European Cov-Lite Loans Increase

The European Central Bank, or ECB, issued a Dear CEO Letter on its expectations on the risk appetite frameworks for leveraged transactions of the institutions under its supervision.

This follows the consideration of the ECB that leveraged finance is a key vulnerability of the institutions under its supervision due to their increased leverage finance exposure over the past few years and the higher risks carried by these transactions.

The ECB states a number of indicators suggest that risks are now higher than they were before the global financial crisis. For example, loan agreement documentation is very weak (as captured by, but not limited to, covenant-lite loans), which is eroding lenders’ protection and can be expected to lead to significantly lower recovery rates.

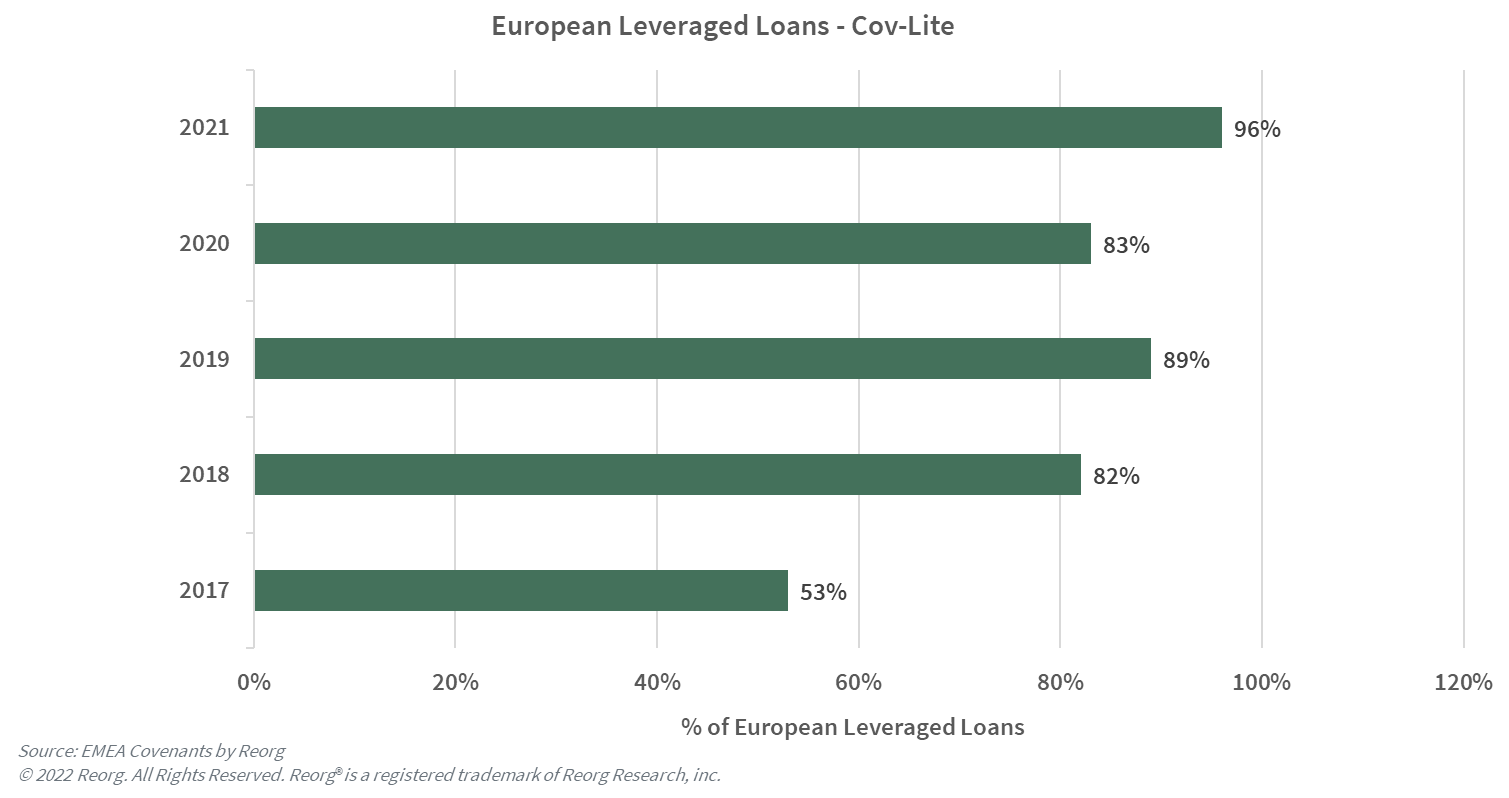

According to our loans database European cov-lite loans have increased to 96% in 2021 from 53% in 2017 as illustrated below.

Reorg’s EMEA Covenants team publish regular updates on covenant, covenant-lite (also known as cov-lite) trends regularly. Request trial access here.