Peking University Founder Group Company Limited

PKU Founder Debt Restructuring Plans Submission Deadline Postponed

Mon 08/10/2020 04:48 AM

UPDATE 1: 4:48 a.m. ET 8/10/2020: The deadline for potential strategic investors to submit debt restructuring plans for PKU Founder Group has been postponed for up to two months, as the debt restructuring of PKU Resources, PKU Healthcare Industry, PKU Founder Information Industry Group and Founder Industry Holdings have been consolidated into the PKU Founder bankruptcy case, according to two holder sources briefed by the administrator. Continue reading for the Asia Core Credit team's update on the PKU Founder debt restructuring, and request access to continue following this and other debt restructurings across APAC.

The administrators have shortlisted six candidates following a second round of due diligence, which started in June, as reported. The candidates include Zhuhai Huafa Group which is directly controlled by Zhuhai SASAC, Shenzhen SASAC-backed Shenzhen Investment Holdings, stated-owned enterprise Qingdao Military-Civilian Integration Development Group Co., insurance service company Taikang Insurance Group, as well as two other privately-owned enterprises, according to the sources.

As reported, the administrator of PKU Founder applied to Beijing No.1 Intermediate People’s court for consolidating the four subsidiaries’ restructuring into the PKU Founder case on July 17 while the court later accepted the petition on July 31.

Bondholders view the consolidation as a positive sign, as they believe assets of the subsidiaries, especially PKU Healthcare, have good value, according to the sources. The consolidation is also expected to generate a higher recovery rate for unsecured creditors than the sole restructuring of PKU Founder, the sources added.

The administrator of PKU announced on April 20 that it is soliciting strategic investors in the debtor’s bankruptcy reorganization proceeding. Eligible strategic investor applicants are

required to have total assets of no less than RMB 50 billion or net assets of no less than RMB 20 billion as of the most recent fiscal year, with certain exceptions applicable to applicants that have a competitive advantage in its sector or extensive experience in M&A.

-- Frances Yue, Skylar Chen, Katherine Shi

Original Story 7:10 a.m. UTC on July 17, 2020

PKU Founder Offshore Noteholders Represented by Linklaters Poised to Take Action; Onshore Bankruptcy Administrators Shortlist 6 Potential Strategic Investors Including Zhuhai SASAC

Relevant Documents:

Offering Circular - HongKong JHC $300 million 4.575% April 20, 2020

Offering Circular - HongKong JHC $400 million 5.35% Jan 24, 2023

Offering Circular - HongKong JHC $200 million 4.7% Jan 24, 2021

Offering Circular - Founder Information $310 million FRN May 21, 2021

Offering Circular - Founder Information $490 million 6.25% Oct 17, 2020

A group of holders of Peking University Founder Group’s defaulted offshore notes - represented by Linklaters - are close to meeting the 25% holding threshold for acceleration and enforcement after its Hong Kong listed subsidiary PKU Resources failed to repay the $350 million 8.45% notes issued by Dawn Victor Limited when they matured on Tuesday (July 14), according to people close to the matter.

Meanwhile, the state-owned technology conglomerate’s onshore bankruptcy administrators have so far shortlisted six candidates as potential strategic investors following a second round of due diligence, according to separate people close to the process. Among the potential white knights are the Zhuhai State-owned Assets Supervision and Administration Commission (SASAC) and insurance company Taikang Life Insurance, the sources said.

The offshore noteholder group - understood to be composed of a Hong Kong-based hedge fund, several Chinese firms and private investors - have holdings in multiple tranches of PKU Founder’s offshore notes and are poised to enforce the Dawn Victor notes once a seven-day grace period expires next Tuesday, two sources said. Enforcement could also take place under the $310 million floating rate notes due 2021, which are in default due to non-payment of interest, another source said.

The noteholders - who have either engaged or about to engage Linklaters as their legal advisor - are also in talks with Admiralty Harbour as a potential financial advisor, according to the sources. Some of the noteholders in the group were previously working with Kirkland & Ellis and Addleshaw Goddard, the sources added.

On behalf of the group, Linklaters also wrote to BNY Mellon, which is advised by Allen & Overy, requesting the bond trustee to notify other noteholders and encourage them to join, said a separate source close to the matter.

As reported by Reorg, Addleshaw was previously in talks with noteholders with significant holdings across different tranches to explore legal actions, but they were split on whether they should take an aggressive approach.

K&E was also working with Admiralty Harbour to advise some noteholders in an attempt to organise, while Linklaters, engaged by a separate set of holders, attempted to take actions by convening extraordinary bondholder meetings, as reported.

Advisory firms have been vying to organise noteholders since PKU Founder’s onshore bankruptcy administrators rejected debt claims arising from the Dawn Victor notes - as they are neither guaranteed nor benefit from a keepwell deed from PKU Founder - and put on hold the recognition of RMB 12.054 billion ($1.7 billion) total claims under five keepwell notes.

The recognition of the keepwell bonds requires a valid judgment or arbitral award confirming PKU Founder’s liability before the bankruptcy administrators can make their final determination according to previous trustee notices.

The onshore bankruptcy proceedings of PKU Founder is also awaiting the judgment of the Shanghai Financial Court on whether it will recognise a Hong Kong judgment that upheld a creditor’s right of recovery under keepwell obligations provided by CEFC Shanghai International Group (See Reorg’s legal analysis HERE).

The ruling, which is likely to have significant implications to the wider credit market, was previously thought to be made in May but has since been delayed due to the sensitivity, a person close to the case said.

Some of Dawn Victor noteholders were previously concerned about taking legal actions against the Hong Kong-listed guarantor PKU Resources based on cross-default provision because they also own both the keepwell-backed and the PKU Founder-guaranteed notes and therefore feared that legal actions could jeopardise their recovery, as reported.

However, the default on Tuesday has dashed the hope of some noteholders and paved the way for taking a more proactive approach, two sources close to the matter noted.

Linklaters and Admiralty Harbour declined to comment.

Strategic Investors

Onshore, the administrators have currently shortlisted six candidates as potential strategic investors following a second round of due diligence, including Zhuhai SASAC and insurance company Taikang Life Insurance, according to a bondholder source briefed by the administrators and two sources close to the restructuring process.

Other candidates include a Shenzhen-based state-owned enterprise, a Beijing-based state-owned enterprise and two private companies, said one of the sources.

Among all the candidates, Zhuhai SASAC would be the most promising candidate, said two sources, as the company is known for being deep-pocketed and acquiring multiple listed companies in recent years under China’s Greater Bay Area development strategies.

Zhuhai SASAC had been in talks with PKU Founder Group since late 2019 regarding the sale of up to 70% of the equity of PKU Founder by its holding company Peking University Asset Management (PKUAM). The company also confirmed that it was negotiating with Zhuhai SASAC for corporations in December 2019, as reported.

Background

On Feb. 19, Beijing No.1 Intermediate People's Court accepted the petition filed by Bank of Beijing for the bankruptcy reorganization of PKU Founder. The court has appointed a team of government officials as the administrators of the case, consisting of those from the People’s Bank of China, Ministry of Education, certain related financial regulatory institutions and the Beijing municipal government. Ernst and Young has been formally appointed as financial advisor to the administrator group and China Cinda Asset Management has joined the administrator group as an administrator and law firm Dentons has been appointed as the group’s legal advisor, as reported.

The administrator of PKU announced on April 20 that it is soliciting strategic investors in the debtor’s bankruptcy reorganization proceeding. Eligible strategic investor applicants are required to have total assets of no less than RMB 50 billion or net assets of no less than RMB 20 billion as of the most recent fiscal year, with certain exceptions applicable to applicants that have a competitive advantage in its sector or extensive experience in M&A.

The company convened its first creditors’ meeting on April 30 through the National Enterprise Bankruptcy Information Disclosure Platform for its creditors to vote on whether to approve its asset management plan - which details that an administrator team will take control of the company and introduce certain asset security measures, as reported.

As a standalone entity, PKU Founder has around RMB 81.9 billion in assets, RMB 91.5 billion in debts and negative RMB 9.5 billion in net assets, according to sources briefed by the administrator during the online creditors meeting held on April 30, as reported.

It later announced on May 25 that creditors had passed two resolutions including the asset management plan.

In June, potential strategic investors started the second round of due diligence on the company, as reported.

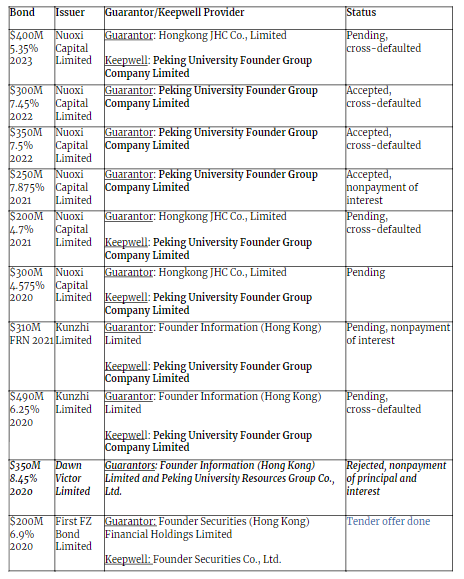

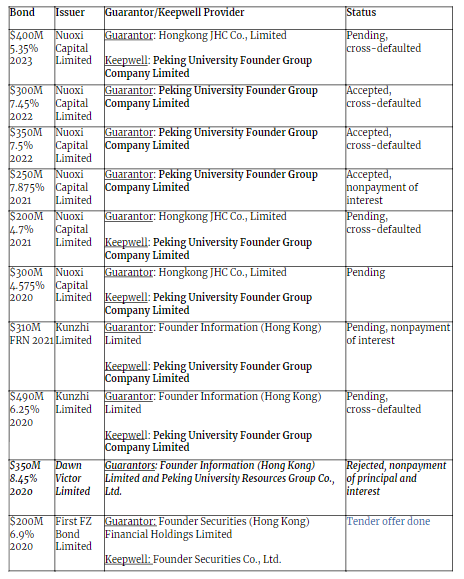

The offshore notes issued under PKU Founder are below:

PKU Founder’s corporate structure with issuers of the offshore senior notes:

(Click HERE to enlarge)

(Click HERE to enlarge)

-- Simon Lee, Katherine Shi, Shirley Li

The administrators have shortlisted six candidates following a second round of due diligence, which started in June, as reported. The candidates include Zhuhai Huafa Group which is directly controlled by Zhuhai SASAC, Shenzhen SASAC-backed Shenzhen Investment Holdings, stated-owned enterprise Qingdao Military-Civilian Integration Development Group Co., insurance service company Taikang Insurance Group, as well as two other privately-owned enterprises, according to the sources.

As reported, the administrator of PKU Founder applied to Beijing No.1 Intermediate People’s court for consolidating the four subsidiaries’ restructuring into the PKU Founder case on July 17 while the court later accepted the petition on July 31.

Bondholders view the consolidation as a positive sign, as they believe assets of the subsidiaries, especially PKU Healthcare, have good value, according to the sources. The consolidation is also expected to generate a higher recovery rate for unsecured creditors than the sole restructuring of PKU Founder, the sources added.

The administrator of PKU announced on April 20 that it is soliciting strategic investors in the debtor’s bankruptcy reorganization proceeding. Eligible strategic investor applicants are

required to have total assets of no less than RMB 50 billion or net assets of no less than RMB 20 billion as of the most recent fiscal year, with certain exceptions applicable to applicants that have a competitive advantage in its sector or extensive experience in M&A.

-- Frances Yue, Skylar Chen, Katherine Shi

Original Story 7:10 a.m. UTC on July 17, 2020

PKU Founder Offshore Noteholders Represented by Linklaters Poised to Take Action; Onshore Bankruptcy Administrators Shortlist 6 Potential Strategic Investors Including Zhuhai SASAC

Relevant Documents:

Offering Circular - HongKong JHC $300 million 4.575% April 20, 2020

Offering Circular - HongKong JHC $400 million 5.35% Jan 24, 2023

Offering Circular - HongKong JHC $200 million 4.7% Jan 24, 2021

Offering Circular - Founder Information $310 million FRN May 21, 2021

Offering Circular - Founder Information $490 million 6.25% Oct 17, 2020

A group of holders of Peking University Founder Group’s defaulted offshore notes - represented by Linklaters - are close to meeting the 25% holding threshold for acceleration and enforcement after its Hong Kong listed subsidiary PKU Resources failed to repay the $350 million 8.45% notes issued by Dawn Victor Limited when they matured on Tuesday (July 14), according to people close to the matter.

Meanwhile, the state-owned technology conglomerate’s onshore bankruptcy administrators have so far shortlisted six candidates as potential strategic investors following a second round of due diligence, according to separate people close to the process. Among the potential white knights are the Zhuhai State-owned Assets Supervision and Administration Commission (SASAC) and insurance company Taikang Life Insurance, the sources said.

The offshore noteholder group - understood to be composed of a Hong Kong-based hedge fund, several Chinese firms and private investors - have holdings in multiple tranches of PKU Founder’s offshore notes and are poised to enforce the Dawn Victor notes once a seven-day grace period expires next Tuesday, two sources said. Enforcement could also take place under the $310 million floating rate notes due 2021, which are in default due to non-payment of interest, another source said.

The noteholders - who have either engaged or about to engage Linklaters as their legal advisor - are also in talks with Admiralty Harbour as a potential financial advisor, according to the sources. Some of the noteholders in the group were previously working with Kirkland & Ellis and Addleshaw Goddard, the sources added.

On behalf of the group, Linklaters also wrote to BNY Mellon, which is advised by Allen & Overy, requesting the bond trustee to notify other noteholders and encourage them to join, said a separate source close to the matter.

As reported by Reorg, Addleshaw was previously in talks with noteholders with significant holdings across different tranches to explore legal actions, but they were split on whether they should take an aggressive approach.

K&E was also working with Admiralty Harbour to advise some noteholders in an attempt to organise, while Linklaters, engaged by a separate set of holders, attempted to take actions by convening extraordinary bondholder meetings, as reported.

Advisory firms have been vying to organise noteholders since PKU Founder’s onshore bankruptcy administrators rejected debt claims arising from the Dawn Victor notes - as they are neither guaranteed nor benefit from a keepwell deed from PKU Founder - and put on hold the recognition of RMB 12.054 billion ($1.7 billion) total claims under five keepwell notes.

The recognition of the keepwell bonds requires a valid judgment or arbitral award confirming PKU Founder’s liability before the bankruptcy administrators can make their final determination according to previous trustee notices.

The onshore bankruptcy proceedings of PKU Founder is also awaiting the judgment of the Shanghai Financial Court on whether it will recognise a Hong Kong judgment that upheld a creditor’s right of recovery under keepwell obligations provided by CEFC Shanghai International Group (See Reorg’s legal analysis HERE).

The ruling, which is likely to have significant implications to the wider credit market, was previously thought to be made in May but has since been delayed due to the sensitivity, a person close to the case said.

Some of Dawn Victor noteholders were previously concerned about taking legal actions against the Hong Kong-listed guarantor PKU Resources based on cross-default provision because they also own both the keepwell-backed and the PKU Founder-guaranteed notes and therefore feared that legal actions could jeopardise their recovery, as reported.

However, the default on Tuesday has dashed the hope of some noteholders and paved the way for taking a more proactive approach, two sources close to the matter noted.

Linklaters and Admiralty Harbour declined to comment.

Strategic Investors

Onshore, the administrators have currently shortlisted six candidates as potential strategic investors following a second round of due diligence, including Zhuhai SASAC and insurance company Taikang Life Insurance, according to a bondholder source briefed by the administrators and two sources close to the restructuring process.

Other candidates include a Shenzhen-based state-owned enterprise, a Beijing-based state-owned enterprise and two private companies, said one of the sources.

Among all the candidates, Zhuhai SASAC would be the most promising candidate, said two sources, as the company is known for being deep-pocketed and acquiring multiple listed companies in recent years under China’s Greater Bay Area development strategies.

Zhuhai SASAC had been in talks with PKU Founder Group since late 2019 regarding the sale of up to 70% of the equity of PKU Founder by its holding company Peking University Asset Management (PKUAM). The company also confirmed that it was negotiating with Zhuhai SASAC for corporations in December 2019, as reported.

Background

On Feb. 19, Beijing No.1 Intermediate People's Court accepted the petition filed by Bank of Beijing for the bankruptcy reorganization of PKU Founder. The court has appointed a team of government officials as the administrators of the case, consisting of those from the People’s Bank of China, Ministry of Education, certain related financial regulatory institutions and the Beijing municipal government. Ernst and Young has been formally appointed as financial advisor to the administrator group and China Cinda Asset Management has joined the administrator group as an administrator and law firm Dentons has been appointed as the group’s legal advisor, as reported.

The administrator of PKU announced on April 20 that it is soliciting strategic investors in the debtor’s bankruptcy reorganization proceeding. Eligible strategic investor applicants are required to have total assets of no less than RMB 50 billion or net assets of no less than RMB 20 billion as of the most recent fiscal year, with certain exceptions applicable to applicants that have a competitive advantage in its sector or extensive experience in M&A.

The company convened its first creditors’ meeting on April 30 through the National Enterprise Bankruptcy Information Disclosure Platform for its creditors to vote on whether to approve its asset management plan - which details that an administrator team will take control of the company and introduce certain asset security measures, as reported.

As a standalone entity, PKU Founder has around RMB 81.9 billion in assets, RMB 91.5 billion in debts and negative RMB 9.5 billion in net assets, according to sources briefed by the administrator during the online creditors meeting held on April 30, as reported.

It later announced on May 25 that creditors had passed two resolutions including the asset management plan.

In June, potential strategic investors started the second round of due diligence on the company, as reported.

The offshore notes issued under PKU Founder are below:

PKU Founder’s corporate structure with issuers of the offshore senior notes:

(Click HERE to enlarge)

The capital structure of PKU Founder is detailed below:

(Click HERE to enlarge)

-- Simon Lee, Katherine Shi, Shirley Li

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.