dilution by the (a) new first lien exit facility equity, (b) new equity issued pursuant to the first lien exit facility put option premium and (c) the management incentive plan, and would also have the right to purchase pursuant to the rights offering up to their pro rata share of 12.5% of the term loans under the first lien exit facility and the new first lien exit facility equity. The prepetition convertible noteholders would exchange their debt for (i) a pro rata share of 40% of the new equity (subject to dilution by the new first lien exit facility equity, new equity issued pursuant to the first lien exit facility put option premium and the management incentive plan), (ii) the right to purchase pursuant to the rights offering up to their pro rata share of 9.5% of the term loans under the first lien exit facility and the new first lien exit facility equity.

The plan contemplates (i) the entry into a new first lien exit facility in an aggregate principal amount of $15 million with lenders under the existing ABL and term loan facilities and convertible notes, (ii) the refinancing of the existing credit facility with a new second lien exit facility in an aggregate principal amount of $20.5 million with the existing lenders, and (iii) the elimination of $89 million of principal plus accrued interest with respect to the existing senior loan facility and the convertible notes, in exchange for new common stock to be issued by the reorganized company (subject to dilution by “(x) new common stock to be issued to the lenders under the new first lien exit facility that will represent 95% of the outstanding new common stock to be issued by the reorganized Company, and (y) new common stock to be issued to the parties backstopping the new first lien exit facility that will represent 2.5% of the outstanding new common stock to be issued by the reorganized Company”). The release indicates that the new common stock to be issued by the reorganized company will be subject to further dilution by new common stock to be issued by the reorganized company in connection with a management incentive plan that would reserve 9.5% of the common stock. The plan also contemplates a cash pot of $100,000 for general unsecured claims.

The debtors propose a rights offering through which all eligible prepetition ABL lenders, term loan lenders and convertible noteholders would be offered the opportunity to purchase loans to be advanced under the first lien exit facility and equity in reorganized SAE, to be backstopped by certain of the consenting lenders and noteholders. The debtors seek to assume a backstop agreement and approve related obligations, including a backstop commitment premium in the form of new equity equal to 2.5% of the new equity, subject to dilution by the management incentive plan. The equity in the reorganized company pursuant to the rights offering (by which the debtors would raise $15 million of new capital) would constitute 95% of the new common equity, and proceeds of the rights offering would be used to fund plan distributions, administrative expenses and provide working capital for general corporate purposes. Pursuant to the RSA, certain of the consenting lenders and noteholders have agreed to fund the first lien exit facility and to backstop the rights offering.

Signatories to the RSA consist of consenting ABL lenders Whitebox, BlueMountain, Highbridge, John Pecora, Amzak, Jeff Hastings, DuPont Capital Management Corp., consenting term loan lenders WBOX 2015-7 Ltd., BlueMountain, John Pecora, Amzak, and consenting convertible noteholders Whitebox, BlueMountain, Highbridge, John Pecora, Amzak, Jeff Hastings and DuPont Capital Management Corp. Backstop commitment parties include Whitebox, BlueMountain, Highbridge, Amzak, DuPont Capital Management Corp., Jeff Hastings and John Pecora.

The first day hearing has been scheduled for today, Friday, Aug. 28, at 2:30 p.m. ET. The court docket can be found on Reorg HERE.

The company reports $1 million to $10 million in assets and $100 million to $500 million in liabilities. The company’s prepetition capital structure includes:

Forbearance agreements with respect to the ABL and term loans and the convertible notes terminated upon the commencement of the cases. The company reported on Aug. 14 that it had been unable to negotiate extensions and waivers for various of its outstanding debt.

“Due to the significant uncertainty in the outlook for oil and natural gas development as a result of the significant decline in oil prices since the beginning of 2020 due to the COVID-19 coronavirus pandemic and its impact on the worldwide economy and global demand for oil,” Faust writes in the first day declaration, “the Debtors’ project visibility has continued to deteriorate as certain of their scheduled and anticipated projects have recently been cancelled or delayed and there is no assurance as to when they may be reinitiated or awarded, if at all.” The debtors note their inability to predict when market conditions may improve and stress that worsening overall market conditions could result in additional reductions of backlog and bids outstanding.

Although SAE generated net income and cash from operating activities in the first six months of 2020, the company has suffered recurring losses from operations and has not generated cash from operating activities for the six years ended Dec. 31, 2019, and, as of June 30, 2020, the debtors had a stockholders’ deficit of $33.2 million. The debtors say that they anticipate negative cash flows from operating activities to begin to occur again in the second half of 2020 and continue “for the foreseeable future.”

From 2018 to 2020, the debtors took the following actions, among others, to increase liquidity, reduce debt levels and extend debt maturities: (i) consummated an exchange offer and consent solicitation through which the majority of the then outstanding amount of SAE’s 10% senior secured notes due 2019 and 10% senior notes due 2019 were exchanged, reducing cash interest expense and the amount due at maturity; (ii) entered into the prepetition credit agreement and issued the prepetition convertible notes; (iii) sold assets related to the debtors’ Australia business for (a) $6 million (AUD) paid in cash on the closing date, (b) $600,000 (AUD) payable no later than 30 business days after the closing date and (iii) earn-out payments based on the utilization of certain of the sold assets following the closing date in an amount of up to $3 million (AUD), with a minimum earn-out payment of $750,000 (AUD) in each of the two earn-out years; (iv) sold seismic data and related assets with respect to surveys known as Aklaq, Kuukpik and CRD for $15 million and repaid $14.5 million of the amount due under the prepetition credit agreement with the proceeds received from the sale of the seismic data; (v) reduced full-time employees by 30% since year-end 2019; and (vi) applied for and received the $6.8 million unsecured PPP loan under the CARES Act.

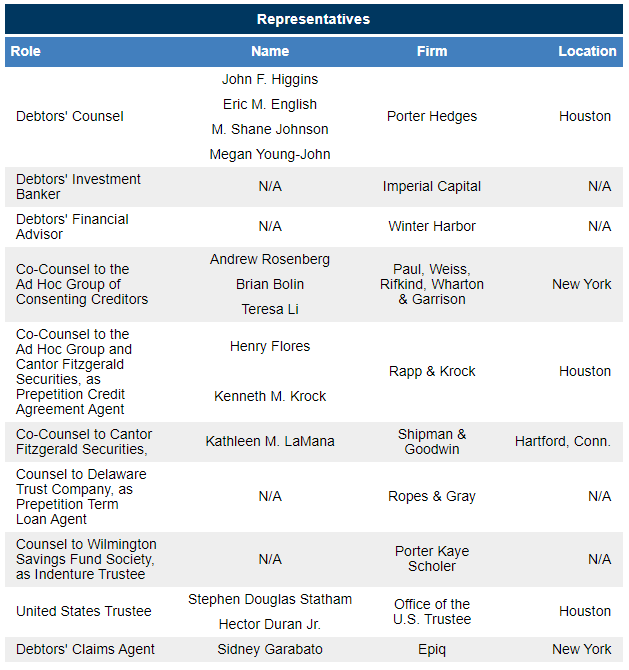

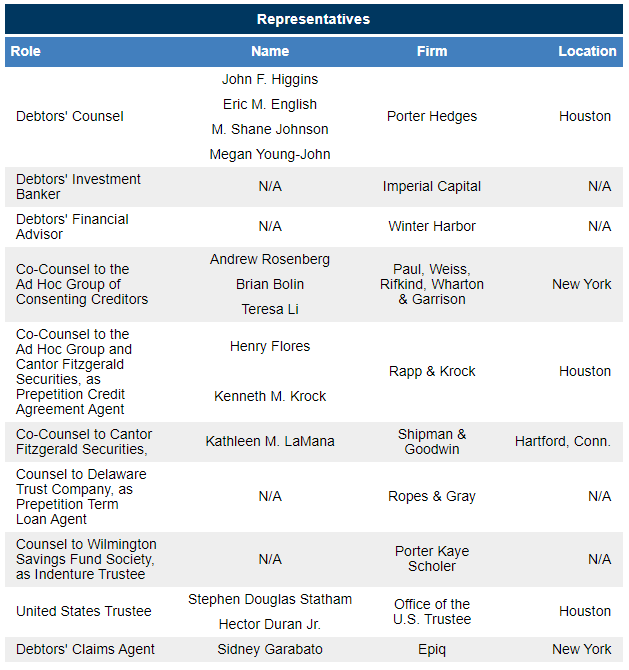

The debtors are represented by Porter Hedges as bankruptcy counsel, and Imperial Capital LLC and Winter Harbor LLC as investment banker, financial advisor and consultant advisor, as applicable. Epiq has been retained as claims and noticing agent. The case has been assigned to Judge Marvin Isgur (case No. 20-34306).

Background

SAExploration is a full-service global provider of seismic data acquisition, logistical support and processing services for the oil and natural gas industry, operating through wholly owned subsidiaries, branch offices and variable interest entities in North America, South America, Asia Pacific, West Africa and the Middle East. In addition to the acquisition of 2D, 3D, time-lapse 4D and multi-component seismic data on land, transition zones between land and water and offshore in depths reaching 3,000 meters, the debtors offer a suite of logistical support and data processing services, utilizing proprietary, patented software. The debtors, along with their nondebtor affiliates, currently employ 132 full-time employees.

SAE specializes in the acquisition of seismic data in logistically complex and challenging environments and delicate ecosystems, including jungle, mountain, arctic and subaquatic terrains.

The debtors operate crews around the world that are currently supported by more than 160,000 owned land channels of seismic data acquisition equipment and other leased equipment. The SAE’s seismic data is used by major integrated oil companies, national oil companies and independent oil and gas exploration and production companies. While the results of the seismic surveys the debtors conduct generally belong to their customers and are proprietary in nature, Alaskan Seismic Ventures LLC, “a related party variable interest entity,” currently maintains a multi-client seismic data library of approximately 440 square kilometers in certain basins in Alaska, which is available for future sale or license.

As of the petition eate, the debtors had approximately $65.3 million of backlog under contract, in addition to approximately $977.6 million of bids outstanding. Of the $65.3 million of backlog under contract, the debtors expect $2 million to be completed in 2020.

While the last several years have seen a decline in demand, the North American market has historically been a stable and sustainable market for 3D seismic data acquisition, the debtors say, with producers seeking to maximize efficiency through the use of 3D technology. The economies in South American countries continue to expand and develop, demanding significantly more energy to fuel their growth, according to the debtors. As the political environments stabilize, oil companies are increasing operations in the market and are seeking the help of experienced seismic service providers. The debtors note that, while the global oil and natural gas industry downturn has significantly impacted exploration activity in South America, particularly during 2019 and 2018, Brazil is projected to show strong growth in the marine-based market. However, while some improvements in the level of customer interest can be seen by an increase in inquiries and subsequent tenders, “no assurance can be given that this will result in increased activity or that future decreases in activity will not occur again.”

Exploration activities in Asia-Pacific have declined recently with lower commodity prices but there is a steady demand for energy in the region. The debtors expect the Asia Pacific market to continue to be a predominantly marine-based market in the current commodity price environment. This trend is expected to continue as long as customers remain hesitant to commit capital to large onshore projects that are more exploration-driven. Historically, the West Africa region has presented numerous offshore marine opportunities, the debtors say, with offshore marine seismic activity increasing recently in the region. These projects are more focused on production-enhancement initiatives than new exploration. Despite the current instability of the macroeconomy with respect to the oil and natural gas industry downturn, the debtors say that they “expect overall offshore marine seismic activity to continue to improve in the near to medium-term future.”

SAE’s corporate organizational structure is shown below:

The debtors' largest unsecured creditors are listed below:

Plan of Reorganization / Disclosure Statement

The debtors propose the following confirmation-related timeline:

Deadlines with respect to the rights offering follow:

Treatment of Claims and Interests

The debtors’ plan sets forth the following classification of and proposed distributions to holders of allowed claims and interests:

Management Incentive Plan

The management incentive plan would reserve up to 9% of common stock.

First Lien Exit Facility

The plan contemplates a $15 million senior secured first lien term loan exit facility, with an agent to be determined and lenders consisting of backstop lenders and other rights offering participants. The facility would bear interest at 12.75%, with 2% added for the default rate, and would mature on the third anniversary of the effective date. The backstop lenders would receive a premium payable in the reorganized equity in an amount equal to 2.5% of the issued and outstanding fully diluted common equity, subject to dilution on account of the MIP.

Second Lien Exit Facility

The debtors also propose a senior secured second lien term loan that would bear interest at 3.4%, with 2% added for the default rate, and mature on the fourth anniversary of the effective date. The agent is to be determined, and lenders include each prepetition credit agreement lender

Other Plan Provisions

The plan provides for customary releases for the debtors, reorganized debtors, consenting creditors, parties to the exit facilities, any member of an appointed official committee of unsecured creditors, agents under the debtors’ prepetition lending facilities and releasing parties, as well as the affiliates, officers, directors, professionals and other related parties. In addition, the plan includes an exculpation provision in favor of the debtors and reorganized debtors, as well as the affiliates, officers, directors, professionals and other related parties.

Under the plan, the current term for the members of the board of directors, members and managers of each of the debtors will automatically expire on the effective date of the plan. The initial members of the new parent company board and other company boards, as well as persons serving as company officers, will be disclosed, to the extent known, in a plan supplement which is to be filed no later than seven days before the proposed Oct. 19 plan voting deadline.

Liquidation Analysis

The liquidation analysis, based on a hypothetical liquidation under chapter 7 of the Bankruptcy Code and assuming an Oct. 27 conversion date, is below:

Financial Projections

The DS also includes the following financial projections for the period Jan. 1, 2021, through Dec. 31, 2025:

Valuation Analysis

The DS provides for a valuation analysis with an enterprise valuation, prepared by Imperial Capital as investment banker, of a range of approximately $52.6 million to $80.3 million, with a midpoint of $66.4 million, assuming a Nov. 10 effective date.

Cash Collateral Motion

The company seeks the use of cash collateral, proposing the following adequate protection to its prepetition ABL, term loan and convertible note creditors: adequate protection liens on all of the debtors’ present and after-acquired property and assets, not subject to valid and unavoidable prepetition liens; superpriority administrative expense claims against all debtors on a joint and several basis, subject only to the carve-out and reasonable and documented fees of the professionals of the prepetition agents and the ad hoc of prepetition ABL, term loan and convertible note holders; as well as obligating the debtors to reporting requirements and record access to the ad hoc group.

The proposed order also provides for various stipulations as to the perfection and validity of prepetition obligations owing to prepetition lenders, as well as customary releases for the prepetition secured parties, their agents and professionals.

The superpriority claim includes claims against the proceeds of avoidance action, though this provision is subject to the entry of a final order, and the lenders must exhaust all other collateral before seeking recourse against the avoidance action proceeds.

In addition, subject to the entry of a final order, the debtors propose a waiver of the estate’s right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carve-out for professional fees is $500,000.

The challenge period provided for in the proposed order runs from 60 days from the date of formation of any official committee of unsecured creditors appointed in the debtors’ chapter 11 cases or 75 days from the entry of an interim order authorizing the use of cash collateral for any other party.

The proposed budget for the use of cash collateral is HERE.

The use of cash collateral is subject to the following milestones:

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

First Day Declaration

Plan of Reorganization / Disclosure Statement

DS Approval Order

Cash Collateral Motion

Backstop Agreement Motion

Press Release

First Day Hearing Agenda

SAExploration Holdings, a Houston-based provider of seismic data acquisition, logistical support and processing services for the global oil and natural gas industry, and four affiliates filed for chapter 11 protection early this morning in the Bankruptcy Court for the Southern District of Texas. The prenegotiated cases would be effectuated through a plan of reorganization agreed to by holders of approximately 100% of the debtors’ ABL secured debt, 82% of the prepetition term loan debt and 100% of the secured debt under 6% senior secured convertible notes due 2023, pursuant to a restructuring support agreement. According to a press release, the parties to the RSA also hold in the aggregate approximately 67.4% of the outstanding equity interests of the company (including outstanding warrants, but excluding outstanding the convertible notes) on a fully diluted basis. The proposed plan of reorganization would eliminate approximately $74 million in debt from the company’s balance sheet. The debtors say that they intend to emerge from chapter 11 before the end of November.

Pursuant to the plan, the prepetition ABL lenders would exchange their debt for $20.5 million of principal amount of the second lien exit facility, have the option to purchase pursuant to a rights offering up to their pro rata share of 78% of the principal amount of the term loans under the first lien exit facility and the new first lien exit facility equity and payment in full in cash on the effective date of all accrued interest as of the effective date. The prepetition term loan lenders would exchange their debt for a pro rata share of 60% of the new equity under the plan, subject to dilution by the (a) new first lien exit facility equity, (b) new equity issued pursuant to the first lien exit facility put option premium and (c) the management incentive plan, and would also have the right to purchase pursuant to the rights offering up to their pro rata share of 12.5% of the term loans under the first lien exit facility and the new first lien exit facility equity. The prepetition convertible noteholders would exchange their debt for (i) a pro rata share of 40% of the new equity (subject to dilution by the new first lien exit facility equity, new equity issued pursuant to the first lien exit facility put option premium and the management incentive plan), (ii) the right to purchase pursuant to the rights offering up to their pro rata share of 9.5% of the term loans under the first lien exit facility and the new first lien exit facility equity.

The plan contemplates (i) the entry into a new first lien exit facility in an aggregate principal amount of $15 million with lenders under the existing ABL and term loan facilities and convertible notes, (ii) the refinancing of the existing credit facility with a new second lien exit facility in an aggregate principal amount of $20.5 million with the existing lenders, and (iii) the elimination of $89 million of principal plus accrued interest with respect to the existing senior loan facility and the convertible notes, in exchange for new common stock to be issued by the reorganized company (subject to dilution by “(x) new common stock to be issued to the lenders under the new first lien exit facility that will represent 95% of the outstanding new common stock to be issued by the reorganized Company, and (y) new common stock to be issued to the parties backstopping the new first lien exit facility that will represent 2.5% of the outstanding new common stock to be issued by the reorganized Company”). The release indicates that the new common stock to be issued by the reorganized company will be subject to further dilution by new common stock to be issued by the reorganized company in connection with a management incentive plan that would reserve 9.5% of the common stock. The plan also contemplates a cash pot of $100,000 for general unsecured claims.

The debtors propose a rights offering through which all eligible prepetition ABL lenders, term loan lenders and convertible noteholders would be offered the opportunity to purchase loans to be advanced under the first lien exit facility and equity in reorganized SAE, to be backstopped by certain of the consenting lenders and noteholders. The debtors seek to assume a backstop agreement and approve related obligations, including a backstop commitment premium in the form of new equity equal to 2.5% of the new equity, subject to dilution by the management incentive plan. The equity in the reorganized company pursuant to the rights offering (by which the debtors would raise $15 million of new capital) would constitute 95% of the new common equity, and proceeds of the rights offering would be used to fund plan distributions, administrative expenses and provide working capital for general corporate purposes. Pursuant to the RSA, certain of the consenting lenders and noteholders have agreed to fund the first lien exit facility and to backstop the rights offering.

Signatories to the RSA consist of consenting ABL lenders Whitebox, BlueMountain, Highbridge, John Pecora, Amzak, Jeff Hastings, DuPont Capital Management Corp., consenting term loan lenders WBOX 2015-7 Ltd., BlueMountain, John Pecora, Amzak, and consenting convertible noteholders Whitebox, BlueMountain, Highbridge, John Pecora, Amzak, Jeff Hastings and DuPont Capital Management Corp. Backstop commitment parties include Whitebox, BlueMountain, Highbridge, Amzak, DuPont Capital Management Corp., Jeff Hastings and John Pecora.

The first day hearing has been scheduled for today, Friday, Aug. 28, at 2:30 p.m. ET. The court docket can be found on Reorg HERE.

The company reports $1 million to $10 million in assets and $100 million to $500 million in liabilities. The company’s prepetition capital structure includes:

- Secured debt:

- ABL credit agreement (Cantor Fitzgerald Securities as agent): $20.5 million

- Term loan (Delaware Trust Co. as agent): $29 million

- 6% senior secured convertible notes due 2023 (Wilmington Savings Funds Society as trustee): $60 million

- GTC Inc. equipment loan: $8.2 million

- Unsecured debt:

- Trade debt: Less than $3 million

- PPP loan: $6.8 million

- Equity: SAE’s common stock is traded on electronic bulletin boards such as the OTC Bulletin Board or OTC Markets Pink Open Market, since the stock was delisted from Nasdaq. SAE had approximately 35.4 million warrants outstanding as of the petition date, potentially exercisable into approximately 2.3 million shares of common stock of SAE. The prepetition convertible notes also have the right to convert to equity.

Forbearance agreements with respect to the ABL and term loans and the convertible notes terminated upon the commencement of the cases. The company reported on Aug. 14 that it had been unable to negotiate extensions and waivers for various of its outstanding debt.

“Due to the significant uncertainty in the outlook for oil and natural gas development as a result of the significant decline in oil prices since the beginning of 2020 due to the COVID-19 coronavirus pandemic and its impact on the worldwide economy and global demand for oil,” Faust writes in the first day declaration, “the Debtors’ project visibility has continued to deteriorate as certain of their scheduled and anticipated projects have recently been cancelled or delayed and there is no assurance as to when they may be reinitiated or awarded, if at all.” The debtors note their inability to predict when market conditions may improve and stress that worsening overall market conditions could result in additional reductions of backlog and bids outstanding.

Although SAE generated net income and cash from operating activities in the first six months of 2020, the company has suffered recurring losses from operations and has not generated cash from operating activities for the six years ended Dec. 31, 2019, and, as of June 30, 2020, the debtors had a stockholders’ deficit of $33.2 million. The debtors say that they anticipate negative cash flows from operating activities to begin to occur again in the second half of 2020 and continue “for the foreseeable future.”

From 2018 to 2020, the debtors took the following actions, among others, to increase liquidity, reduce debt levels and extend debt maturities: (i) consummated an exchange offer and consent solicitation through which the majority of the then outstanding amount of SAE’s 10% senior secured notes due 2019 and 10% senior notes due 2019 were exchanged, reducing cash interest expense and the amount due at maturity; (ii) entered into the prepetition credit agreement and issued the prepetition convertible notes; (iii) sold assets related to the debtors’ Australia business for (a) $6 million (AUD) paid in cash on the closing date, (b) $600,000 (AUD) payable no later than 30 business days after the closing date and (iii) earn-out payments based on the utilization of certain of the sold assets following the closing date in an amount of up to $3 million (AUD), with a minimum earn-out payment of $750,000 (AUD) in each of the two earn-out years; (iv) sold seismic data and related assets with respect to surveys known as Aklaq, Kuukpik and CRD for $15 million and repaid $14.5 million of the amount due under the prepetition credit agreement with the proceeds received from the sale of the seismic data; (v) reduced full-time employees by 30% since year-end 2019; and (vi) applied for and received the $6.8 million unsecured PPP loan under the CARES Act.

The debtors are represented by Porter Hedges as bankruptcy counsel, and Imperial Capital LLC and Winter Harbor LLC as investment banker, financial advisor and consultant advisor, as applicable. Epiq has been retained as claims and noticing agent. The case has been assigned to Judge Marvin Isgur (case No. 20-34306).

Background

SAExploration is a full-service global provider of seismic data acquisition, logistical support and processing services for the oil and natural gas industry, operating through wholly owned subsidiaries, branch offices and variable interest entities in North America, South America, Asia Pacific, West Africa and the Middle East. In addition to the acquisition of 2D, 3D, time-lapse 4D and multi-component seismic data on land, transition zones between land and water and offshore in depths reaching 3,000 meters, the debtors offer a suite of logistical support and data processing services, utilizing proprietary, patented software. The debtors, along with their nondebtor affiliates, currently employ 132 full-time employees.

SAE specializes in the acquisition of seismic data in logistically complex and challenging environments and delicate ecosystems, including jungle, mountain, arctic and subaquatic terrains.

The debtors operate crews around the world that are currently supported by more than 160,000 owned land channels of seismic data acquisition equipment and other leased equipment. The SAE’s seismic data is used by major integrated oil companies, national oil companies and independent oil and gas exploration and production companies. While the results of the seismic surveys the debtors conduct generally belong to their customers and are proprietary in nature, Alaskan Seismic Ventures LLC, “a related party variable interest entity,” currently maintains a multi-client seismic data library of approximately 440 square kilometers in certain basins in Alaska, which is available for future sale or license.

As of the petition eate, the debtors had approximately $65.3 million of backlog under contract, in addition to approximately $977.6 million of bids outstanding. Of the $65.3 million of backlog under contract, the debtors expect $2 million to be completed in 2020.

While the last several years have seen a decline in demand, the North American market has historically been a stable and sustainable market for 3D seismic data acquisition, the debtors say, with producers seeking to maximize efficiency through the use of 3D technology. The economies in South American countries continue to expand and develop, demanding significantly more energy to fuel their growth, according to the debtors. As the political environments stabilize, oil companies are increasing operations in the market and are seeking the help of experienced seismic service providers. The debtors note that, while the global oil and natural gas industry downturn has significantly impacted exploration activity in South America, particularly during 2019 and 2018, Brazil is projected to show strong growth in the marine-based market. However, while some improvements in the level of customer interest can be seen by an increase in inquiries and subsequent tenders, “no assurance can be given that this will result in increased activity or that future decreases in activity will not occur again.”

Exploration activities in Asia-Pacific have declined recently with lower commodity prices but there is a steady demand for energy in the region. The debtors expect the Asia Pacific market to continue to be a predominantly marine-based market in the current commodity price environment. This trend is expected to continue as long as customers remain hesitant to commit capital to large onshore projects that are more exploration-driven. Historically, the West Africa region has presented numerous offshore marine opportunities, the debtors say, with offshore marine seismic activity increasing recently in the region. These projects are more focused on production-enhancement initiatives than new exploration. Despite the current instability of the macroeconomy with respect to the oil and natural gas industry downturn, the debtors say that they “expect overall offshore marine seismic activity to continue to improve in the near to medium-term future.”

SAE’s corporate organizational structure is shown below:

(Click HERE to enlarge.)

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

Plan of Reorganization / Disclosure Statement

The debtors propose the following confirmation-related timeline:

Deadlines with respect to the rights offering follow:

Treatment of Claims and Interests

The debtors’ plan sets forth the following classification of and proposed distributions to holders of allowed claims and interests:

Management Incentive Plan

The management incentive plan would reserve up to 9% of common stock.

First Lien Exit Facility

The plan contemplates a $15 million senior secured first lien term loan exit facility, with an agent to be determined and lenders consisting of backstop lenders and other rights offering participants. The facility would bear interest at 12.75%, with 2% added for the default rate, and would mature on the third anniversary of the effective date. The backstop lenders would receive a premium payable in the reorganized equity in an amount equal to 2.5% of the issued and outstanding fully diluted common equity, subject to dilution on account of the MIP.

Second Lien Exit Facility

The debtors also propose a senior secured second lien term loan that would bear interest at 3.4%, with 2% added for the default rate, and mature on the fourth anniversary of the effective date. The agent is to be determined, and lenders include each prepetition credit agreement lender

Other Plan Provisions

The plan provides for customary releases for the debtors, reorganized debtors, consenting creditors, parties to the exit facilities, any member of an appointed official committee of unsecured creditors, agents under the debtors’ prepetition lending facilities and releasing parties, as well as the affiliates, officers, directors, professionals and other related parties. In addition, the plan includes an exculpation provision in favor of the debtors and reorganized debtors, as well as the affiliates, officers, directors, professionals and other related parties.

Under the plan, the current term for the members of the board of directors, members and managers of each of the debtors will automatically expire on the effective date of the plan. The initial members of the new parent company board and other company boards, as well as persons serving as company officers, will be disclosed, to the extent known, in a plan supplement which is to be filed no later than seven days before the proposed Oct. 19 plan voting deadline.

Liquidation Analysis

The liquidation analysis, based on a hypothetical liquidation under chapter 7 of the Bankruptcy Code and assuming an Oct. 27 conversion date, is below:

Financial Projections

The DS also includes the following financial projections for the period Jan. 1, 2021, through Dec. 31, 2025:

Valuation Analysis

The DS provides for a valuation analysis with an enterprise valuation, prepared by Imperial Capital as investment banker, of a range of approximately $52.6 million to $80.3 million, with a midpoint of $66.4 million, assuming a Nov. 10 effective date.

Cash Collateral Motion

The company seeks the use of cash collateral, proposing the following adequate protection to its prepetition ABL, term loan and convertible note creditors: adequate protection liens on all of the debtors’ present and after-acquired property and assets, not subject to valid and unavoidable prepetition liens; superpriority administrative expense claims against all debtors on a joint and several basis, subject only to the carve-out and reasonable and documented fees of the professionals of the prepetition agents and the ad hoc of prepetition ABL, term loan and convertible note holders; as well as obligating the debtors to reporting requirements and record access to the ad hoc group.

The proposed order also provides for various stipulations as to the perfection and validity of prepetition obligations owing to prepetition lenders, as well as customary releases for the prepetition secured parties, their agents and professionals.

The superpriority claim includes claims against the proceeds of avoidance action, though this provision is subject to the entry of a final order, and the lenders must exhaust all other collateral before seeking recourse against the avoidance action proceeds.

In addition, subject to the entry of a final order, the debtors propose a waiver of the estate’s right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carve-out for professional fees is $500,000.

The challenge period provided for in the proposed order runs from 60 days from the date of formation of any official committee of unsecured creditors appointed in the debtors’ chapter 11 cases or 75 days from the entry of an interim order authorizing the use of cash collateral for any other party.

The proposed budget for the use of cash collateral is HERE.

The use of cash collateral is subject to the following milestones:

- Aug. 28: Deadline to file a plan and disclosure statement;

- Sept. 1: Deadline for entry of interim order authorizing use of cash collateral;

- Sept. 16: Deadline for entry of order provisionally approving DS;

- Sept. 21: Deadline to commence solicitation;

- Oct. 1: Deadline for entry of final order authorizing use of cash collateral;

- Nov. 5: Deadline for entry of confirmation order; and

- Nov. 15: Deadline for plan effective date.

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case No. 20-34306.

- Complex chapter 11 case designation

- Motion to establish trading procedures

- SAExploration seeks to establish trading procedures for its common stock, to be able to object to and prevent transfers if necessary to preserve net operating losses. As of Aug. 27 2020, the debtors estimate consolidated federal, state and foreign NOLs of approximately $100.2 million, $62.4 million and $2.6 million, respectively.

- Motion to pay critical vendors

- The debtors seek to pay critical vendor claims as follows:

- Motion to pay employee wages and benefits

- The debtors owe approximately $481,895 of workforce obligations, including $68,332 of unpaid wages and salaries and $413,562 of vacation awards.

- Motion to use cash management system

- The company has bank accounts with Wells Fargo Bank, Kotak Mahindra Bank, HSBC, Texas Champions, Banco Nacional de Bolivia, Banco de Bogota Miami, Banco BBVA and Credicorp Capital Colombia SA.

- Motion to maintain insurance programs

- Motion to pay taxes and fees

- Approximately $399,183 in state and Colombian income taxes are due, of which approximately $299,528 is due Oct. 15, approximately $57,443 is due Nov. 15, and approximately $42,212 is due Dec. 15. The debtors also estimate property tax obligations of approximately $685,371, none of which is payable within 30 days after the petition date. The debtors also owe $74,766 on account of franchise taxes, none of which will become payable within 30 days after the petition date and $14,545 on account of sales and value added taxes, all of which will be due within 30 days.

- Motion to provide utilities with adequate assurance

- Motion to extend the schedules/statements deadline to Oct. 1

- Application to appoint Epiq Corporate Restructuring as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.