Oi S.a. - In Judicial Reorganization

Oi Creditors Continue to Organize, Receive Pitches; Aurelius Seeks to Block Dutch SPV From Extending Intercompany Loans

Wed 04/06/2016 10:54 AM

Relevant Document:

Writ document

Houlihan Lokey and Alvarez & Marsal are pitching Oi bondholders in an attempt to form creditor groups in expectation of a restructuring process, according to sources familiar with the situation. Oi creditors continue to organize as Aurelius seeks to preserve cash at the company’s Netherlands-based subsidiary ahead of a July payment. A group composed of a large number of Telemar bondholders has already tapped Moelis as financial advisor.

The Brazilian telecom company, advised by PJT Partners and White & Case, is assessing its options ahead of debt repayments due in 2016 and 2017. Investors expect the company to come to market with a debt exchange. However, last month, the Oi denied rumors that it’s considering a debt-for-equity swap entailing steep principal haircuts up to 70% or 80% of face value. In a call with investors, the company shed no light on its plans to address its capital structure and debt profile.

Investors question Oi’s ability to come to market with a debt exchange to address debt issued across the corporate structure due to the company’s complex capital structure and broad mix of bondholders. Oi has outstanding bonds denominated in Brazilian reais, euros and U.S. dollars, and its bondholders range from Europe-based retail holders to global institutional investors. Many sources assert that a bankruptcy filing will be difficult to avoid.

Investors are not sitting still. Over the past several months, many buysiders have shorted the bonds or taken positions in the CDS, anticipating a potential credit event.

In Europe, Capricorn Capital, a fund managed by Aurelius Capital, filed a lawsuit in the Netherlands to prevent Oi Brasil Holdings Coöperatief UA, or FinCo, from transferring funds or making intercompany loans to the parent company or any of its affiliates. According to Reorg sources, Aurelius is doing so to ensure Oi can pay the upcoming €231 million bonds due in June. Other investors speculate that Aurelius could also have a position in the CDS and could be seeking to force a default at Oi by preventing the company from moving cash from one part of its corporate structure to another as the company’s maturity schedule gains pace later this year.

At the end of 2015, Oi’s gross debt stood at 54.981 million reais (€13.08 billion), and the cash position was 16.826 million reais (€4 billion).

Oi’s updated capital structure is provided below:

The Lawsuit

Aurelius holds some of Oi’s euro-denominated debt - the legacy Portugal Telecom International Finance debt, or PTIF. The fund outlined its position and its claims against the Brazilian telecom company in a writ issued earlier this month. The writ seeks to prohibit FinCo from “in any way, directly or indirectly, providing funds or financial assistance to any Oi Group Member as long as FinCo has any outstanding obligation in connection” with a FinCo loan to PTIF, according to the writ, obtained by Reorg Research. Aurelius seeks to protect the FinCo subsidiary from making loans to other parts of Oi’s corporate structure until it repays its €3.9 billion in debt debt to PTIF that comes due on June 2. Aurelius does not disclose any position in Oi’s CDS in its writ.

On March 16, Capricorn began its main action against FinCo, seeking a declaration to confirm the voidance of the FinCo loan. A court in Amsterdam will hold a hearing on the matter April 18 at 2:45 p.m., and failure to appear will be considered a default. Capricorn Capital is advised by lawyers J.W. de Groot and F. Verhoeven from law firm Houthoff Buruma

Aurelius stresses the urgency of Oi’s situation, noting the company has limited access to the capital markets and will likely rely on intercompany loans to honor its obligations. “Taking into account Oi’s rapidly deteriorating financial position, such request can be make any day now.” FinCo is currently insolvent, Aurelius charges, “and a further drain of its only liquid and valuable asset - i.e. its cash - would cause immediate damage to FinCo, its creditors and by extension PTIF’s creditors, including Capricorn, particularly because such a drain would dramatically reduce FinCo’s ability to fulfill its obligations in connection with the FinCo Loan.”

Aurelius said that Capricorn owns notes with a face value of more than €100 million issued by PTIF, a sister company of FinCo and that subsidiary’s largest creditor. The writ notes that PTIF loaned FinCo €3.9 billion and that loan serves as PTIF’s principal asset. “If the FinCo loan is not repaid, PTIF will be unable to repay its debts. The only asset that FinCo realistically has to repay the FinCo Loan is whatever cash it has on hand.”

As of the end of December, the book value of FinCo’s assets totaled €5.86 billion, consisting of €3.01 billion in cash and intercompany loans owed by its parent company of €2.85 billion, which the parent is unable to repay, the writ adds. FinCo’s total debt, meanwhile, reaches €5.87 billion, €3.9 billion of which comes due on June 2. “Any additional loans to Oi by FinCo will further reduce FinCo’s ability to repay the FinCo Loan on 2 June 2016,” the writ reads.

Aurelius asserts that PTIF was technically insolvent when it provided FinCo with the loan in mid-June 2015. PTIF received €4.7 billion in cash when Oi sold PT Portugal in December 2014 for €5.8 billion. PTIF subsequently used a portion of that cash to repay outstanding debt with its parent and the remainder to provide the FinCo loan. By the end of June 2015, the size of the FinCo Loan reached €4.1 billion, which left PTIF with only €2 million in cash, according to the writ.

As of the end of December 2014, however, PTIF had negative equity of €168 million and the company’s financial statements noted that the subsidiary’s continuation as a going concern was dependent on the support of the parent company, whose financial health has declined over the past several months. FinCo had negative equity as of the same date of $8 million and its current liabilities exceeded current assets as well. That subsidiary had total assets as of the end of December of $1.527 billion, of which $1.49 billion was a loan to Oi. The financial statements for that subsidiary also contained language indicating the company’s ability to remain a going concern depends on continued support from the parent company.

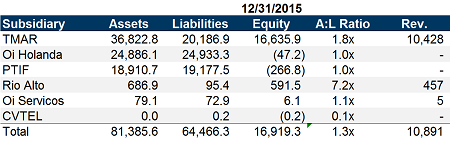

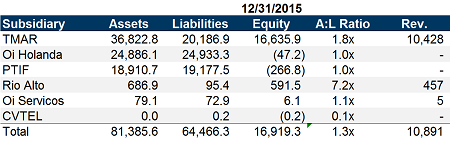

Taken from Oi’s Dec. 31, 2015, financial statements, a summary of assets and liabilities at Oi’s subsidiaries is as follows:

FinCo is believed to have made a €1.5 billion loan to Oi in June 2015, despite its weak financial position. FinCo funded that loan using the €876 million in cash received from PTIF, “which presumably took place under the Credit Facility,” and the proceeds from the issuance of €600 million in notes last year. Aurelius now argues that Oi does not have sufficient resources to repay €876 million “that is about to come due.” As of the end of December, Oi owed FinCo €2.8 billion.

The company was able to address a PTIF maturity in February for a 5.625% €543 million bond. Come July, however, the company faces another maturity totaling approximately €400 million for its 6.25% senior unsecured note, followed by the maturity of its Brazilian real-denominated unsecured bond totaling 1 billion reais due September.

The PTIF EMTN program prospectus does have some cross-default language, however, it is unclear if this would apply to Oi Netherlands as the event of default would apply to a “relevant Issuer” having “some non-performance or non-observance by the relevant Issuer.”

In light of Oi’s financial decline and the liabilities outstanding at the subsidiary level, Capricorn sought to extrajudicially void the FinCo Loan and hold FinCo, Oi, PITF and their board members liable for any amount that it failed to recover as creditor of PTIF. When Capricorn informed the companies of its intention to start legal proceedings, the fund urged FinCo to refrain from lending to Oi. However, last month, Oi disclosed that it replaced certain PTIF and FinCo directors, including all directors from outside the company. “Now, all current directors of PTIF and FinCo are either employees of or counsel to Oi.”

Writ document

Houlihan Lokey and Alvarez & Marsal are pitching Oi bondholders in an attempt to form creditor groups in expectation of a restructuring process, according to sources familiar with the situation. Oi creditors continue to organize as Aurelius seeks to preserve cash at the company’s Netherlands-based subsidiary ahead of a July payment. A group composed of a large number of Telemar bondholders has already tapped Moelis as financial advisor.

The Brazilian telecom company, advised by PJT Partners and White & Case, is assessing its options ahead of debt repayments due in 2016 and 2017. Investors expect the company to come to market with a debt exchange. However, last month, the Oi denied rumors that it’s considering a debt-for-equity swap entailing steep principal haircuts up to 70% or 80% of face value. In a call with investors, the company shed no light on its plans to address its capital structure and debt profile.

Investors question Oi’s ability to come to market with a debt exchange to address debt issued across the corporate structure due to the company’s complex capital structure and broad mix of bondholders. Oi has outstanding bonds denominated in Brazilian reais, euros and U.S. dollars, and its bondholders range from Europe-based retail holders to global institutional investors. Many sources assert that a bankruptcy filing will be difficult to avoid.

Investors are not sitting still. Over the past several months, many buysiders have shorted the bonds or taken positions in the CDS, anticipating a potential credit event.

In Europe, Capricorn Capital, a fund managed by Aurelius Capital, filed a lawsuit in the Netherlands to prevent Oi Brasil Holdings Coöperatief UA, or FinCo, from transferring funds or making intercompany loans to the parent company or any of its affiliates. According to Reorg sources, Aurelius is doing so to ensure Oi can pay the upcoming €231 million bonds due in June. Other investors speculate that Aurelius could also have a position in the CDS and could be seeking to force a default at Oi by preventing the company from moving cash from one part of its corporate structure to another as the company’s maturity schedule gains pace later this year.

At the end of 2015, Oi’s gross debt stood at 54.981 million reais (€13.08 billion), and the cash position was 16.826 million reais (€4 billion).

Oi’s updated capital structure is provided below:

The Lawsuit

Aurelius holds some of Oi’s euro-denominated debt - the legacy Portugal Telecom International Finance debt, or PTIF. The fund outlined its position and its claims against the Brazilian telecom company in a writ issued earlier this month. The writ seeks to prohibit FinCo from “in any way, directly or indirectly, providing funds or financial assistance to any Oi Group Member as long as FinCo has any outstanding obligation in connection” with a FinCo loan to PTIF, according to the writ, obtained by Reorg Research. Aurelius seeks to protect the FinCo subsidiary from making loans to other parts of Oi’s corporate structure until it repays its €3.9 billion in debt debt to PTIF that comes due on June 2. Aurelius does not disclose any position in Oi’s CDS in its writ.

On March 16, Capricorn began its main action against FinCo, seeking a declaration to confirm the voidance of the FinCo loan. A court in Amsterdam will hold a hearing on the matter April 18 at 2:45 p.m., and failure to appear will be considered a default. Capricorn Capital is advised by lawyers J.W. de Groot and F. Verhoeven from law firm Houthoff Buruma

Aurelius stresses the urgency of Oi’s situation, noting the company has limited access to the capital markets and will likely rely on intercompany loans to honor its obligations. “Taking into account Oi’s rapidly deteriorating financial position, such request can be make any day now.” FinCo is currently insolvent, Aurelius charges, “and a further drain of its only liquid and valuable asset - i.e. its cash - would cause immediate damage to FinCo, its creditors and by extension PTIF’s creditors, including Capricorn, particularly because such a drain would dramatically reduce FinCo’s ability to fulfill its obligations in connection with the FinCo Loan.”

Aurelius said that Capricorn owns notes with a face value of more than €100 million issued by PTIF, a sister company of FinCo and that subsidiary’s largest creditor. The writ notes that PTIF loaned FinCo €3.9 billion and that loan serves as PTIF’s principal asset. “If the FinCo loan is not repaid, PTIF will be unable to repay its debts. The only asset that FinCo realistically has to repay the FinCo Loan is whatever cash it has on hand.”

As of the end of December, the book value of FinCo’s assets totaled €5.86 billion, consisting of €3.01 billion in cash and intercompany loans owed by its parent company of €2.85 billion, which the parent is unable to repay, the writ adds. FinCo’s total debt, meanwhile, reaches €5.87 billion, €3.9 billion of which comes due on June 2. “Any additional loans to Oi by FinCo will further reduce FinCo’s ability to repay the FinCo Loan on 2 June 2016,” the writ reads.

Aurelius asserts that PTIF was technically insolvent when it provided FinCo with the loan in mid-June 2015. PTIF received €4.7 billion in cash when Oi sold PT Portugal in December 2014 for €5.8 billion. PTIF subsequently used a portion of that cash to repay outstanding debt with its parent and the remainder to provide the FinCo loan. By the end of June 2015, the size of the FinCo Loan reached €4.1 billion, which left PTIF with only €2 million in cash, according to the writ.

As of the end of December 2014, however, PTIF had negative equity of €168 million and the company’s financial statements noted that the subsidiary’s continuation as a going concern was dependent on the support of the parent company, whose financial health has declined over the past several months. FinCo had negative equity as of the same date of $8 million and its current liabilities exceeded current assets as well. That subsidiary had total assets as of the end of December of $1.527 billion, of which $1.49 billion was a loan to Oi. The financial statements for that subsidiary also contained language indicating the company’s ability to remain a going concern depends on continued support from the parent company.

Taken from Oi’s Dec. 31, 2015, financial statements, a summary of assets and liabilities at Oi’s subsidiaries is as follows:

FinCo is believed to have made a €1.5 billion loan to Oi in June 2015, despite its weak financial position. FinCo funded that loan using the €876 million in cash received from PTIF, “which presumably took place under the Credit Facility,” and the proceeds from the issuance of €600 million in notes last year. Aurelius now argues that Oi does not have sufficient resources to repay €876 million “that is about to come due.” As of the end of December, Oi owed FinCo €2.8 billion.

The company was able to address a PTIF maturity in February for a 5.625% €543 million bond. Come July, however, the company faces another maturity totaling approximately €400 million for its 6.25% senior unsecured note, followed by the maturity of its Brazilian real-denominated unsecured bond totaling 1 billion reais due September.

The PTIF EMTN program prospectus does have some cross-default language, however, it is unclear if this would apply to Oi Netherlands as the event of default would apply to a “relevant Issuer” having “some non-performance or non-observance by the relevant Issuer.”

In light of Oi’s financial decline and the liabilities outstanding at the subsidiary level, Capricorn sought to extrajudicially void the FinCo Loan and hold FinCo, Oi, PITF and their board members liable for any amount that it failed to recover as creditor of PTIF. When Capricorn informed the companies of its intention to start legal proceedings, the fund urged FinCo to refrain from lending to Oi. However, last month, Oi disclosed that it replaced certain PTIF and FinCo directors, including all directors from outside the company. “Now, all current directors of PTIF and FinCo are either employees of or counsel to Oi.”

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.