Tianqi Lithium

Tianqi Lithium Mulls Holistic Debt Restructuring, to Submit Proposal to Syndicated Loan Lenders

Mon 09/21/2020 06:17 AM

Distressed Chinese lithium producer Tianqi Lithium has contemplated a holistic debt restructuring plan, assisted by its onshore legal advisor Zhong Lun Law Firm, and plans to submit a debt restructuring proposal to CITIC Bank-led syndicated loan lenders, said two sources with direct knowledge of the matter. Continue reading for the Asia Core Credit by Reorg team's analysis of a potential Tianqi Lithium debt restructuring, and request a trial to access our coverage of thousands of others.

Tianqi has requested the syndicated loan lenders to amend the loan structure including extending the maturity date, while the lenders will make a decision after reviewing the restructuring proposal, according to two buyside sources briefed by the company.

Tianqi has told lenders in the syndicate that it is unable to make full interest payments due in September, said one source with direct knowledge of the matter.

The company faces at least $42.7 million and $14.7 million interest payments this month arising from different tranches of the loan, as calculated by Reorg.

The $42.7 million interest payment was originally due in June, and lenders agreed to defer the payment to September, said the two sources with direct knowledge of the matter.

Tianqi Lithium raised the total $3.5 billion syndicated loan in 2018 to help fund its acquisition of a roughly 25.9% stake in SQM, as reported. The loan has about $3.082 billion outstanding, of which $1.884 billion is due in November.

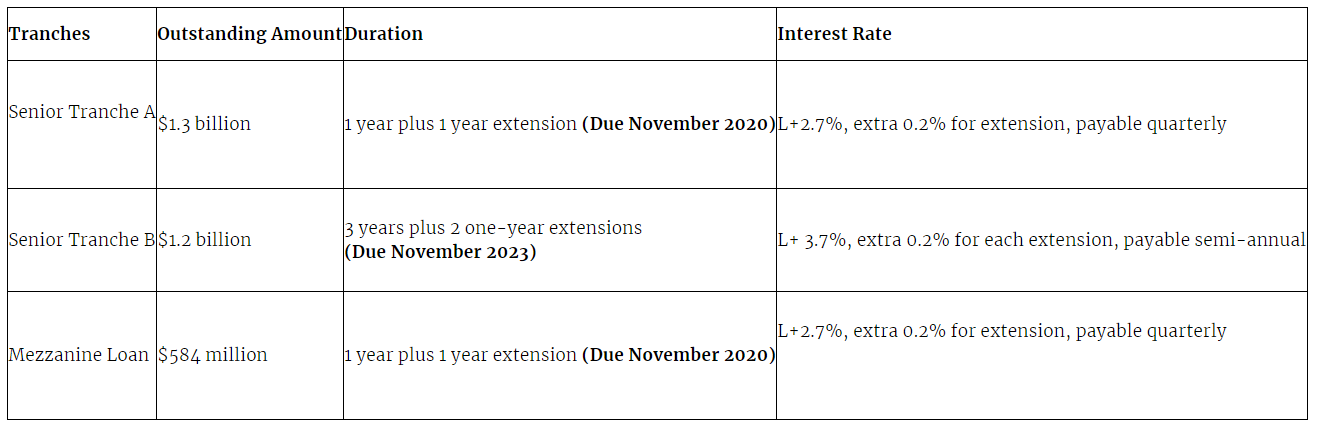

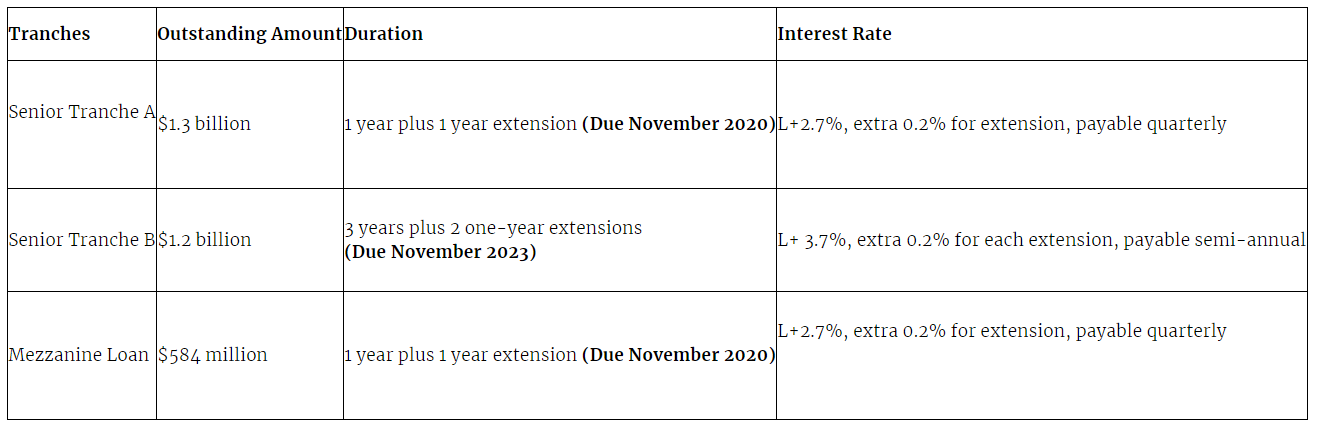

Details of the syndicated loan are listed below:

As reported, the $1.3 billion one-year senior tranche A and $1.2 billion three-year senior tranche B were both arranged and underwritten by China CITIC Bank, Chengdu branch. The mezzanine loan was arranged and underwritten by China CITIC Bank International.

Tranches A and B were not syndicated, while the mezzanine loan was syndicated to banks including Societe Generale, China Minsheng Bank, BNP Paribas and Industrial and Commercial Bank of China. The Western banks are more ready to accelerate payment, while the Chinese banks are leaning towards rolling over the loan, the same sources noted.

Deloitte and Allen & Overy serve as the syndicated loan lenders’ financial advisor and legal advisor, respectively.

Spokespeople for Deloitte and Allen & Overy did not immediately respond to Reorg’s emailed request for comment, and Tianqi did not respond to Reorg’s request for comment.

The company’s capital structure is listed below:

(Click HERE to enlarge)

--Shirley Li

Tianqi has requested the syndicated loan lenders to amend the loan structure including extending the maturity date, while the lenders will make a decision after reviewing the restructuring proposal, according to two buyside sources briefed by the company.

Tianqi has told lenders in the syndicate that it is unable to make full interest payments due in September, said one source with direct knowledge of the matter.

The company faces at least $42.7 million and $14.7 million interest payments this month arising from different tranches of the loan, as calculated by Reorg.

The $42.7 million interest payment was originally due in June, and lenders agreed to defer the payment to September, said the two sources with direct knowledge of the matter.

Tianqi Lithium raised the total $3.5 billion syndicated loan in 2018 to help fund its acquisition of a roughly 25.9% stake in SQM, as reported. The loan has about $3.082 billion outstanding, of which $1.884 billion is due in November.

Details of the syndicated loan are listed below:

As reported, the $1.3 billion one-year senior tranche A and $1.2 billion three-year senior tranche B were both arranged and underwritten by China CITIC Bank, Chengdu branch. The mezzanine loan was arranged and underwritten by China CITIC Bank International.

Tranches A and B were not syndicated, while the mezzanine loan was syndicated to banks including Societe Generale, China Minsheng Bank, BNP Paribas and Industrial and Commercial Bank of China. The Western banks are more ready to accelerate payment, while the Chinese banks are leaning towards rolling over the loan, the same sources noted.

Deloitte and Allen & Overy serve as the syndicated loan lenders’ financial advisor and legal advisor, respectively.

Spokespeople for Deloitte and Allen & Overy did not immediately respond to Reorg’s emailed request for comment, and Tianqi did not respond to Reorg’s request for comment.

The company’s capital structure is listed below:

(Click HERE to enlarge)

--Shirley Li

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.