Algeco Scotsman

UPDATE: Algeco Scotsman Senior Secured Bonds Fall 7 Points to High 70s After Merger Announcement

Thu 04/21/2016 11:27 AM

UPDATE 11:27 a.m. EDT 4/21/2016: Algeco Scotsman's subsidiary, Williams Scotsman International, and Modular Space Corporation both received supplementary information requests (SIRs) on April 20 from the Canadian Competition Bureau (CCB) on their proposed merger with ModSpace's North American subsidiary. The SIR extends the waiting period imposed by the Act until 30 days after the parties have complied with the SIR unless that period is extended voluntarily by the parties or terminated sooner by the CCB and management continues to maintain that the transaction will close by the end of the second or third quarter of 2016.

Original Story 10:39 a.m. EDT 3/16/2016:

Relevant Document:

North American Modular Space Business Merger

Algeco Scotsman senior secured bonds fell around 7 points to the high 70s after the company announced the merger of its North American modular space operations with Modular Space Corp., or ModSpace, according to investors Reorg spoke to. The merger of equals will create a new company with a fleet of approximately 150,000 units and 1,800 employees across Canada, Mexico and the United States, according to a statement today.

The debt dropped as investors reacted to the fact that a significant portion or all of the proceeds will be used to repay borrowings under Algeco Scotsman’s asset-based loan facility. Any surplus cash will primarily be used to reinvest into targeted project capital expenditures in its remaining businesses. The deal won’t lead to a prepayment event under Algeco Scotsman’s senior secured notes, according to the statement.

Investors Reorg spoke to also lamented the lack of details in the merger announcement. Algeco Scotsman has been under the scrutiny of the distressed investor community because of its worsening liquidity profile and weak earnings. The company’s senior 2019 noted trade in the high 20s.

Algeco Scotsman’s Asian, European and remote accommodation businesses are not part of the merger. Algeco Scotsman will contribute its North American modular space business to ModSpace.

As part of the financing requirements, the parties are evaluating capital structure alternatives. The transaction is subject to a number of conditions including minimum financing and applicable regulatory clearances.

Under the agreement, approved by both companies’ boards, ModSpace and Algeco Scotsman will own approximately half of the equity in the merged business. Algeco Scotsman will receive additional cash in connection with the contribution of its North American modular space business.

After the merger, the entities in Algeco Scotsman’s North American modular space business that merged with ModSpace will no longer be subsidiaries of Algeco Scotsman. These entities will no longer be obligors under or guarantee any of Algeco Scotsman’s outstanding indebtedness. The liens on the stock and assets of such entities securing Algeco Scotsman’s outstanding indebtedness will be released.

Pro forma the transaction, Algeco Scotsman’s total leverage is expected to increase to 6x through the senior secured notes and 8.8x through its senior unsecured notes, with cash interest cover reducing to 1.3x.

Chairman Gerry Holthaus and CEO Charles Paquin will lead the combined company. Holthaus is the chairman of Algeco Scotsman and was previously CEO and president of Williams Scotsman, Algeco Scotsman’s North America business.

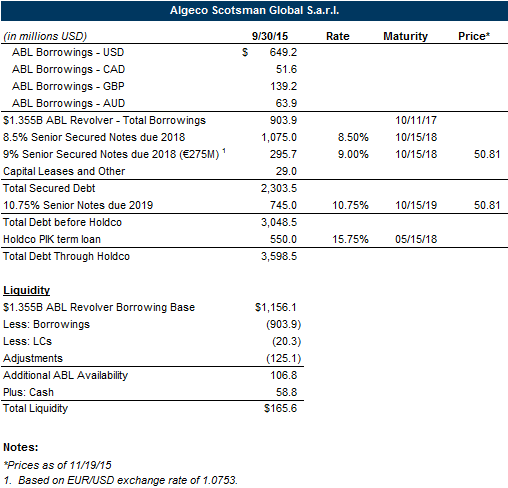

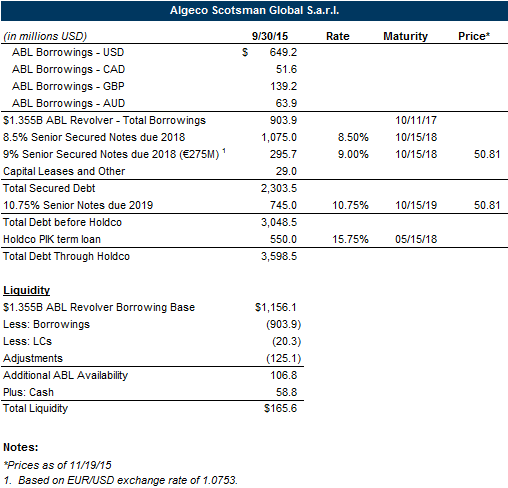

The company’s capital structure is below, while its updated tearsheet is available here.

Original Story 10:39 a.m. EDT 3/16/2016:

Relevant Document:

North American Modular Space Business Merger

Algeco Scotsman senior secured bonds fell around 7 points to the high 70s after the company announced the merger of its North American modular space operations with Modular Space Corp., or ModSpace, according to investors Reorg spoke to. The merger of equals will create a new company with a fleet of approximately 150,000 units and 1,800 employees across Canada, Mexico and the United States, according to a statement today.

The debt dropped as investors reacted to the fact that a significant portion or all of the proceeds will be used to repay borrowings under Algeco Scotsman’s asset-based loan facility. Any surplus cash will primarily be used to reinvest into targeted project capital expenditures in its remaining businesses. The deal won’t lead to a prepayment event under Algeco Scotsman’s senior secured notes, according to the statement.

Investors Reorg spoke to also lamented the lack of details in the merger announcement. Algeco Scotsman has been under the scrutiny of the distressed investor community because of its worsening liquidity profile and weak earnings. The company’s senior 2019 noted trade in the high 20s.

Algeco Scotsman’s Asian, European and remote accommodation businesses are not part of the merger. Algeco Scotsman will contribute its North American modular space business to ModSpace.

As part of the financing requirements, the parties are evaluating capital structure alternatives. The transaction is subject to a number of conditions including minimum financing and applicable regulatory clearances.

Under the agreement, approved by both companies’ boards, ModSpace and Algeco Scotsman will own approximately half of the equity in the merged business. Algeco Scotsman will receive additional cash in connection with the contribution of its North American modular space business.

After the merger, the entities in Algeco Scotsman’s North American modular space business that merged with ModSpace will no longer be subsidiaries of Algeco Scotsman. These entities will no longer be obligors under or guarantee any of Algeco Scotsman’s outstanding indebtedness. The liens on the stock and assets of such entities securing Algeco Scotsman’s outstanding indebtedness will be released.

Pro forma the transaction, Algeco Scotsman’s total leverage is expected to increase to 6x through the senior secured notes and 8.8x through its senior unsecured notes, with cash interest cover reducing to 1.3x.

Chairman Gerry Holthaus and CEO Charles Paquin will lead the combined company. Holthaus is the chairman of Algeco Scotsman and was previously CEO and president of Williams Scotsman, Algeco Scotsman’s North America business.

The company’s capital structure is below, while its updated tearsheet is available here.

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.