Obrascon Huarte Lain S.a./adr

Waterfall Download: OHL Projects Par Recovery for Holdco Bonds

Wed 07/15/2015 13:15 PM

Relevant Item:

OHL Waterfall

In recent weeks, OHL has come under scrutiny after another leak of phone calls between company officials and Mexican government officials and the depressed trading levels of its partially owned subsidiary Abertis. The company has not fallen into distressed territory yet, but it continues to be of interest to high-yield investors. OHL bonds continue to trade in the low to mid 90s as of publication.

Reorg Research has completed a waterfall analysis which can be downloaded here.

Like many other concession operators, OHL operates on a project-by-project basis and raises debt that is specific to each contract it wins. OHL’s projects are related to infrastructure developments, with a focus on toll roads, railways, airports and marine ports. The company’s projects span the world, with significant operations in Mexico, Spain, Chile, Colombia and Peru.

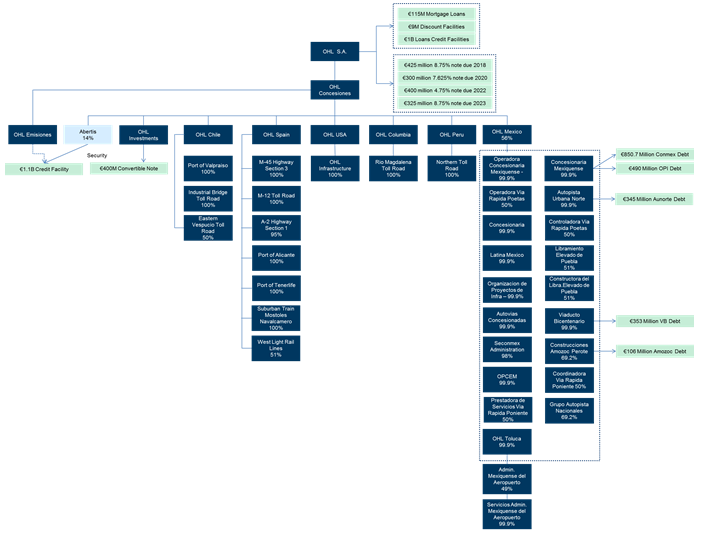

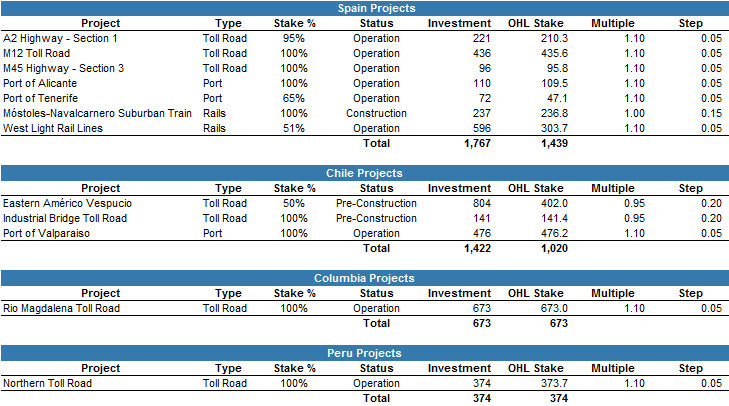

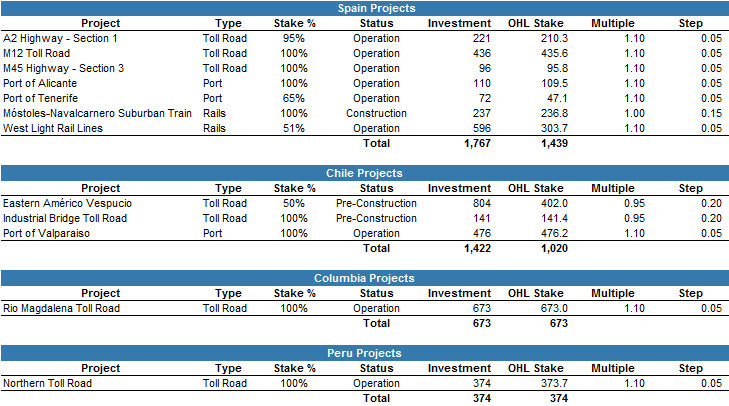

A summary of the company’s corporate structure by project is provided as follows:

For the purposes of our waterfall, we have evaluated the company on a project-by-project basis, assigning a base case value of 1.05x investment for projects currently in operation with a range of +/- 0.5x, implying a high-case return of 15% on an investment. For projects in construction, we apply a base-case multiple of 1.0x, with a range of +/- 0.15x, and lastly for projections in the pre-construction phase, we reflect the added risk and volatility of the outcome of the project with a base multiple of 0.95x, +/- 0.2x.

As a point of reference, in 2013, ICA Empresas closed on the sale of its RCA toll road, and it disclosed that it generated a profit of 498 million Mexican pesos (€30 million) with a total sale price of 5,073 million Mexican pesos (page 89 of the 2013 Annual Report). Backing out the 498 million Mexican pesos, we assume that this investment initially totaled 4,575 million Mexican pesos, implying a multiple of 1.1x.

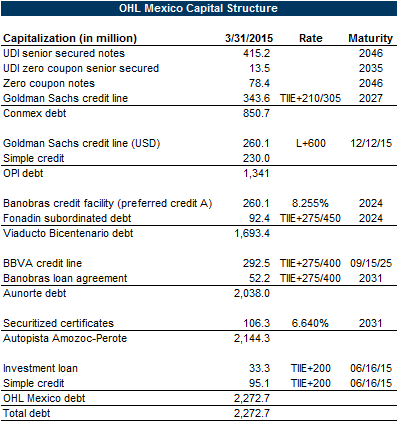

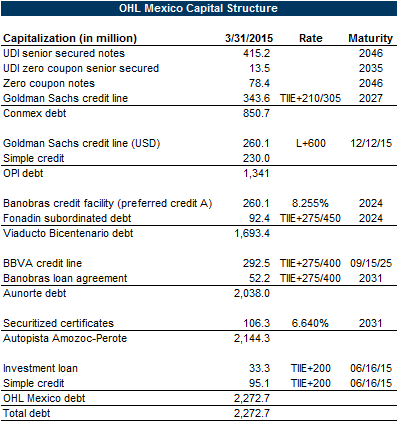

A summary of OHL Mexico’s most recent capital structure is provided as follows:

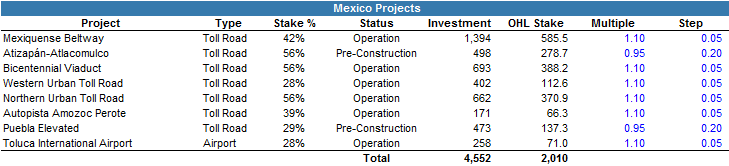

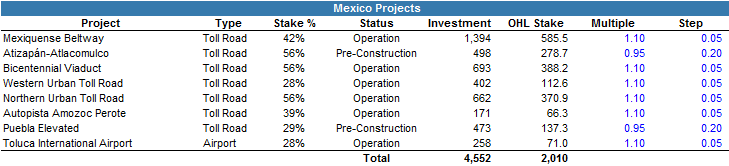

In total, OHL Mexico has eight projects outstanding, most of which are related to toll road development along with the Toluca International Airport, which is currently in operation. OHL Mexico is a direct subsidiary of OHL Concesiones, which is subsequently owned by OHL SA, as illustrated in our corporate structure. All of OHL Mexico’s projects are only partially owned, and its stakes are outlined below:

The projects represent a total investment of €4.5 billion, however OHL’s stake totals €2.0 billion.

Starting our waterfall analysis, we first look at the Conmex project, in which OHL Mexico has a 42% stake and a €586 million investment. This is the Mexiquense Beltway toll road, which covers 155 km in length and has an annual average daily traffic figure of 283,241 vehicles. The project was started in 2003 and is set to go until 2051.

In the Conmex box we assign both the Conmex and Operadora de Proyectos de Infraestructura S. de R. L. de C. V. (“OPI”) debt. According to the company’s annual statements, OPI signed a credit agreement with Goldman Sachs for $300 million USD (€271 million), which was used to make an intercompany loan to Conmex (Holdco Loan, page 71 of PDF in annual financials) for certain payments on Conmex’s existing credit facility and to fund any shortfalls in the debt service reserve account provided by the Holdco payment trust agreement. The Holdco loan agreement is set to mature in December 2015. With total debt of €1.1 billion in the Conmex box, we estimate almost no residual value recoveries from this project, even in the high case, in which we apply a multiple of 1.15x. At minimum, Conmex would need to generate a return of 1.9x its investment to cover its debt.

Next we look at OHL’s Viaducto Bicentenario project, in which the company has a 56% stake in the €693 million investment, or €388 million. Viaducto Bicentenario is an elevated highway covering 32 kilometers and an average daily vehicle count of 29,075. The project’s lifespan ends on May 6, 2038. In total, as of the end of the first quarter, this project carried about €353 million, broken down as €260 million in a credit line with Banobras and €92 million subordinated debt with Fonadin. As such, we see residual value ranging from €55 million to €94 million from this project. Similarly, OHL Mexico’s Aunorte investment is a 9 kilometer toll road with about €293 million in a BBVA credit line and €52 million in a Banobras loan agreement. With OHL’s stake at €371 million, we estimate residual values ranging from €45 million to €82 million.

OHL Mexico’s Amozoc Perote highway has €106 million in securitized certificates and an investment value of €66 million, with OHL Mexico having a 39% stake, or €66 million. As such, our analysis anticipates no residual value from this box, and a recovery range of 65% to 72%.

The remaining projects of OHL Mexico did not have any debt listed as of the first quarter. The two operational projects include the Western Urban toll road and the Toluca International Airport, in which OHL Mexico has €113 million and €71 million stakes, respectively, bringing cumulative distributable value to a range of €193 million to €211 million.

Lastly, OHL Mexico also has two projects that are in the pre-construction phase, and as such we have applied a multiple range of 0.75x to 1.15x for preconstruction projects. With a stake of €279 million in the Atizapan Altacomulco toll road and €138 million in the Puebla Elevated toll road, this brings total distributable value to a range of €312 million to €478 million from the pre-construction projects.

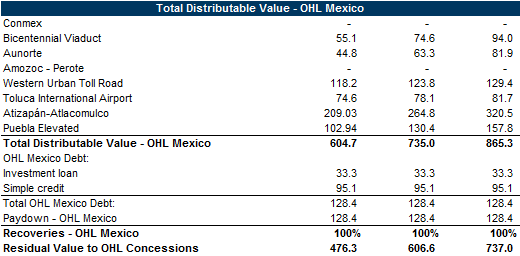

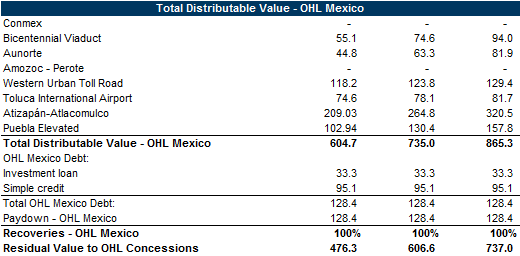

A summary of OHL Mexico’s waterfall is provided as follows:

Following the paydown of OHL Mexico’s €128 million in debt, comprising a €33 million investment loan and a €95 million simple credit line, about €476 million to €737 million in equity value flows up to OHL Concessions.

Prior to moving to the OHL Concessions box, we look at the other projects outstanding by country. The remaining projects are as follows:

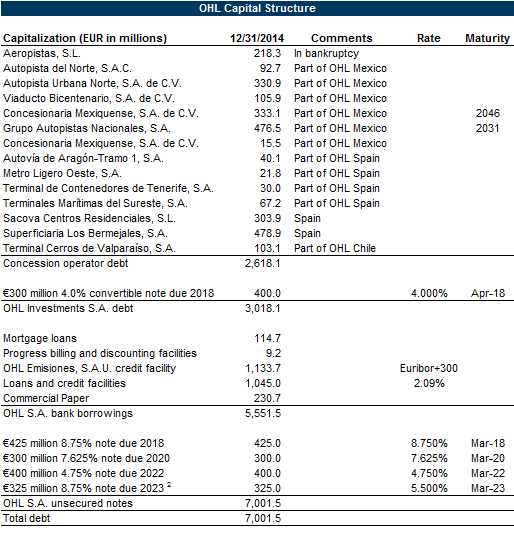

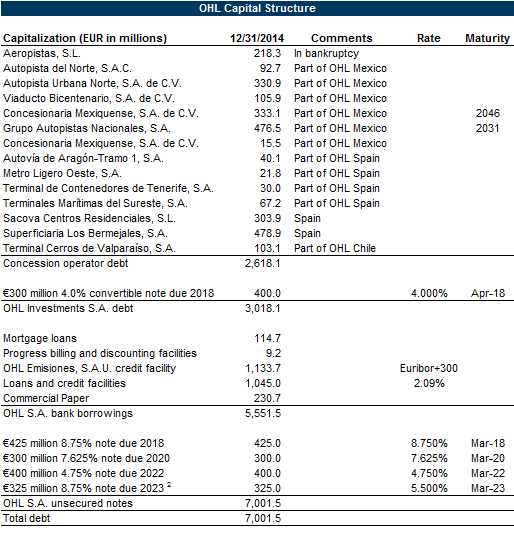

A summary of the remaining debt at OHL is provided as follows

Beginning with OHL Spain, the company has about €106 million in debt at its Autovía de Aragón-Tramo 1 SA project, in which OHL Concessions has a €210 million stake, translating into a range of €221 million to €242 million - indicating total residual value to OHL Concessions of €181 million to €202 million. Next, with €237 million in investments in the Metro Ligero, which is to operate as a suburban train with the contract lasting through Jan. 1, 2028, and which bears about €475 million in project debt, our analysis anticipates €180 million to €251 million in residual equity value after the debt paydown.

OHL Spain also operates two ports, both of which are in operation. The Port of Tenerife carries €30 million in debt, and OHL has invested €47 million into the project - thus translating into residual value of €19 million to €24 million. The Port of Alicante carried €68 million of debt as of Dec. 31, 2014, and has €110 million invested from OHL. As such, we expect residual value of €48 million to €59 million.

Similar with OHL Mexico, the remaining projects in Spain carry no debt burden reported in the latest financials, which include the M12 toll road, the M45 highway and the West Light Rail, all of which are currently in construction.

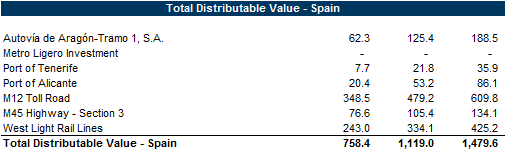

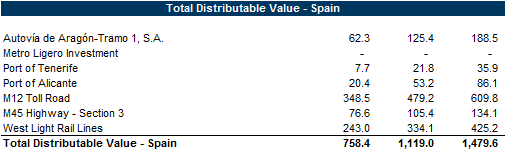

A summary of the equity value from the company’s Spanish projects are provided below:

The last remaining projects are held in South America across Chile, Colombia and Peru. In Chile, from the Port of Valparaiso, we anticipate €397 million to €445 million in residual value after the paydown of €103 million in debt. From the Eastern Americo Vespucio project, which is a 9.3 kilometer long toll road in which OHL has a 50% stake, we expect distributable value of between €302 million to €462 million. Lastly, in Chile, OHL Concessions also operates a bridge toll road with an investment of €141 million, contributing a range of €106 million to €163 million in distributable value. OHL Concessions operates only one project in Colombia and one in Peru, the Rio Magdalena toll road and the Northern toll road, respectively. The Rio Magdalena toll road carries an investment of €673 million, and it is fully operational, translating to distributable value of €707 million to €774 million. For the Northern toll road, applying the same range to an investment of €374 million, we expect equity of €392 million to €430 million.

OHL Concessions has a subsidiary, OHL Investments SA, which issued a €400 million secured convertible bond that is convertible into shares of OHL Mexico. In total, the bond represents about 17% of OHL Mexico’s share capital. We anticipate that this convertible note is fully covered.

In addition, OHL Concessions is also the parent of OHL Emisiones, which has a €1.1 billion credit facility that is is secured by OHL Concessions’ 14% stake in Abertis Infraestructuras SA.. Specifically, as noted in OHL Concessions financials, the credit facility comes due Dec. 31 this year and bears an interest rate of three-month Euribor plus 375 basis points. In the event Abertis shares fall below €15.105, OHL must provide a cash guarantee. As of July 14, Abertis shares traded at €15.16, and Abertis has approximately 943 million ordinary shares according to its website, which translates to a market cap of €14.3 billion, or a €2 billion stake for OHL Concessions.

As such, we anticipate that unless the share prices falls drastically to below €8.62 per share, the OHL Emisiones credit facility will be well covered. For the purposes of this analysis, we apply a range of €2.00 per share to the Abertis shares, indicating a range of €1.7 billion to €2.3 billion for OHL Concessions stake. Following the paydown of the Emisiones facility, we anticipate residual value of €595 million to €1.1 billion from the Abertis stake.

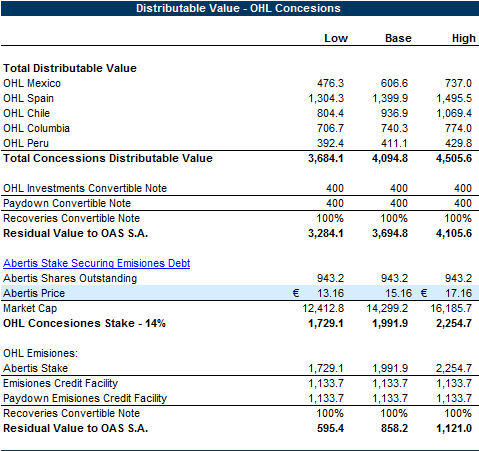

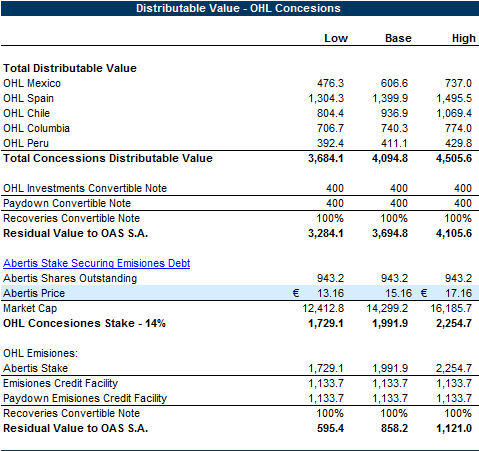

In sum, from OHL Concessions - we expect total residual value from its various projects as follows:

Lastly, as discussed in our previous article, OHL Concesiones also disclosed several intercompany transactions outstanding with its parent, OHL SA.. These entail (according to page 45 of OHL Concessions 2014 financials):

However, because after any paydown of OHL Concessions outstanding debt would simply flow up again to OHL SA, we anticipate that this would be circular and eventually flow up to OHL SA in the form of residual value.

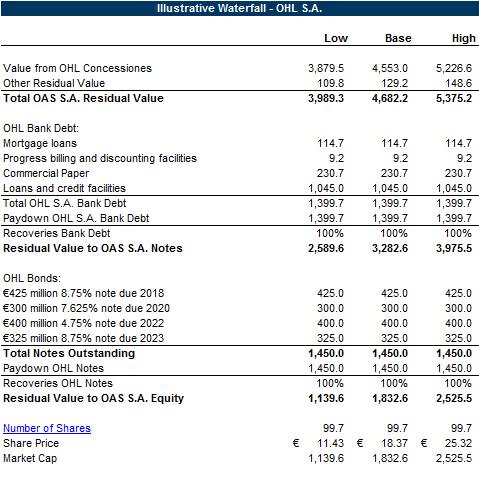

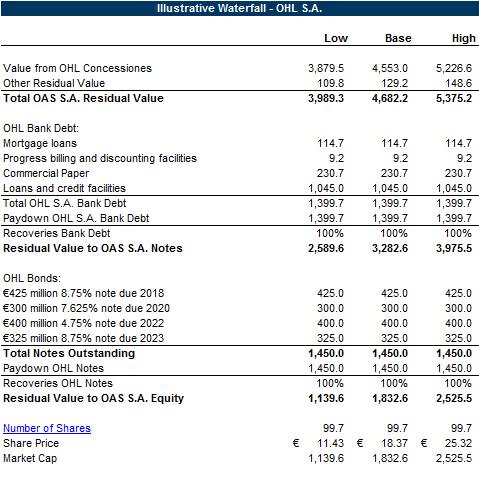

As such, we move on to OHL SA’s bank debt outstanding, totaling €1.4 billion. With a total residual value of €4 billion to €5.4 billion from OHL Concessions following the paydown of both the OHL Investments and OHL Emisiones debt, along with €110 million to €150 million in residual value from other projects under non-OHL Concessions subsidiaries, our analysis anticipates that OHL SA bank debt will also be covered in full, leaving €2.6 billion to €4 billion in residual value for the unsecured bonds, which has €1.5 billion outstanding and is thus fully covered, leaving €1.1 billion to €2.5 billion to the company’s equity, which according to its website has 99.7 million shares outstanding. As such, in our base case, our analysis values OHL’s shares at €18.37 per share, compared with today’s trading price of €17.15 per share.

A summary of the waterfall at Topco is provided as follows:

OHL Waterfall

In recent weeks, OHL has come under scrutiny after another leak of phone calls between company officials and Mexican government officials and the depressed trading levels of its partially owned subsidiary Abertis. The company has not fallen into distressed territory yet, but it continues to be of interest to high-yield investors. OHL bonds continue to trade in the low to mid 90s as of publication.

Reorg Research has completed a waterfall analysis which can be downloaded here.

Like many other concession operators, OHL operates on a project-by-project basis and raises debt that is specific to each contract it wins. OHL’s projects are related to infrastructure developments, with a focus on toll roads, railways, airports and marine ports. The company’s projects span the world, with significant operations in Mexico, Spain, Chile, Colombia and Peru.

A summary of the company’s corporate structure by project is provided as follows:

(Click on image to enlarge)

For the purposes of our waterfall, we have evaluated the company on a project-by-project basis, assigning a base case value of 1.05x investment for projects currently in operation with a range of +/- 0.5x, implying a high-case return of 15% on an investment. For projects in construction, we apply a base-case multiple of 1.0x, with a range of +/- 0.15x, and lastly for projections in the pre-construction phase, we reflect the added risk and volatility of the outcome of the project with a base multiple of 0.95x, +/- 0.2x.

As a point of reference, in 2013, ICA Empresas closed on the sale of its RCA toll road, and it disclosed that it generated a profit of 498 million Mexican pesos (€30 million) with a total sale price of 5,073 million Mexican pesos (page 89 of the 2013 Annual Report). Backing out the 498 million Mexican pesos, we assume that this investment initially totaled 4,575 million Mexican pesos, implying a multiple of 1.1x.

A summary of OHL Mexico’s most recent capital structure is provided as follows:

In total, OHL Mexico has eight projects outstanding, most of which are related to toll road development along with the Toluca International Airport, which is currently in operation. OHL Mexico is a direct subsidiary of OHL Concesiones, which is subsequently owned by OHL SA, as illustrated in our corporate structure. All of OHL Mexico’s projects are only partially owned, and its stakes are outlined below:

The projects represent a total investment of €4.5 billion, however OHL’s stake totals €2.0 billion.

Starting our waterfall analysis, we first look at the Conmex project, in which OHL Mexico has a 42% stake and a €586 million investment. This is the Mexiquense Beltway toll road, which covers 155 km in length and has an annual average daily traffic figure of 283,241 vehicles. The project was started in 2003 and is set to go until 2051.

In the Conmex box we assign both the Conmex and Operadora de Proyectos de Infraestructura S. de R. L. de C. V. (“OPI”) debt. According to the company’s annual statements, OPI signed a credit agreement with Goldman Sachs for $300 million USD (€271 million), which was used to make an intercompany loan to Conmex (Holdco Loan, page 71 of PDF in annual financials) for certain payments on Conmex’s existing credit facility and to fund any shortfalls in the debt service reserve account provided by the Holdco payment trust agreement. The Holdco loan agreement is set to mature in December 2015. With total debt of €1.1 billion in the Conmex box, we estimate almost no residual value recoveries from this project, even in the high case, in which we apply a multiple of 1.15x. At minimum, Conmex would need to generate a return of 1.9x its investment to cover its debt.

Next we look at OHL’s Viaducto Bicentenario project, in which the company has a 56% stake in the €693 million investment, or €388 million. Viaducto Bicentenario is an elevated highway covering 32 kilometers and an average daily vehicle count of 29,075. The project’s lifespan ends on May 6, 2038. In total, as of the end of the first quarter, this project carried about €353 million, broken down as €260 million in a credit line with Banobras and €92 million subordinated debt with Fonadin. As such, we see residual value ranging from €55 million to €94 million from this project. Similarly, OHL Mexico’s Aunorte investment is a 9 kilometer toll road with about €293 million in a BBVA credit line and €52 million in a Banobras loan agreement. With OHL’s stake at €371 million, we estimate residual values ranging from €45 million to €82 million.

OHL Mexico’s Amozoc Perote highway has €106 million in securitized certificates and an investment value of €66 million, with OHL Mexico having a 39% stake, or €66 million. As such, our analysis anticipates no residual value from this box, and a recovery range of 65% to 72%.

The remaining projects of OHL Mexico did not have any debt listed as of the first quarter. The two operational projects include the Western Urban toll road and the Toluca International Airport, in which OHL Mexico has €113 million and €71 million stakes, respectively, bringing cumulative distributable value to a range of €193 million to €211 million.

Lastly, OHL Mexico also has two projects that are in the pre-construction phase, and as such we have applied a multiple range of 0.75x to 1.15x for preconstruction projects. With a stake of €279 million in the Atizapan Altacomulco toll road and €138 million in the Puebla Elevated toll road, this brings total distributable value to a range of €312 million to €478 million from the pre-construction projects.

A summary of OHL Mexico’s waterfall is provided as follows:

Following the paydown of OHL Mexico’s €128 million in debt, comprising a €33 million investment loan and a €95 million simple credit line, about €476 million to €737 million in equity value flows up to OHL Concessions.

Prior to moving to the OHL Concessions box, we look at the other projects outstanding by country. The remaining projects are as follows:

A summary of the remaining debt at OHL is provided as follows

Beginning with OHL Spain, the company has about €106 million in debt at its Autovía de Aragón-Tramo 1 SA project, in which OHL Concessions has a €210 million stake, translating into a range of €221 million to €242 million - indicating total residual value to OHL Concessions of €181 million to €202 million. Next, with €237 million in investments in the Metro Ligero, which is to operate as a suburban train with the contract lasting through Jan. 1, 2028, and which bears about €475 million in project debt, our analysis anticipates €180 million to €251 million in residual equity value after the debt paydown.

OHL Spain also operates two ports, both of which are in operation. The Port of Tenerife carries €30 million in debt, and OHL has invested €47 million into the project - thus translating into residual value of €19 million to €24 million. The Port of Alicante carried €68 million of debt as of Dec. 31, 2014, and has €110 million invested from OHL. As such, we expect residual value of €48 million to €59 million.

Similar with OHL Mexico, the remaining projects in Spain carry no debt burden reported in the latest financials, which include the M12 toll road, the M45 highway and the West Light Rail, all of which are currently in construction.

A summary of the equity value from the company’s Spanish projects are provided below:

The last remaining projects are held in South America across Chile, Colombia and Peru. In Chile, from the Port of Valparaiso, we anticipate €397 million to €445 million in residual value after the paydown of €103 million in debt. From the Eastern Americo Vespucio project, which is a 9.3 kilometer long toll road in which OHL has a 50% stake, we expect distributable value of between €302 million to €462 million. Lastly, in Chile, OHL Concessions also operates a bridge toll road with an investment of €141 million, contributing a range of €106 million to €163 million in distributable value. OHL Concessions operates only one project in Colombia and one in Peru, the Rio Magdalena toll road and the Northern toll road, respectively. The Rio Magdalena toll road carries an investment of €673 million, and it is fully operational, translating to distributable value of €707 million to €774 million. For the Northern toll road, applying the same range to an investment of €374 million, we expect equity of €392 million to €430 million.

OHL Concessions has a subsidiary, OHL Investments SA, which issued a €400 million secured convertible bond that is convertible into shares of OHL Mexico. In total, the bond represents about 17% of OHL Mexico’s share capital. We anticipate that this convertible note is fully covered.

In addition, OHL Concessions is also the parent of OHL Emisiones, which has a €1.1 billion credit facility that is is secured by OHL Concessions’ 14% stake in Abertis Infraestructuras SA.. Specifically, as noted in OHL Concessions financials, the credit facility comes due Dec. 31 this year and bears an interest rate of three-month Euribor plus 375 basis points. In the event Abertis shares fall below €15.105, OHL must provide a cash guarantee. As of July 14, Abertis shares traded at €15.16, and Abertis has approximately 943 million ordinary shares according to its website, which translates to a market cap of €14.3 billion, or a €2 billion stake for OHL Concessions.

As such, we anticipate that unless the share prices falls drastically to below €8.62 per share, the OHL Emisiones credit facility will be well covered. For the purposes of this analysis, we apply a range of €2.00 per share to the Abertis shares, indicating a range of €1.7 billion to €2.3 billion for OHL Concessions stake. Following the paydown of the Emisiones facility, we anticipate residual value of €595 million to €1.1 billion from the Abertis stake.

In sum, from OHL Concessions - we expect total residual value from its various projects as follows:

Lastly, as discussed in our previous article, OHL Concesiones also disclosed several intercompany transactions outstanding with its parent, OHL SA.. These entail (according to page 45 of OHL Concessions 2014 financials):

- a €1.08 billion receivable from OHL SA to OHL Concessions that matures on Dec. 31, 2015, and bears a fixed interest rate of 6.8%

- a €394.8 million receivable from OHL SA to OHL Concessions subsidiary, OHL Investment, which matures in April 2019 and bears a fixed interest rate of 5.2%

However, because after any paydown of OHL Concessions outstanding debt would simply flow up again to OHL SA, we anticipate that this would be circular and eventually flow up to OHL SA in the form of residual value.

As such, we move on to OHL SA’s bank debt outstanding, totaling €1.4 billion. With a total residual value of €4 billion to €5.4 billion from OHL Concessions following the paydown of both the OHL Investments and OHL Emisiones debt, along with €110 million to €150 million in residual value from other projects under non-OHL Concessions subsidiaries, our analysis anticipates that OHL SA bank debt will also be covered in full, leaving €2.6 billion to €4 billion in residual value for the unsecured bonds, which has €1.5 billion outstanding and is thus fully covered, leaving €1.1 billion to €2.5 billion to the company’s equity, which according to its website has 99.7 million shares outstanding. As such, in our base case, our analysis values OHL’s shares at €18.37 per share, compared with today’s trading price of €17.15 per share.

A summary of the waterfall at Topco is provided as follows:

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.