IT’SUGAR LLC

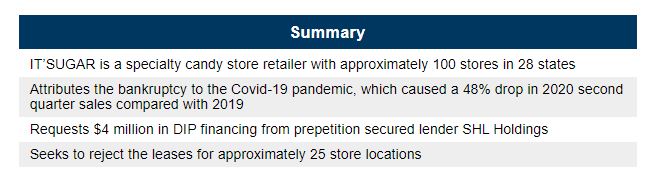

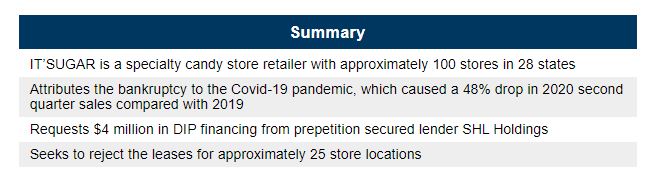

CASE SUMMARY: Specialty Candy Store Chain IT’SUGAR, Facing 48% Drop in 2020 Q2 Sales, Seeks to Restructure

Thu 09/24/2020 16:38 PM

Relevant Documents:

Voluntary Petition

Press Release

Case Management Summary

DIP Financing Motion

First Day Hearing Notice

The first day hearing is set for tomorrow, Friday, Sept. 25, at 1:30 p.m. ET.

The company’s prepetition capital structure includes:

SHL acquired the prepetition revolving secured loan from Bank of America in April. The debtors say that the value of the collateral securing the loan is $12.9 million.

The debtors have $500,000 of cash on hand, retail inventory estimated at $5.6 million as of Sept. 22 and furniture, fixtures, equipment and supplies valued at approximately $6.2 million.

IT’SUGAR’s parent company, BBX, issued a press release, attributing the bankruptcy filing to “the effects of the COVID-19 pandemic on demand, sales levels, and consumer behavior, as well as the recessionary economic environment,” noting that travel and tourism sales historically represented 60% of annual sales. The debtors also say that store closures sparked a 48% drop in 2020 second quarter sales compared with 2019. The debtors say that there “is no assurance that sales will improve or will not continue to decline, as the duration and severity of the COVID-19 pandemic and its effects remain uncertain.” While approximately 90 locations had been reopened following initial store closures, the debtors say they “regularly must close individual locations due to staffing shortages or local government mandates.”

The debtors do not own any real property, and stopped paying rent to landlords in April 2020; negotiations with landlords have been ongoing. “A number” of the debtors’ leases are “no longer market value and It’Sugar has accrued unpaid rent obligations of approximately $7.5 Million, thus necessitating bankruptcy in order to reject certain leases and restructure It’Sugar’s corresponding debt,” the debtors’ case management summary says.

“Parent and its other principal subsidiaries, including New BBX Capital and its subsidiaries other than IT’SUGAR, remain financially strong and continue to conduct normal business operations,” BBX says in its release, adding that “New BBX Capital and its subsidiaries, including IT’SUGAR, will be spun-off to the shareholders of Parent if Parent’s previously announced spin-off of New BBX Capital is completed.”

The debtors are represented by Meland Budwick in Miami as counsel and Algon Capital, LLC d/b/a Algon Group as financial advisor. Troy Taylor of Algon is the chief restructuring officer. The case has been assigned to Judge Robert A. Mark (case no. 20-20259).

Background

IT’SUGAR is a specialty candy retailer offering bulk candy and candy in giant packaging, along with licensed and novelty items. The company’s store portfolio includes approximately 100 retail locations across 28 states. The debtors have 598 employees.

Estimated gross Income for the Dec. 29, 2019 - Sept. 22, 2020 period is $30.6 million. Gross income for the fiscal year 2019 was $85.4 million.

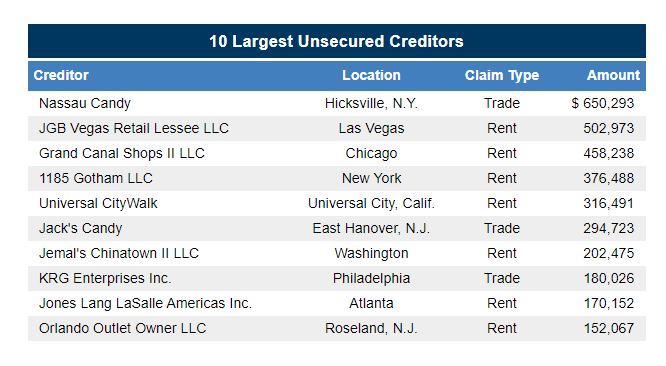

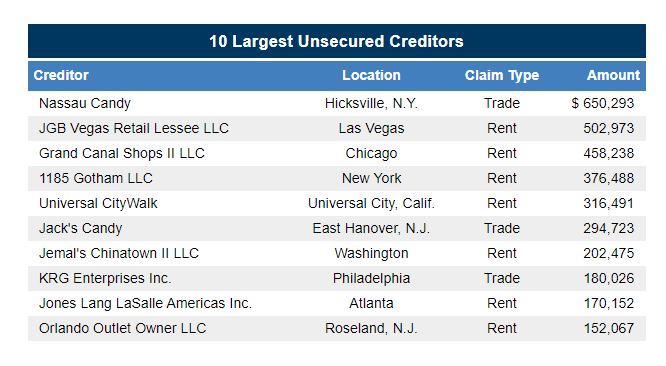

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

DIP Financing Motion

The debtors request DIP financing of $4 million from prepetition secured lender SHL Holdings. The DIP financing bears interest at L+1.5%. “The Debtors have determined that they are not able to secure sufficient funding on an unsecured or junior lien basis. SHL has existing liens on substantially all the Debtor’s assets,” according to the motion.

To secure the DIP financing, the debtors propose to grant consensual priming liens, except to the extent of “Permitted Liens.” The debtors say that they are unaware of any secured claims other than the claims of SHL, and therefore that “adequate protection to existing lien-holders is not an issue in this case.” The DIP financing would also have superpriority administrative expense status.

The debtors also request the use of cash collateral subject to customary termination events. The company proposes the following adequate protection in the form of replacement liens, reaffirmation of a prepetition guaranty and payment of fees and expenses of SHL.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The proposed budget for the use of the DIP facility is HERE.

The lien challenge deadline is 60 days after entry of the interim order.

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

Press Release

Case Management Summary

DIP Financing Motion

First Day Hearing Notice

IT’SUGAR, an Aventura, Fla.-based specialty candy store retailer with approximately 100 stores in 28 states, filed for chapter 11 protection on Tuesday in the Bankruptcy Court for the Southern District of Florida, along with various affiliates. Due to Covid-19-driven store closures and sales declines, the company filed chapter 11 to reject certain leases and undertake a debt restructuring. The debtors request approval of $4 million in DIP financing from prepetition secured lender SHL Holdings. SHL shares a common, ultimate parent with the debtor - BBX Capital Florida, LLC. Continue reading for the First Day by Reorg team's update on the IT'SUGAR chapter 11 filing, and request a trial to access our coverage of thousands of other chapter 11 filings.

The first day hearing is set for tomorrow, Friday, Sept. 25, at 1:30 p.m. ET.

The company’s prepetition capital structure includes:

- Secured debt:

- SHL Holdings, Inc.: $6.3 million plus interest

- Unsecured debt: $10.5 million (including unpaid rent)

- Equity: BBX Capital Florida, LLC wholly owns It’Sugar Holdings LLC, which owns 90% of the common membership interests in It’Sugar, LLC. BBX acquired IT’SUGAR in 2017 for $57 million, net of cash acquired, at which time it was the largest specialty candy retailer in the U.S., according to a release issued at the time.

SHL acquired the prepetition revolving secured loan from Bank of America in April. The debtors say that the value of the collateral securing the loan is $12.9 million.

The debtors have $500,000 of cash on hand, retail inventory estimated at $5.6 million as of Sept. 22 and furniture, fixtures, equipment and supplies valued at approximately $6.2 million.

IT’SUGAR’s parent company, BBX, issued a press release, attributing the bankruptcy filing to “the effects of the COVID-19 pandemic on demand, sales levels, and consumer behavior, as well as the recessionary economic environment,” noting that travel and tourism sales historically represented 60% of annual sales. The debtors also say that store closures sparked a 48% drop in 2020 second quarter sales compared with 2019. The debtors say that there “is no assurance that sales will improve or will not continue to decline, as the duration and severity of the COVID-19 pandemic and its effects remain uncertain.” While approximately 90 locations had been reopened following initial store closures, the debtors say they “regularly must close individual locations due to staffing shortages or local government mandates.”

The debtors do not own any real property, and stopped paying rent to landlords in April 2020; negotiations with landlords have been ongoing. “A number” of the debtors’ leases are “no longer market value and It’Sugar has accrued unpaid rent obligations of approximately $7.5 Million, thus necessitating bankruptcy in order to reject certain leases and restructure It’Sugar’s corresponding debt,” the debtors’ case management summary says.

“Parent and its other principal subsidiaries, including New BBX Capital and its subsidiaries other than IT’SUGAR, remain financially strong and continue to conduct normal business operations,” BBX says in its release, adding that “New BBX Capital and its subsidiaries, including IT’SUGAR, will be spun-off to the shareholders of Parent if Parent’s previously announced spin-off of New BBX Capital is completed.”

The debtors are represented by Meland Budwick in Miami as counsel and Algon Capital, LLC d/b/a Algon Group as financial advisor. Troy Taylor of Algon is the chief restructuring officer. The case has been assigned to Judge Robert A. Mark (case no. 20-20259).

Background

IT’SUGAR is a specialty candy retailer offering bulk candy and candy in giant packaging, along with licensed and novelty items. The company’s store portfolio includes approximately 100 retail locations across 28 states. The debtors have 598 employees.

Estimated gross Income for the Dec. 29, 2019 - Sept. 22, 2020 period is $30.6 million. Gross income for the fiscal year 2019 was $85.4 million.

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

DIP Financing Motion

The debtors request DIP financing of $4 million from prepetition secured lender SHL Holdings. The DIP financing bears interest at L+1.5%. “The Debtors have determined that they are not able to secure sufficient funding on an unsecured or junior lien basis. SHL has existing liens on substantially all the Debtor’s assets,” according to the motion.

To secure the DIP financing, the debtors propose to grant consensual priming liens, except to the extent of “Permitted Liens.” The debtors say that they are unaware of any secured claims other than the claims of SHL, and therefore that “adequate protection to existing lien-holders is not an issue in this case.” The DIP financing would also have superpriority administrative expense status.

The debtors also request the use of cash collateral subject to customary termination events. The company proposes the following adequate protection in the form of replacement liens, reaffirmation of a prepetition guaranty and payment of fees and expenses of SHL.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The proposed budget for the use of the DIP facility is HERE.

The lien challenge deadline is 60 days after entry of the interim order.

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case no. 20-20259.

- Motion to reject unexpired leases

- The debtors seek to reject the unexpired leases of approximately 25 retail locations, as listed HERE.

- Motion to pay employee wages and benefits

- The company seeks authorization to pay about $400,000 in unpaid wages and $75,000 with respect to payroll tax obligations. The company also seeks to pay or honor certain employee benefit obligations, which as of the petition date consist solely of employee contributions to such plans, totaling $30,000.

- Motion to use cash management system

- The company has bank accounts with Bank of America and JPMorgan Chase.

- Motion to honor customer programs

- The debtors have liability of approximately $200,000 in gift cards that do not expire.

- Motion to maintain insurance programs

- Application to employ Meland Budwick as counsel

- Application to employ Troy Taylor and Algon Capital as CRO

- Application to employ Ricki S. Friedman as special counsel

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.