Iona Energy Inc.

FTI Releases Update of Asset Sale in Liquidation, $50M of Restricted Cash Distributed to Bondholders

Fri 01/15/2016 05:50 AM

Relevant Documents:

Jan. 15 Creditor Information Update

Lisa Rickelton of FTI released an update of Iona Energy’s ongoing asset sale as part of its ongoing administration process. The administrators also noted that as of Dec. 22, Iona carried a restricted cash balance of $57.1 million in which the bond trustee enforced its security on, and as such it is no longer an asset to the company. Of this, the Nordic Trustee made an interim distribution of $50 million to bondholders on Dec. 30, 2015 and kept the remaining balance to fund the administration process. As of Jan. 6, unrestricted cash held by the company was $8.5 million.

Thus far as part of its accelerated M&A process, materials were sent to 42 parties in November, of which 13 subsequently signed NDAs. The following assets were put up for sale:

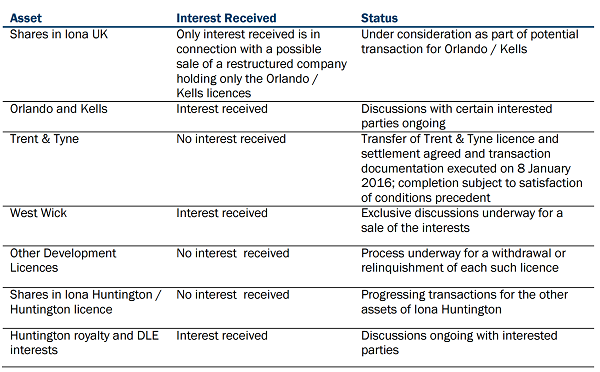

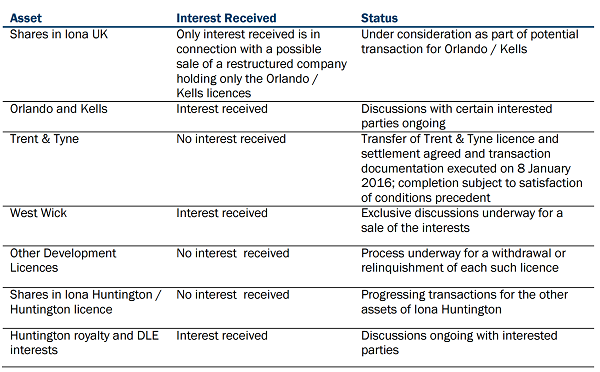

Separately, Iona is also seeking to sell royalty rights and a differential lifting entitlement (DLE) relating the Huntington licence interest and certain plant and equipment. A summary of the current status of the various asset sales is below:

Of note, due to the current oil and gas price environment, the administrators note that the Trent & Tyne assets are deemed to be of either zero or negative value, as they are also involved in a series of legacy disputes. As such Iona will divest the Trent & Tyne licence to Perenco at no cash consideration. In addition, Iona withdrawing from the Ronan & Oran, Fleetwind and Farne & Lundy licenses.

In addition, Iona hopes to realize an aggregate of $3 million for the sale of its Orlando and Kells licenses however $1.8 million is expected to be deferred. Discussions on the divestment of its 1.2% royalty entitlement from Premier Oil UK Limited and Westwick license are ongoing, no details of pricing were provided.

FTI was appointed on Jan. 6 as administrator in liquidation.

Jan. 15 Creditor Information Update

Lisa Rickelton of FTI released an update of Iona Energy’s ongoing asset sale as part of its ongoing administration process. The administrators also noted that as of Dec. 22, Iona carried a restricted cash balance of $57.1 million in which the bond trustee enforced its security on, and as such it is no longer an asset to the company. Of this, the Nordic Trustee made an interim distribution of $50 million to bondholders on Dec. 30, 2015 and kept the remaining balance to fund the administration process. As of Jan. 6, unrestricted cash held by the company was $8.5 million.

Thus far as part of its accelerated M&A process, materials were sent to 42 parties in November, of which 13 subsequently signed NDAs. The following assets were put up for sale:

- shares in Iona Huntington, including tax pool losses;

- asset sales of the Orlando, Kells, Trent & Tyne, and Ronan and Oran licences;

- asset sales of the remaining exploration licences and the West Wick discovery;

- shares in Iona UK, including tax pool losses

Separately, Iona is also seeking to sell royalty rights and a differential lifting entitlement (DLE) relating the Huntington licence interest and certain plant and equipment. A summary of the current status of the various asset sales is below:

Of note, due to the current oil and gas price environment, the administrators note that the Trent & Tyne assets are deemed to be of either zero or negative value, as they are also involved in a series of legacy disputes. As such Iona will divest the Trent & Tyne licence to Perenco at no cash consideration. In addition, Iona withdrawing from the Ronan & Oran, Fleetwind and Farne & Lundy licenses.

In addition, Iona hopes to realize an aggregate of $3 million for the sale of its Orlando and Kells licenses however $1.8 million is expected to be deferred. Discussions on the divestment of its 1.2% royalty entitlement from Premier Oil UK Limited and Westwick license are ongoing, no details of pricing were provided.

FTI was appointed on Jan. 6 as administrator in liquidation.

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.