Vallourec Sa

White & Case, Messier Maris to Host Vallourec Bondholders Call on Sept. 16 Before Extended Consent Solicitation Deadline

Mon 09/14/2020 15:38 PM

Law firm White & Case, financial adviser Messier Maris and public relations adviser Taddeo, who represent an ad hoc group and SteerCo of Vallourec noteholders are hosting a call on Wednesday, Sept. 16. The advisers are yet to confirm the timing of the call, which will take place in the afternoon in Europe (morning in the U.S.), according to an emailed statement.

Continue reading for the EMEA Core Credit by Reorg team's update on the Vallourec debt restructuring, and request a trial to access Reorg's coverage of thousands of other debt restructurings.

The call, which comes ahead of the French company’s extended deadline for its consent solicitation on Sept. 17, will be open to all bondholders with a majority holding in the bonds versus the RCF, according to the statement.

Vallourec is seeking creditors' consent to appoint a mandataire ad hoc without this constituting an event of default. The mandataire would facilitate negotiations with all stakeholders of the group. Management said previously it aimed to complete its debt restructuring talks by February to coincide with the RCF maturity.

The bondholders currently hold the right to choose whether or not to waive the event of default under their indenture that would be triggered by the appointment. The bankruptcy event of default would cause the notes to be immediately accelerated, without the need for noteholder instruction, however a simple majority of noteholders could waive the event of default.

Hedge funds including Bybrook, Apollo, SVP and Sculptor have been buying into the bonds, as reported.

Bondholders interested in joining the call, the ad hoc group or the SteerCo should contact either Saam Golshani at White & Case or Jean-François Cizain at Messier Maris.

A group of hedge funds invested in Vallourec’s RCF is working with Gibson Dunn while another group of RCF banks is working with a different legal advisor. Houlihan Lokey is advising the whole group as a financial advisor. Investors in the RCF currently include Sculptor, Goldman Sachs, Centerbridge and White Box.

Wilkie Farr is advising shareholder BPIFrance, while the company has been working with Rothschild, Morgan Stanley and Weil Gotshal, as reported.

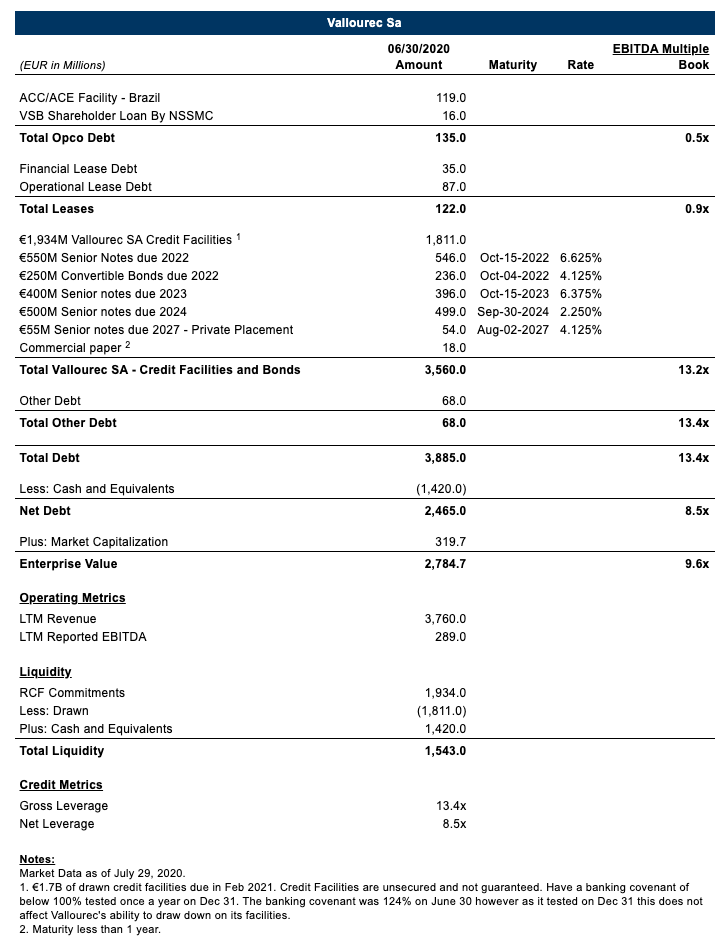

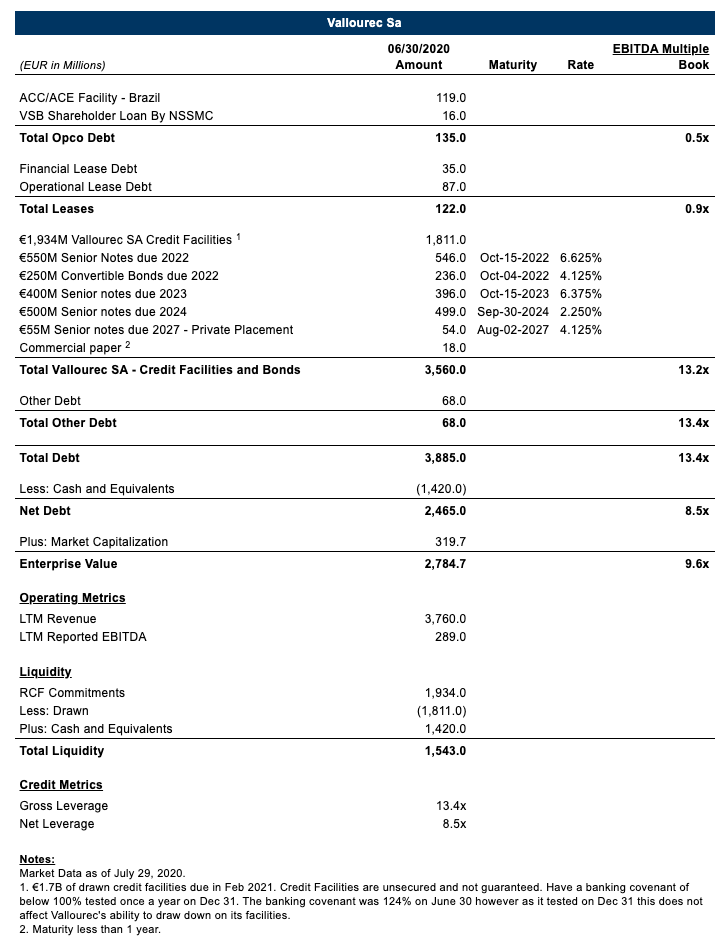

Vallourec’s capital structure as of June 30 is shown below:

Continue reading for the EMEA Core Credit by Reorg team's update on the Vallourec debt restructuring, and request a trial to access Reorg's coverage of thousands of other debt restructurings.

The call, which comes ahead of the French company’s extended deadline for its consent solicitation on Sept. 17, will be open to all bondholders with a majority holding in the bonds versus the RCF, according to the statement.

Vallourec is seeking creditors' consent to appoint a mandataire ad hoc without this constituting an event of default. The mandataire would facilitate negotiations with all stakeholders of the group. Management said previously it aimed to complete its debt restructuring talks by February to coincide with the RCF maturity.

The bondholders currently hold the right to choose whether or not to waive the event of default under their indenture that would be triggered by the appointment. The bankruptcy event of default would cause the notes to be immediately accelerated, without the need for noteholder instruction, however a simple majority of noteholders could waive the event of default.

Hedge funds including Bybrook, Apollo, SVP and Sculptor have been buying into the bonds, as reported.

Bondholders interested in joining the call, the ad hoc group or the SteerCo should contact either Saam Golshani at White & Case or Jean-François Cizain at Messier Maris.

A group of hedge funds invested in Vallourec’s RCF is working with Gibson Dunn while another group of RCF banks is working with a different legal advisor. Houlihan Lokey is advising the whole group as a financial advisor. Investors in the RCF currently include Sculptor, Goldman Sachs, Centerbridge and White Box.

Wilkie Farr is advising shareholder BPIFrance, while the company has been working with Rothschild, Morgan Stanley and Weil Gotshal, as reported.

Vallourec’s capital structure as of June 30 is shown below:

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.