AET/CVS: Positive Signs in a Shifting Competitive Landscape

Wed 02/21/2018 13:21 PM

Event Driven Takeaways

Albertsons’ announcement yesterday to acquire Rite Aid against the backdrop of a potential Amazon entry into the healthcare marketplace will likely lower the antitrust risk for the Aetna/CVS transaction.

In the past, the specter of Amazon’s entry into the healthcare space has not been sufficient to convince regulators that it would replace any competition lost by the Aetna/CVS merger. For instance, the parties in the failed Rite Aid/Walgreens transaction unsuccessfully argued that potential entry by Amazon would justify the pro-competitive benefits of the merger.

With the tech giant announcing plans to partner with JP Morgan and Berkshire Hathaway to enter the healthcare business, the competition posed by Amazon in both the pharmacy benefits management, or PBM, and retail pharmacy markets is an emerging threat for established players. While the details of the venture are not yet public, the recent actions by Amazon bring its entry closer to being likely and sufficient to replace competition that might be considered lost by the regulators as a result of mergers in the space.

In addition to Amazon’s potential market entry, Albertsons’ announcement yesterday to acquire Rite Aid in conjunction with the sale of Rite Aid stores to Walgreens last fall, promises to reshape the competitive landscape in the pharmacy space. Together, Amazon’s anticipated entry, proforma Albertsons, and Walgreens all present added competition for Aetna/CVS.

Amazon’s partnership with JP Morgan and Berkshire Hathaway could allow the tech giant to piggyback on the combined workforce of more than 1 million employees to test out its own in-house PBM. And while the 1 million number is insignificant when compared to the number of covered lives that other established PBMs control, including CVS Caremark, it could set the stage for Amazon to scale quickly in a PBM industry that is likely to see greater fragmentation in the future. However, for Amazon to truly disrupt the market using its technology and data, the company would need control over medical lives and manage their pharmacy benefits. Amazon can achieve that by building its own in-house PBM (as discussed above), or by acquiring a medium-sized PBM.

However, Albertsons’ acquisition of Rite Aid could limit the potential PBM targets for Amazon. By acquiring Rite Aid, Albertsons would acquire Rite Aid’s in-house PBM, EnvisionRx, thus preventing the PBM from falling into Amazon’s hands. Prime Therapeutics, a PBM that serves nearly 26 million members, remains perhaps the only mid-sized acquisition target for Amazon’s PBM ambitions in the near term.

From Aetna/CVS’s perspective, even though the Rite Aid/Albertsons deal prevents Amazon from acquiring EnvisionRx, the transaction still strengthens the competitive landscape in the pharmacy business. Rite Aid/Albertsons would control EnvisionRx, which services roughly 22 million lives, in addition to a combined retail pharmacy platform of around 4,892 pharmacies.

EnvisionRx has struggled as a PBM and Albertsons’ acquisition of Rite Aid could provide the PBM with new opportunities. Rite Aid’s SEC filings indicate that not only have EnvisionRx’s revenues declined in recent quarters, but the PBM is also sending fewer customers into Rite Aid pharmacies.

In the second half of 2017, Rite Aid’s intersegment eliminations, which includes intersegment revenues and corresponding cost of revenues that occur when EnvisionRx’s members use Rite Aid stores to purchase drugs, fell 38% (see Figure 1). This indicates Rite Aid has been unsuccessful in deriving synergies from the company’s combined “PBM plus pharmacy” platform.

Figure 1: Intersegment Eliminations

In this context, the Rite Aid/Albertsons deal, in addition to expanding the combination’s in-house pharmacy coverage, is also designed to leverage EnvisionRx to drive more lives to the rebranded in-store pharmacies at Albertsons locations post acquisition.

For Aetna/CVS, this means that there will be a stronger pharmacy-PBM combination that would be better positioned to attract drug beneficiaries and consumers away from CVS pharmacies.

For CVS, another potential avenue for competition could emerge from Amazon entering the mail order specialty drug market. As Figure 2 illustrates, Amazon could either acquire 1) a PBM with a specialty pharmacy business or 2) an independent specialty pharmacy such as Diplomat Pharmacy.

In recent years, the specialty pharmacy industry has seen rapid growth with considerable entry from new participants, including insurers, PBMs, wholesalers, and traditional retail pharmacy chains.

According to an estimate by the Drug Channels Institute, CVS cornered roughly 28% of prescription revenues from specialty drugs in 2016. As of Sept. 30, 2017, CVS Caremark operated 23 retail specialty pharmacy stores and 15 specialty mail order pharmacies.

-- Shrey Verma and Nils Tracy

- Amazon’s recent announcement to partner with JP Morgan and Berkshire Hathaway to enter the pharmacy business has the potential to reshape the market, and could change the manner in which antitrust regulators analyze transactions in this sector.

- Regulators are likely to view Amazon’s announcements as credible data points to support the view that the company’s market entry will be likely and sufficient to replace competition that might be considered lost as a result of mergers in the pharmacy space.

- During the regulatory review of the unsuccessful Rite Aid/Walgreens transaction, the specter of Amazon's entry could only be considered as a hypothetical. Today, the announced Rite Aid/Albertsons transaction, along with a more tangible declaration of entry by Amazon, creates stronger competitive constraints to a combined Aetna/CVS.

- For CVS, the Rite Aid/Albertsons deal will also create a stronger pharmacy-PBM combination with the potential to attract drug beneficiaries and consumers away from CVS stores. Furthermore, DOJ staff may consider Amazon’s potential entry into the mail order specialty drug market as another avenue for competition directed at CVS.

Albertsons’ announcement yesterday to acquire Rite Aid against the backdrop of a potential Amazon entry into the healthcare marketplace will likely lower the antitrust risk for the Aetna/CVS transaction.

In the past, the specter of Amazon’s entry into the healthcare space has not been sufficient to convince regulators that it would replace any competition lost by the Aetna/CVS merger. For instance, the parties in the failed Rite Aid/Walgreens transaction unsuccessfully argued that potential entry by Amazon would justify the pro-competitive benefits of the merger.

With the tech giant announcing plans to partner with JP Morgan and Berkshire Hathaway to enter the healthcare business, the competition posed by Amazon in both the pharmacy benefits management, or PBM, and retail pharmacy markets is an emerging threat for established players. While the details of the venture are not yet public, the recent actions by Amazon bring its entry closer to being likely and sufficient to replace competition that might be considered lost by the regulators as a result of mergers in the space.

In addition to Amazon’s potential market entry, Albertsons’ announcement yesterday to acquire Rite Aid in conjunction with the sale of Rite Aid stores to Walgreens last fall, promises to reshape the competitive landscape in the pharmacy space. Together, Amazon’s anticipated entry, proforma Albertsons, and Walgreens all present added competition for Aetna/CVS.

Amazon’s partnership with JP Morgan and Berkshire Hathaway could allow the tech giant to piggyback on the combined workforce of more than 1 million employees to test out its own in-house PBM. And while the 1 million number is insignificant when compared to the number of covered lives that other established PBMs control, including CVS Caremark, it could set the stage for Amazon to scale quickly in a PBM industry that is likely to see greater fragmentation in the future. However, for Amazon to truly disrupt the market using its technology and data, the company would need control over medical lives and manage their pharmacy benefits. Amazon can achieve that by building its own in-house PBM (as discussed above), or by acquiring a medium-sized PBM.

However, Albertsons’ acquisition of Rite Aid could limit the potential PBM targets for Amazon. By acquiring Rite Aid, Albertsons would acquire Rite Aid’s in-house PBM, EnvisionRx, thus preventing the PBM from falling into Amazon’s hands. Prime Therapeutics, a PBM that serves nearly 26 million members, remains perhaps the only mid-sized acquisition target for Amazon’s PBM ambitions in the near term.

From Aetna/CVS’s perspective, even though the Rite Aid/Albertsons deal prevents Amazon from acquiring EnvisionRx, the transaction still strengthens the competitive landscape in the pharmacy business. Rite Aid/Albertsons would control EnvisionRx, which services roughly 22 million lives, in addition to a combined retail pharmacy platform of around 4,892 pharmacies.

EnvisionRx has struggled as a PBM and Albertsons’ acquisition of Rite Aid could provide the PBM with new opportunities. Rite Aid’s SEC filings indicate that not only have EnvisionRx’s revenues declined in recent quarters, but the PBM is also sending fewer customers into Rite Aid pharmacies.

In the second half of 2017, Rite Aid’s intersegment eliminations, which includes intersegment revenues and corresponding cost of revenues that occur when EnvisionRx’s members use Rite Aid stores to purchase drugs, fell 38% (see Figure 1). This indicates Rite Aid has been unsuccessful in deriving synergies from the company’s combined “PBM plus pharmacy” platform.

Figure 1: Intersegment Eliminations

Source: Rite Aid SEC Filings

In this context, the Rite Aid/Albertsons deal, in addition to expanding the combination’s in-house pharmacy coverage, is also designed to leverage EnvisionRx to drive more lives to the rebranded in-store pharmacies at Albertsons locations post acquisition.

For Aetna/CVS, this means that there will be a stronger pharmacy-PBM combination that would be better positioned to attract drug beneficiaries and consumers away from CVS pharmacies.

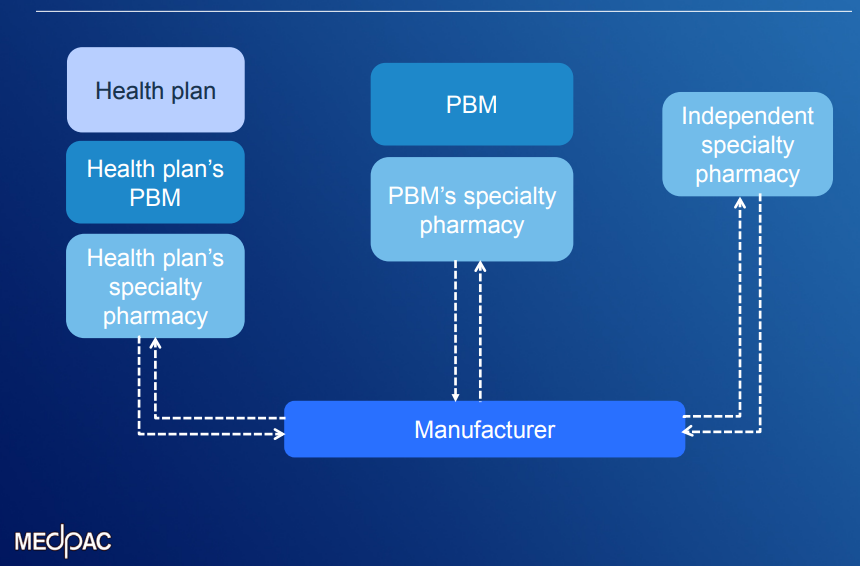

For CVS, another potential avenue for competition could emerge from Amazon entering the mail order specialty drug market. As Figure 2 illustrates, Amazon could either acquire 1) a PBM with a specialty pharmacy business or 2) an independent specialty pharmacy such as Diplomat Pharmacy.

Figure 2: Three examples of Specialty Pharmacy Ownership

Source: Medpac

In recent years, the specialty pharmacy industry has seen rapid growth with considerable entry from new participants, including insurers, PBMs, wholesalers, and traditional retail pharmacy chains.

According to an estimate by the Drug Channels Institute, CVS cornered roughly 28% of prescription revenues from specialty drugs in 2016. As of Sept. 30, 2017, CVS Caremark operated 23 retail specialty pharmacy stores and 15 specialty mail order pharmacies.

-- Shrey Verma and Nils Tracy

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.