Vallourec Sa

Group of Hedge Funds in Vallourec RCF Work With Houlihan Lokey, Gibson Dunn; Over €100M Bonds Trade in Mid-40s; Noteholders Include Bybrook, Apollo, SVP, Sculptor

Fri 09/04/2020 13:25 PM

A small group of hedge funds that previously bought a significant portion of Vallourec’s RCF is working with Houlihan Lokey and Gibson Dunn, sources told Reorg.

Over €100 million of the company’s 2022, 2023 and 2024 bonds traded around the mid-40s after the French pipe manufacturer announced on Sept. 1 it was seeking to open financial restructuring talks with all stakeholders and the option to appoint a mandataire ad hoc. Hedge funds including Bybrook, Apollo, SVP and Sculptor have been buying into the bonds. Sculptor also has cross-holdings with the RCF, sources added.

Continue reading for the EMEA Core Credit by Reorg team's analysis of the Vallourec situation and request a trial to access our coverage of other financial restructurings.

Vallourec is seeking lenders' consent for the upcoming talks and has already asked creditors for approval to appoint a mandataire without triggering an event of default. Management told Reorg it aimed to complete its debt restructuring talks by February, to coincide with the group's €1.724 billion RCF maturity.

The bondholders currently hold the right to choose whether or not to waive the event of default under their indenture that would be triggered by the appointment. The bankruptcy event of default would cause the notes to be immediately accelerated, without need for noteholder instruction, however a simple majority of noteholders could waive the event of default.

The bondholders therefore hold a key negotiation power and are in a tricky position as to whether they should waive the event of default without getting anything in return or risk potentially not having a seat at the table during reconciliation talks.

The French conciliation procedure could be launched upon request of the CEO. The company has to present a full report on its credits and debts, its securities and obligations, its annual reports for the past three years, a presentation of the financial situation highlighting difficulties and financial support needs. The company must also present a document containing reflections and an initial assessment on the situation and a way forward to improve the situation.

The conciliation procedure aims at reaching a friendly agreement between the company and its creditors. The tribunal can proceed with a 'simple order' to stamp the agreement and its details are kept confidential by the parties. Otherwise an 'approval' procedure can be enacted by the tribunal and in this case the case is made public (with the aim of offering more guarantees to the creditors).

The alternative French option would be the sauvegarde procedure. It is a form of creditor protection which is available to companies facing “difficulties that they cannot overcome” but are not in a situation of default of payment. Only the debtor can apply for sauvegarde and it allows the reorganization of a company’s debt under court supervision (via an administrator) and if a plan cannot be agreed upon, it permits the term out of a company’s debt by up to ten years. A sauvegarde plan can lead to a debt restructuring, a recapitalization, sale of assets and a partial sale of the business. In theory, a debt for equity swap could also come out of it.

The group said it is considering a number of “classic” options but there is no baseline scenario at this stage.

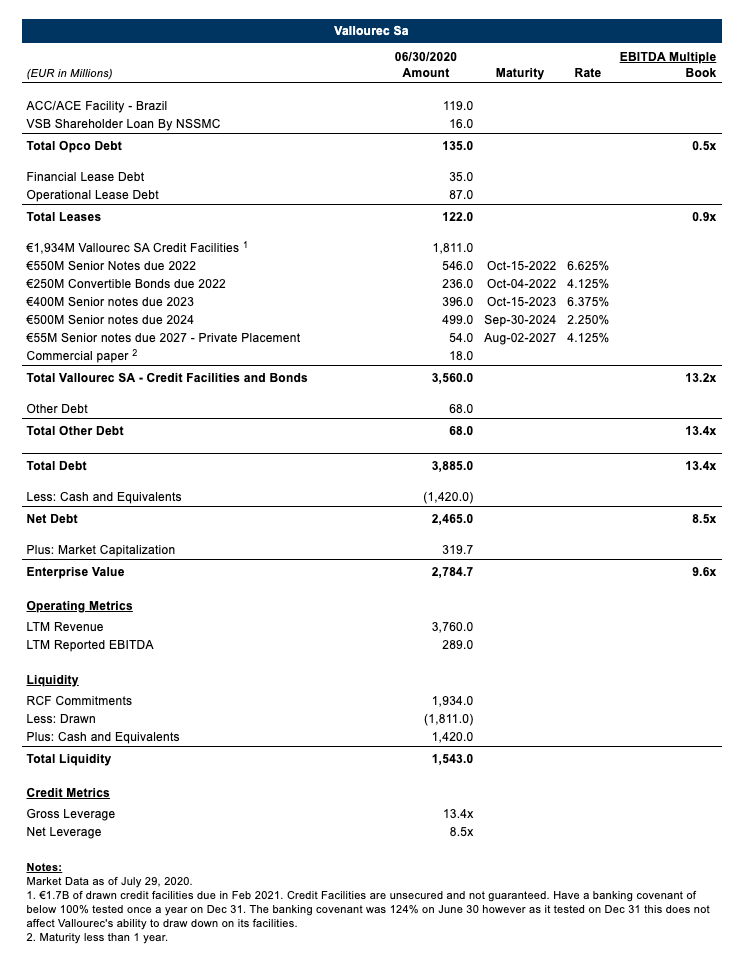

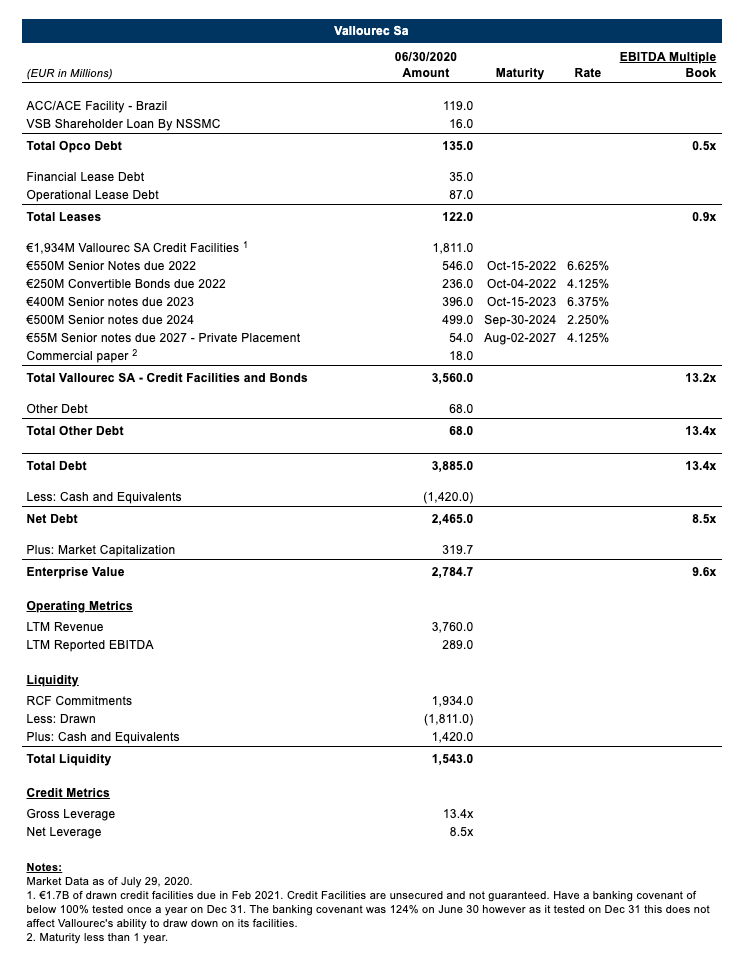

The company’s capital structure is below:

Wilkie Farr is advising shareholder BPIFrance, while the company has been working with Rothschild, Morgan Stanley and Weil Gotshal, as reported.

--Aurelia Seidlhofer, Jaishree Kalia

Over €100 million of the company’s 2022, 2023 and 2024 bonds traded around the mid-40s after the French pipe manufacturer announced on Sept. 1 it was seeking to open financial restructuring talks with all stakeholders and the option to appoint a mandataire ad hoc. Hedge funds including Bybrook, Apollo, SVP and Sculptor have been buying into the bonds. Sculptor also has cross-holdings with the RCF, sources added.

Continue reading for the EMEA Core Credit by Reorg team's analysis of the Vallourec situation and request a trial to access our coverage of other financial restructurings.

Vallourec is seeking lenders' consent for the upcoming talks and has already asked creditors for approval to appoint a mandataire without triggering an event of default. Management told Reorg it aimed to complete its debt restructuring talks by February, to coincide with the group's €1.724 billion RCF maturity.

The bondholders currently hold the right to choose whether or not to waive the event of default under their indenture that would be triggered by the appointment. The bankruptcy event of default would cause the notes to be immediately accelerated, without need for noteholder instruction, however a simple majority of noteholders could waive the event of default.

The bondholders therefore hold a key negotiation power and are in a tricky position as to whether they should waive the event of default without getting anything in return or risk potentially not having a seat at the table during reconciliation talks.

The French conciliation procedure could be launched upon request of the CEO. The company has to present a full report on its credits and debts, its securities and obligations, its annual reports for the past three years, a presentation of the financial situation highlighting difficulties and financial support needs. The company must also present a document containing reflections and an initial assessment on the situation and a way forward to improve the situation.

The conciliation procedure aims at reaching a friendly agreement between the company and its creditors. The tribunal can proceed with a 'simple order' to stamp the agreement and its details are kept confidential by the parties. Otherwise an 'approval' procedure can be enacted by the tribunal and in this case the case is made public (with the aim of offering more guarantees to the creditors).

The alternative French option would be the sauvegarde procedure. It is a form of creditor protection which is available to companies facing “difficulties that they cannot overcome” but are not in a situation of default of payment. Only the debtor can apply for sauvegarde and it allows the reorganization of a company’s debt under court supervision (via an administrator) and if a plan cannot be agreed upon, it permits the term out of a company’s debt by up to ten years. A sauvegarde plan can lead to a debt restructuring, a recapitalization, sale of assets and a partial sale of the business. In theory, a debt for equity swap could also come out of it.

The group said it is considering a number of “classic” options but there is no baseline scenario at this stage.

The company’s capital structure is below:

Wilkie Farr is advising shareholder BPIFrance, while the company has been working with Rothschild, Morgan Stanley and Weil Gotshal, as reported.

--Aurelia Seidlhofer, Jaishree Kalia

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.