DoValue

Covenant Tear Sheet: DoValue’s €265M 2025 Senior Secured Notes

Tue 07/28/2020 06:02 AM

Editor's note: Reorg has prepared the following covenant tear sheet as a complimentary service for its European clients. Our Debt Explained legal analysts will also publish a more in-depth analysis of the bond documentation. We are happy to share our comprehensive legal and financial analysis with you, for a copy please contact questions@reorg.com.

Relevant Documents:

Covenant Tear Sheet

Offering Memorandum

Italian loan and real estate service company DoValue has launched a new five-year €265 million senior secured bond to prepay a bridge facility used in the acquisition of 80% of the share capital of FPS Loans and Credits Claim Management Company S.A (FPS) by DoValue Greece Holding S.M.S.A. (FPS HoldCo). It is contemplated that FPS HoldCo will merge into FPS. Continue reading for the Debt Explained by Reorg team's analysis of the company's capital structure and a sneak preview of the covenant tear sheet.

The bond will have two years’ non-call protection and thereafter can be redeemed at 50%, 25% and finally at par. The company and the issue are currently rated BB Stable by S&P and Fitch. The bond will be listed on the Luxembourg Stock Exchange and governed by New York Law.

Investor meetings will be taking place until tomorrow, with pricing expected after.

Reorg’s tear sheet below is a synthesized legal and financial analytic tool providing covenant and structural highlights to empower you in making your investment decision. A capital structure prepared by Reorg can be found at the end.

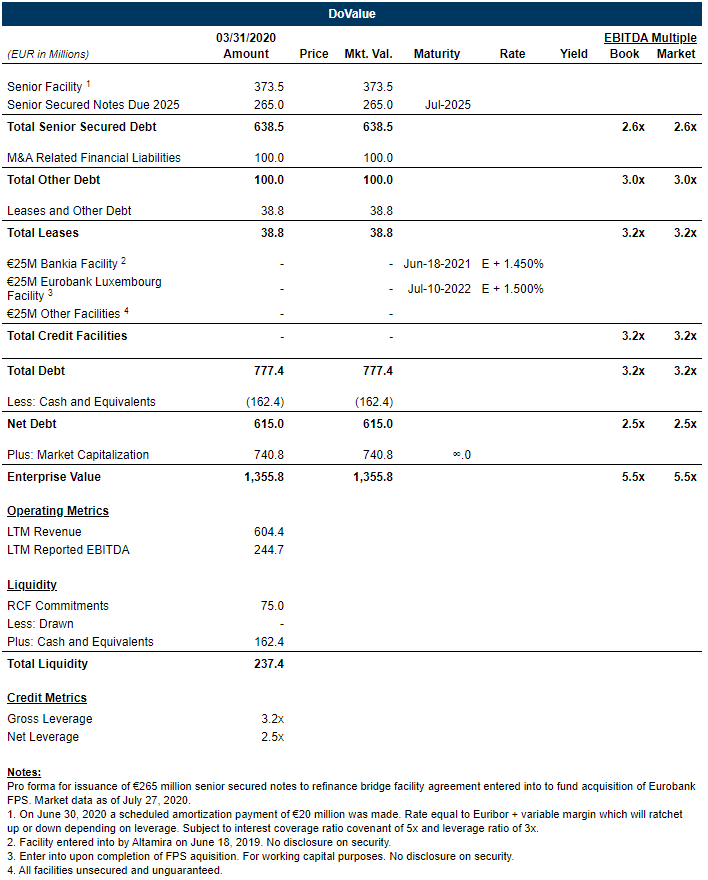

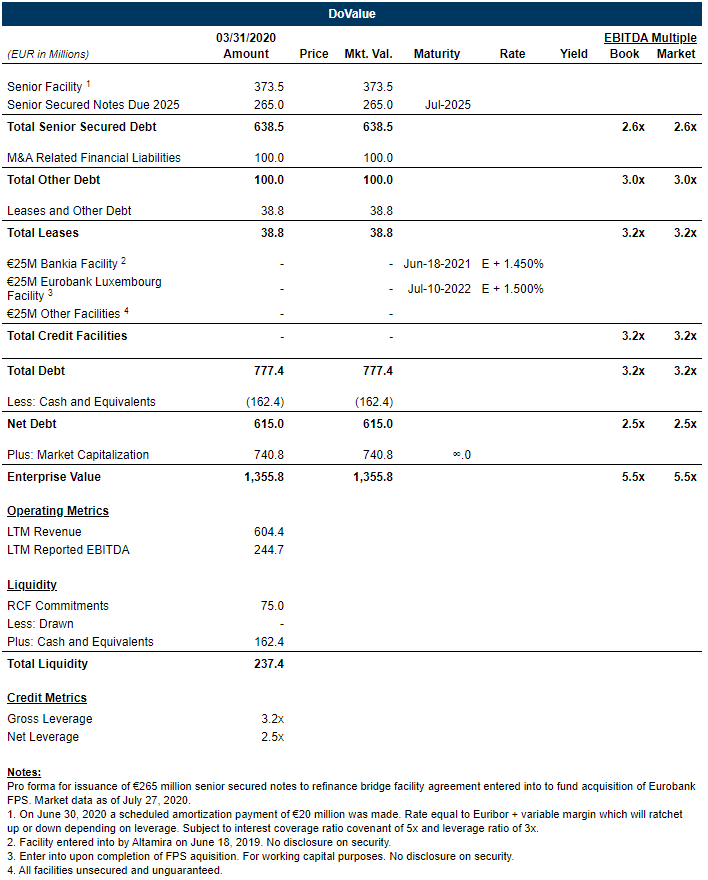

DoValue’s capital structure is below:

Relevant Documents:

Covenant Tear Sheet

Offering Memorandum

The above Related Documents link to content that is only available to current Reorg clients and trialists. Please request access to view the DoValue covenant tear sheet.

Italian loan and real estate service company DoValue has launched a new five-year €265 million senior secured bond to prepay a bridge facility used in the acquisition of 80% of the share capital of FPS Loans and Credits Claim Management Company S.A (FPS) by DoValue Greece Holding S.M.S.A. (FPS HoldCo). It is contemplated that FPS HoldCo will merge into FPS. Continue reading for the Debt Explained by Reorg team's analysis of the company's capital structure and a sneak preview of the covenant tear sheet.

The bond will have two years’ non-call protection and thereafter can be redeemed at 50%, 25% and finally at par. The company and the issue are currently rated BB Stable by S&P and Fitch. The bond will be listed on the Luxembourg Stock Exchange and governed by New York Law.

Investor meetings will be taking place until tomorrow, with pricing expected after.

Reorg’s tear sheet below is a synthesized legal and financial analytic tool providing covenant and structural highlights to empower you in making your investment decision. A capital structure prepared by Reorg can be found at the end.

DoValue’s capital structure is below:

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.