Goodrich Petroleum Corporation

No Recovery for Unsecured Notes Under Goodrich RSA; Consensual Use of Cash Collateral Contemplated

Fri 04/01/2016 18:16 PM

Relevant Document:

Restructuring Support Agreement

Goodrich Petroleum’s restructuring support agreement, or RSA, that the company executed with second lien holders Franklin Advisors, PENN Capital Management, Kayne Anderson Capital Advisors, Columbia and Jeffries, contemplates that the claims under the senior credit facility “will be treated in a manner and form acceptable to the Administrative Agent, the Majority Consenting Noteholders, and the Debtors.” The RSA also does not clarify whether there will be debtor-in-possession financing but does specify that the second lien holders and credit agreement administrative agent have consented to the use of cash collateral. The plan term sheet further provides that unsecured notes will not receive a distribution under the plan.

As disclosed earlier today, under the RSA plan, second lien holders stand to recover 100% of reorganized equity, subject to dilution by a MIP covering 9% of reorganized equity.

The parties anticipate that the in-court restructuring will take roughly two months. The proposed restructuring timeline is as follows:

The term sheet explains that the administrative agent and the second lien noteholders consent to Goodrich’s use of cash collateral, “subject to a reasonable budget approved by the Debtors, Administrative Agent, and the Majority Consenting Noteholders and with adequate protection in a form acceptable to the Majority Consenting Noteholders.”

The agreement may be terminated by Goodrich if the company consummates its exchange offers. It can also be terminated if “the Administrative Agent does not agree to any material term, condition, or other agreement contained in the Plan Term Sheet or this agreement.”

Pursuant to the term sheet, the board of reorganized Goodrich will comprise:

Regarding the management incentive plan, 5% of the total 9% of new equity will be granted upfront, and will be unrestricted. The remaining 4% will vest over a three year period, with one-third vesting each year, and will be restricted.

Current severance agreements will be assumed by reorganized Goodrich, but will be amended “such that the transactions contemplated by this Term Sheet shall not constitute a change of control under any such severance agreements.”

The term sheets also provides a full release by the debtors in favor of certain parties, including the administrative agent, the lenders, second lien noteholders, among others. Additionally, it provides for certain third parties releases in favor of those parties.

Anticipated treatment for classes of claims is as follows:

Goodrich does list certain elements of the plan term sheet as follows:

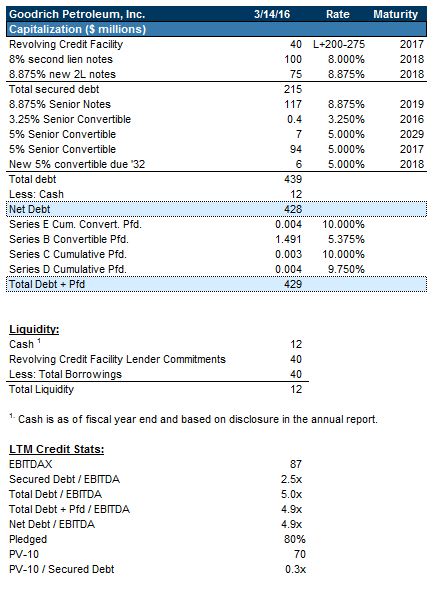

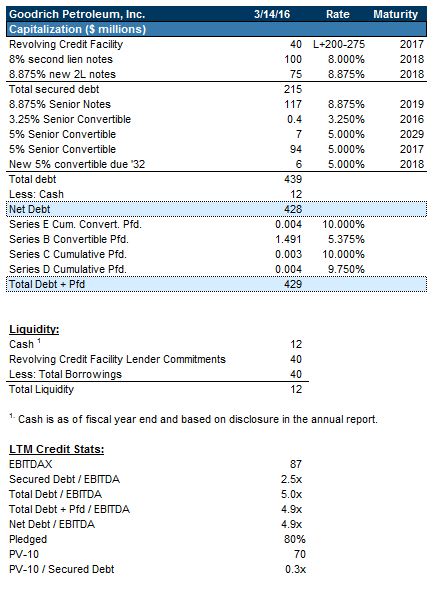

As disclosed in the plan term sheet, the debtors’ capital structure is as follows:

Restructuring Support Agreement

Goodrich Petroleum’s restructuring support agreement, or RSA, that the company executed with second lien holders Franklin Advisors, PENN Capital Management, Kayne Anderson Capital Advisors, Columbia and Jeffries, contemplates that the claims under the senior credit facility “will be treated in a manner and form acceptable to the Administrative Agent, the Majority Consenting Noteholders, and the Debtors.” The RSA also does not clarify whether there will be debtor-in-possession financing but does specify that the second lien holders and credit agreement administrative agent have consented to the use of cash collateral. The plan term sheet further provides that unsecured notes will not receive a distribution under the plan.

As disclosed earlier today, under the RSA plan, second lien holders stand to recover 100% of reorganized equity, subject to dilution by a MIP covering 9% of reorganized equity.

The parties anticipate that the in-court restructuring will take roughly two months. The proposed restructuring timeline is as follows:

- Solicitation of votes: March 23-25

- Petition date: April 15, file the plan, disclosure statement and a motion to approve the RSA

- Petition date +35 days: Obtain court approval of the RSA motion

- Confirmation hearing: May 20-31

- Exit Chapter 11: June 9-15

The term sheet explains that the administrative agent and the second lien noteholders consent to Goodrich’s use of cash collateral, “subject to a reasonable budget approved by the Debtors, Administrative Agent, and the Majority Consenting Noteholders and with adequate protection in a form acceptable to the Majority Consenting Noteholders.”

The agreement may be terminated by Goodrich if the company consummates its exchange offers. It can also be terminated if “the Administrative Agent does not agree to any material term, condition, or other agreement contained in the Plan Term Sheet or this agreement.”

Pursuant to the term sheet, the board of reorganized Goodrich will comprise:

- Walter G. Goodrich, the current CEO;

- Robert C. Turnham Jr., the current President;

- Any member of the Board of Directors of Goodrich, other than the CEO and President, who is interviewed and approved by the holders of the new equity, and

- Up to four additional members, other than members of the Board of Directors of Goodrich, to be appointed by the new equity holders.

Regarding the management incentive plan, 5% of the total 9% of new equity will be granted upfront, and will be unrestricted. The remaining 4% will vest over a three year period, with one-third vesting each year, and will be restricted.

Current severance agreements will be assumed by reorganized Goodrich, but will be amended “such that the transactions contemplated by this Term Sheet shall not constitute a change of control under any such severance agreements.”

The term sheets also provides a full release by the debtors in favor of certain parties, including the administrative agent, the lenders, second lien noteholders, among others. Additionally, it provides for certain third parties releases in favor of those parties.

Anticipated treatment for classes of claims is as follows:

Goodrich does list certain elements of the plan term sheet as follows:

- Allowed priority claim holder: other than a priority tax claim or administrative claim - shall receive either: (a) cash equal to the full allowed amount of its claim or (b) such other treatment as may otherwise be agreed to;

- Secured claim holder: other than a priority tax claim, senior credit facility claim, or second lien notes claim - shall receive, at the debtors’ election and with the consent of the consenting noteholders, either: (a) cash equal to the full allowed amount of its claim, (b) reinstatement of such holder’s claim, (c) the return or abandonment of the collateral securing such claim to such holder, or (d) such other treatment as may otherwise be agreed to; and

- Credit Agreement Claims: Treatment as agreed by the administrative agent, the majority consenting second lien holders and the debtors.

- Holders of the second lien notes shall receive: their pro rata share of 100% of the new membership interests in the reorganized company, or the new equity interests, subject to dilution from shares issued in connection with a proposed long-term MIP for the reorganized company, which shall initially provide for grants of new equity interests in an aggregate amount equal to 9% of the total new equity interests.

- Unsecured Notes Claims: No recovery

- General Unsecured Claims: No recovery

- Holders of convenience class claims: with an allowed amount of less than $10,000 will receive either payment in full in cash or a lesser treatment as may be agreed to.

As disclosed in the plan term sheet, the debtors’ capital structure is as follows:

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.