Merlin Entertainments Group

Merlin Covenants Analysis & Covid-19 Clawback Feature

Mon 08/17/2020 09:30 AM

Relevant Documents:

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes due 2025 (Preliminary OM)

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes 2025 (Pricing Supplement)

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes 2025 Snapshot

The possibility that the U.K. government may extend bailout loans to private equity-owned groups, including Merlin, has reminded investors that, as highlighted in our bond snapshot, Merlin’s April 2020 issuance of senior secured notes was the first and only to date European bond issuance to contain a COVID clawback. This clawback provides that Merlin may redeem up to 40% of these notes (with at least 60% to remain outstanding, unless all notes are redeemed substantially concurrently) within 120 days after issuance using proceeds of any facilities that may be entered into pursuant to COVID-19 government regulations. Continue reading for the Debt Explained by Reorg team's analysis of Merlin covenants, and request a trial to access other companies' covenants analysis.

The notes due 2025 issued in April were priced at par with a 7% coupon. If the bailout loans are indeed received by Merlin, the decision to exercise the COVID clawback will likely depend on the relative attractiveness of the terms of the potential state backed loans and the notes as well as any restrictions on the use of proceeds of such loans and liquidity management decisions among others.

With the notes being issued on April 29 per Merlin’s pricing announcement, next Thursday, August 27, is the 120th day from issuance (not including the issue date), leaving less than two weeks available for Merlin to exercise this feature. We note that the pricing supplement lists the trading date of the notes as April 24, which would leave only until this Saturday to redeem the notes under this clawback, however we consider the issue date April 29 given the bond documentation.

The Financial Times said last weekend that there is the potential for the UK to extend bailout loans to private equity-owned groups - with a specific mention of Merlin as exactly such a group that the government may be aimed at helping.

We have seen no other European bond issuances to date which contain this COVID clawback.

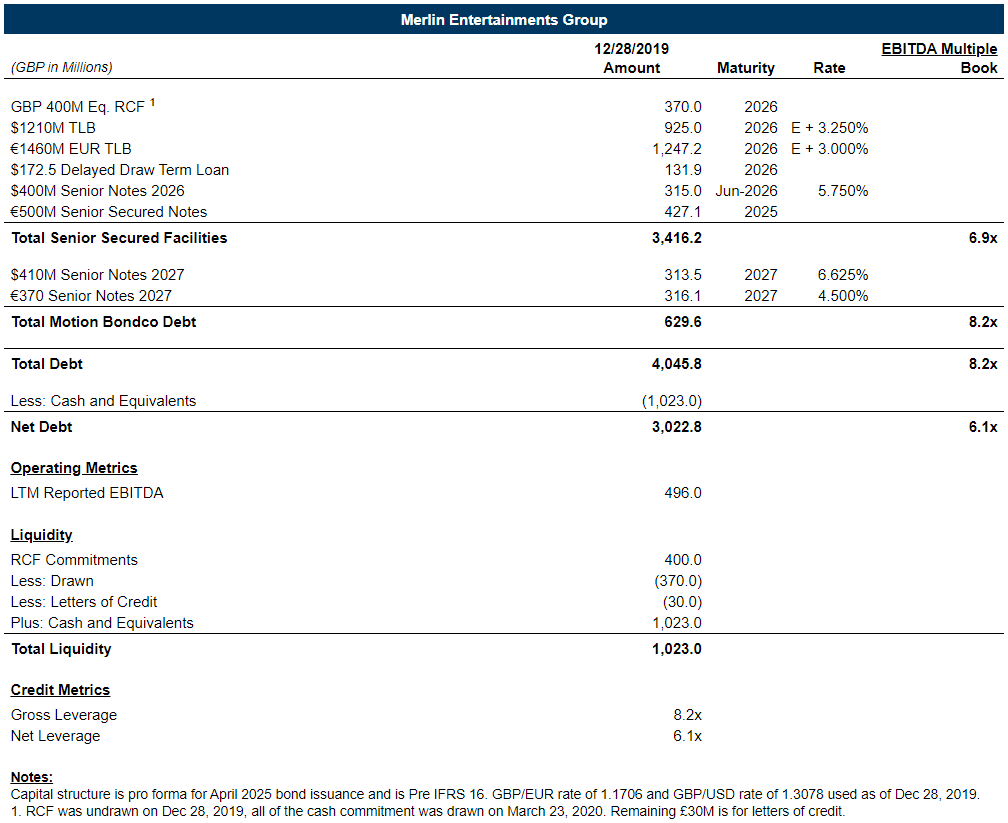

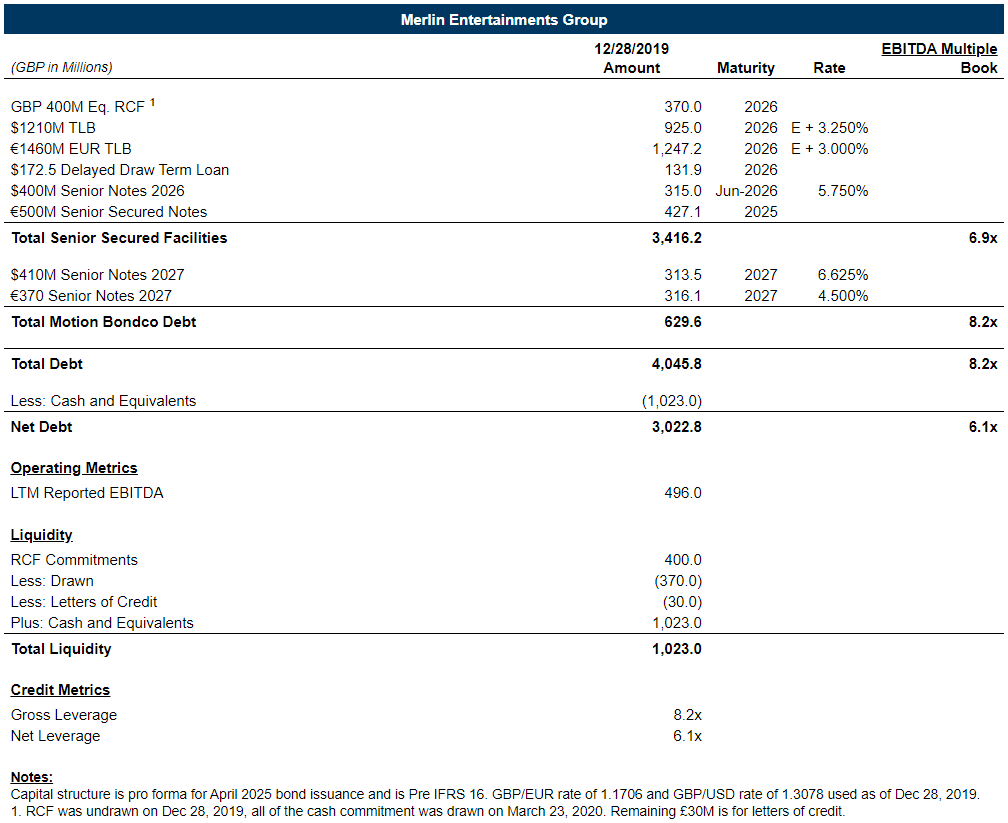

Below is Merlin’s capital structure:

--Jennifer Pence, Ben Kovacka

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes due 2025 (Preliminary OM)

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes 2025 (Pricing Supplement)

Merlin Entertainments (Motion Finco S.à r.l.) Senior Secured Notes 2025 Snapshot

The possibility that the U.K. government may extend bailout loans to private equity-owned groups, including Merlin, has reminded investors that, as highlighted in our bond snapshot, Merlin’s April 2020 issuance of senior secured notes was the first and only to date European bond issuance to contain a COVID clawback. This clawback provides that Merlin may redeem up to 40% of these notes (with at least 60% to remain outstanding, unless all notes are redeemed substantially concurrently) within 120 days after issuance using proceeds of any facilities that may be entered into pursuant to COVID-19 government regulations. Continue reading for the Debt Explained by Reorg team's analysis of Merlin covenants, and request a trial to access other companies' covenants analysis.

The notes due 2025 issued in April were priced at par with a 7% coupon. If the bailout loans are indeed received by Merlin, the decision to exercise the COVID clawback will likely depend on the relative attractiveness of the terms of the potential state backed loans and the notes as well as any restrictions on the use of proceeds of such loans and liquidity management decisions among others.

With the notes being issued on April 29 per Merlin’s pricing announcement, next Thursday, August 27, is the 120th day from issuance (not including the issue date), leaving less than two weeks available for Merlin to exercise this feature. We note that the pricing supplement lists the trading date of the notes as April 24, which would leave only until this Saturday to redeem the notes under this clawback, however we consider the issue date April 29 given the bond documentation.

The Financial Times said last weekend that there is the potential for the UK to extend bailout loans to private equity-owned groups - with a specific mention of Merlin as exactly such a group that the government may be aimed at helping.

We have seen no other European bond issuances to date which contain this COVID clawback.

Below is Merlin’s capital structure:

--Jennifer Pence, Ben Kovacka

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.