Revolution Bars Group

Middle Market: Revolution Bars Working With AlixPartners on Options, Seeks CVA to Reduce Estate After Covid-19-Related Restrictions

Fri 09/25/2020 12:54 PM

Relevant Documents:

Statement

Sept. 3 Trading Update

Banking Facilities Update

British bar chain Revolution Bars Group is working with AlixPartners to explore strategic options, including a company voluntary arrangement, or CVA, as the U.K. government announced further Covid-19-related restrictions earlier this week, sources confirmed to Reorg. Continue reading for the EMEA Middle Market team's update on Revolution Bars Group, and request a trial to access our coverage of thousands of other distressed and performing credits.

The group is seeking to reduce its estate and close underperforming venues, sources added. “Revolution has a strong balance sheet following the £15m equity fundraising and the extension of its banking facilities announced in June but the Board believes that the long term nature and potential impact of the latest operating restrictions means that it must consider all necessary options to ensure that its business remains viable,” the company said in today’s statement.

In a trading update on Sept. 3, the group said it had negotiated rent waivers for 23 of its venues and was in discussions with landlords at 16 others. As of Sept. 7, 62 of the group’s 74 venues had reopened with 11 unlikely to reopen until social distancing restrictions are further relaxed and one being closed permanently.

Earlier this year, Revolution agreed with its lender NatWest to increase its revolving credit facility from £21 million to £30 million to offset the impact of the Covid-19 outbreak on the business. In June, Revolution revised the agreement and opted to contract a £16.5 million amortizing term loan utilizing the U.K. Government's guarantee scheme (CLBILS) and leave the revolving facility commitment to £21 million. The term loan matures in June 2023 with repayments starting in June 2021.

NatWest also amended the group's financial covenants to be based solely on cash headroom, set at a level based on the group’s downside Covid-19 trading scenario.

As a result of the amendments, the group’s financial debt amounted to £37.5 million, reducing to £35.5 million until at least June 2022, according to the banking facilities update. Net debt was £17.8 million on April 12 and then grew to £22 million as of May 26. In June, the group indicated that net debt was expected to be £22 million at the end of its financial year, or at June 27, 2020.

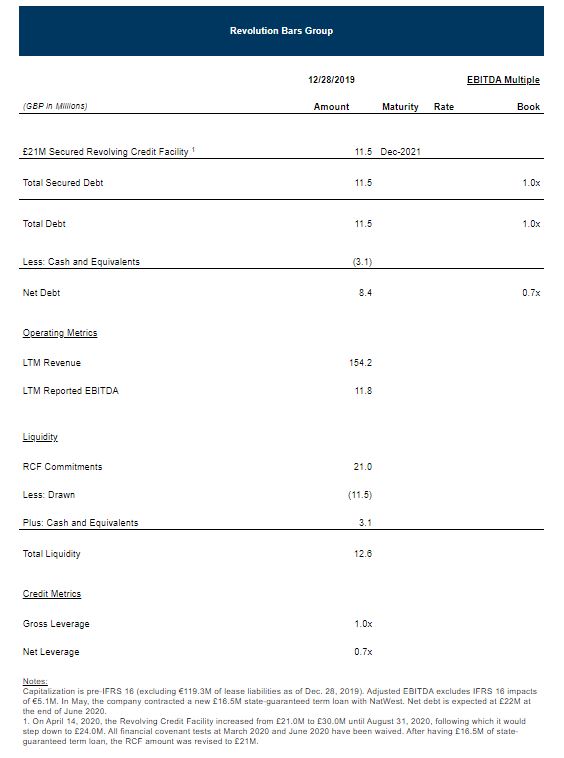

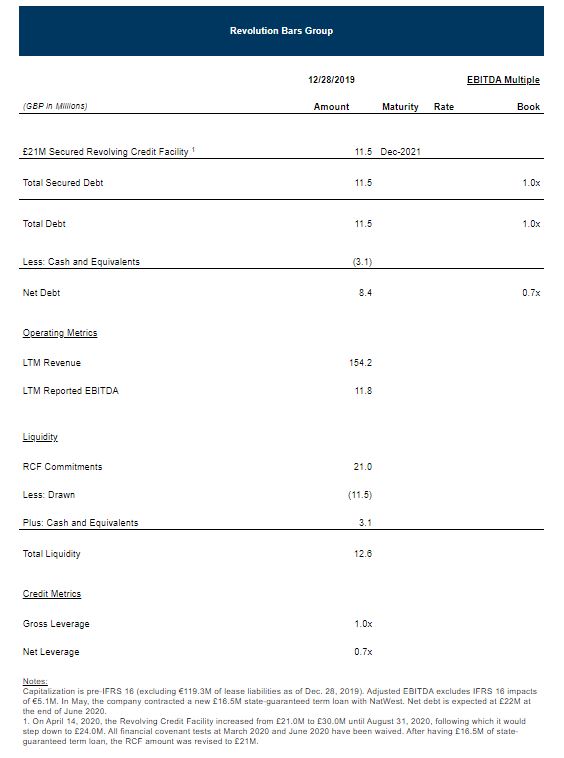

Revolution’s capital structure as of Dec. 28 is below:

Revolution Bars Group was founded in 1991 and owns a chain of 74 bars across the U.K. under the Revolution and Revolucion de Cuba brands.

A number of U.K. middle market casual dining chains have implemented CVA proceedings this month to mitigate the impact of the Covid-19 pandemic. Gusto’s creditors approved its CVA earlier this week, while Wahaca launched CVA proceedings with its creditors writing off £13 million of the group’s debt. Pizza Hut is also in talks with its creditors to cut 29 restaurants in a CVA procedure.

AlixPartners did not reply to Reorg’s request for comment.

Statement

Sept. 3 Trading Update

Banking Facilities Update

British bar chain Revolution Bars Group is working with AlixPartners to explore strategic options, including a company voluntary arrangement, or CVA, as the U.K. government announced further Covid-19-related restrictions earlier this week, sources confirmed to Reorg. Continue reading for the EMEA Middle Market team's update on Revolution Bars Group, and request a trial to access our coverage of thousands of other distressed and performing credits.

The group is seeking to reduce its estate and close underperforming venues, sources added. “Revolution has a strong balance sheet following the £15m equity fundraising and the extension of its banking facilities announced in June but the Board believes that the long term nature and potential impact of the latest operating restrictions means that it must consider all necessary options to ensure that its business remains viable,” the company said in today’s statement.

In a trading update on Sept. 3, the group said it had negotiated rent waivers for 23 of its venues and was in discussions with landlords at 16 others. As of Sept. 7, 62 of the group’s 74 venues had reopened with 11 unlikely to reopen until social distancing restrictions are further relaxed and one being closed permanently.

Earlier this year, Revolution agreed with its lender NatWest to increase its revolving credit facility from £21 million to £30 million to offset the impact of the Covid-19 outbreak on the business. In June, Revolution revised the agreement and opted to contract a £16.5 million amortizing term loan utilizing the U.K. Government's guarantee scheme (CLBILS) and leave the revolving facility commitment to £21 million. The term loan matures in June 2023 with repayments starting in June 2021.

NatWest also amended the group's financial covenants to be based solely on cash headroom, set at a level based on the group’s downside Covid-19 trading scenario.

As a result of the amendments, the group’s financial debt amounted to £37.5 million, reducing to £35.5 million until at least June 2022, according to the banking facilities update. Net debt was £17.8 million on April 12 and then grew to £22 million as of May 26. In June, the group indicated that net debt was expected to be £22 million at the end of its financial year, or at June 27, 2020.

Revolution’s capital structure as of Dec. 28 is below:

Revolution Bars Group was founded in 1991 and owns a chain of 74 bars across the U.K. under the Revolution and Revolucion de Cuba brands.

A number of U.K. middle market casual dining chains have implemented CVA proceedings this month to mitigate the impact of the Covid-19 pandemic. Gusto’s creditors approved its CVA earlier this week, while Wahaca launched CVA proceedings with its creditors writing off £13 million of the group’s debt. Pizza Hut is also in talks with its creditors to cut 29 restaurants in a CVA procedure.

AlixPartners did not reply to Reorg’s request for comment.

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.