Shiloh Industries Inc.

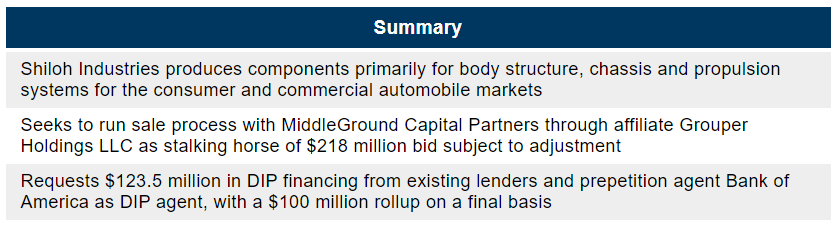

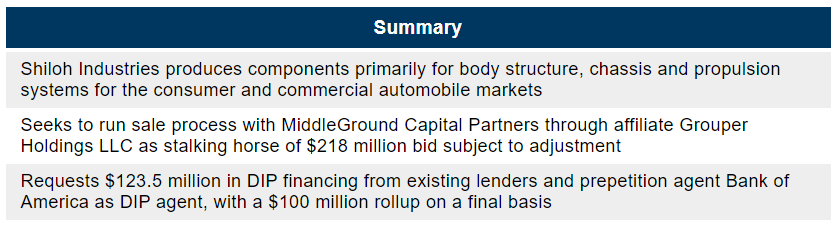

CASE SUMMARY: Shiloh Industries Seeks to Sell Assets With MiddleGround Capital Subsidiary as Stalking Horse With $218M Bid

Mon 08/31/2020 16:39 PM

Relevant Documents:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Shiloh Industries Inc., a Valley City, Ohio-based lightweighting technologies-focused producer of automobile components, and several affiliates filed for chapter 11 protection on Sunday in the Bankruptcy Court for the District of Delaware. The debtors enter chapter 11 with a $218 million bid for their assets from MiddleGround Capital Partners, through its affiliate Grouper Holdings LLC, as the stalking horse bidder pursuant to a stock and asset purchase agreement for substantially all of Shiloh’s assets, including the equity interests of certain of the company’s direct and indirect subsidiaries. The purchase price is “subject to certain price adjustments and mechanisms.”

“Importantly, MiddleGround intends to continue operation of the Debtors' business as a going-concern,” Ernst & Young’s Jeffrey Ficks writes in the first day declaration.

The debtors are requesting DIP financing from their prepetition lenders, with Bank of America as agent, totaling $123.5 million, including $23.5 million of new money and a rollup of $100 million of prepetition obligations upon entry of a final order. In addition, upon a sale of substantially all of the debtors' assets that is approved by certain required prepetition lenders and DIP lenders, the required prepetition lenders would fund $14.1 million of wind-down expenses. The DIP financing is subject to sale milestones requiring the filing of a bid procedures motion within three days of the petition date, with an Oct. 29 auction and sale closing by Dec. 15.

In May, “with continued uncertainty in the operating environment and increasingly stressed liquidity,” the debtors engaged Houlihan Lokey, which ran a marketing process for both (a) financing proposals that would enable the debtors to execute on their business plan and potentially pay down all or a portion of the revolving credit facility and (b) bids for the sale of all or a portion of the debtors' business. Although the company received both financing and sale proposals by a June 29 nonbinding indication of interest deadline, the debtors and their prepetition lenders determined that the sale proposals represented the only viable path forward, and the marketing process was narrowed to focus exclusively on a sale of substantially all of the debtors’ assets. Three parties decided to move forward with the sale process and provided the debtors with letters of intent and draft asset purchase agreements. The debtors ultimately selected the MiddleGround $218 million bid.

Shiloh issued a press release quoting John Stewart, a partner at MiddleGround, saying that “Shiloh has a unique and attractive portfolio of innovative, lightweighting products and technologies that enable OEMs to reduce on-vehicle weight without compromising strength, safety or performance.” Stewart adds, “Despite recent market conditions, we see tremendous value in Shiloh’s business and differentiated product solutions serving the automotive sector. We look forward to working with the Shiloh team in this new chapter for the Company.”

The first day hearing has yet to be scheduled.

The company reports $664.2 million in consolidated assets and $563.4 million in consolidated liabilities. The company’s prepetition capital structure includes:

There was approximately $8.7 million in unused commitments under the prepetition credit agreement as of the petition date, including approximately $4.8 million in issued letters of credit.

The company attributes the bankruptcy filing to recent trends in the global automotive markets, “coupled with escalating trade wars and the economic standstill precipitated by the COVID-19 Pandemic,” which have “stretched the Debtors beyond their financial limits.” According to the company, citing “industry statistics,” production volumes in Asia, Europe and North America dropped 12.2%, 4.3% and 3.4% respectively, from Oct. 31, 2018, to Oct. 31, 2019, resulting in “nearly 5 million less vehicles being produced” year over year. These initial headwinds began in the Asian markets, the debtors say, “which appears to have been precipitated by the trade dispute between China and the United States, as well as increasing emissions standards and tightening credit markets in China generally.” These trends have “eroded” consumer confidence and/or altered consumer decision-making related to the purchase of vehicles, the debtors assert.

Compounding these negative economic trends, in late 2019, the Covid-19 pandemic emerged, resulting in travel restrictions, border closures and business slowdowns or shutdowns in affected areas. “The impact of COVID-19 developments and uncertainty with respect to the economic effects of the pandemic has introduced significant volatility in the financial markets and is having a widespread adverse effect on the automotive industry, including reductions in consumer demand and OEM automotive production,” the debtors say.

In response to these trends, the debtors undertook various cost-saving measures in late 2018 and in 2019, including a “realignment” of manufacturing processes, headcount reductions, consolidation of administrative functions and “general process improvements.” While these initiatives were expected to result in efficiency-driven profitability, the debtors say that they have not realized the anticipated benefits “largely due” to the emergence of coronavirus.

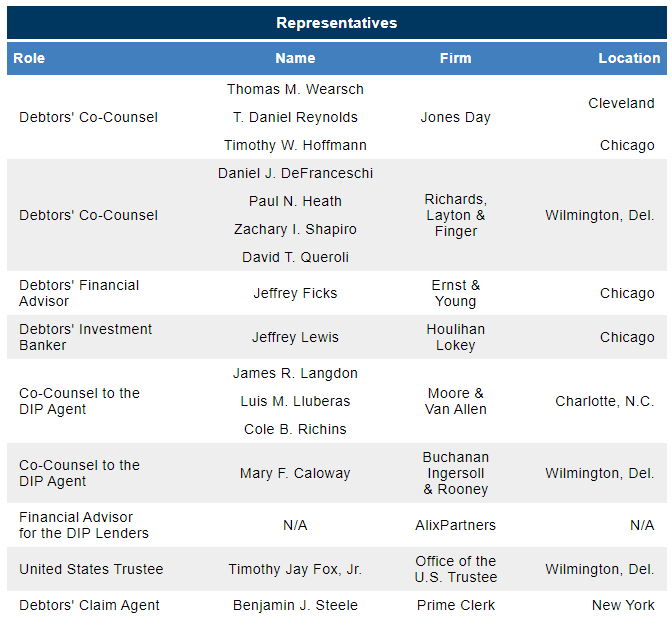

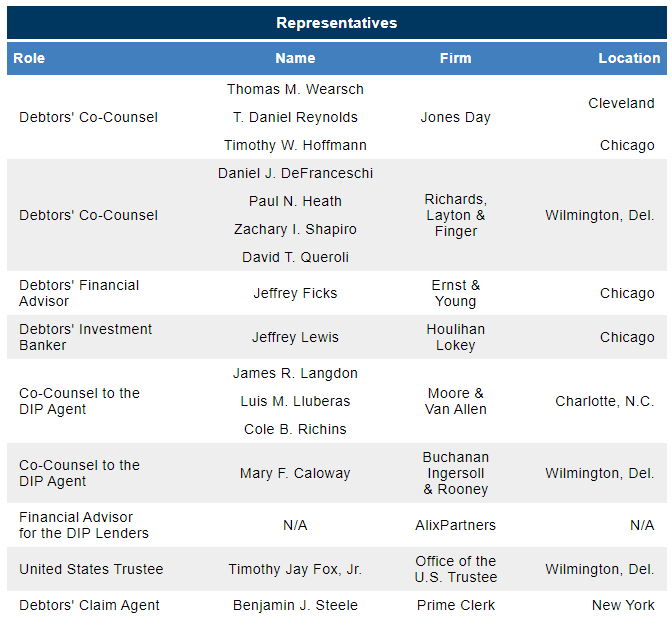

The debtors have engaged Jones Day, Richards, Layton & Finger, Ernst & Young and Houlihan Lokey Capital Inc. Prime Clerk is the claims agent. The case has been assigned to Judge Laurie Selber Silverstein (case No. 20-12024).

Background

The debtors focus on lightweighting technologies that provide environmental and safety benefits to the mobility market. Shiloh has a global network of manufacturing operations and technical centers in Asia, Europe and North America. The debtors produce components primarily for body structure, chassis and propulsion systems of vehicles, with solution materials including aluminum, magnesium, steel, high-strength steel alloys and ShilohCore acoustic laminates, which they deliver to original equipment manufacturers, or OEMs, and tier 1 suppliers in the automotive and commercial vehicle markets. For the 12 months ended Oct. 31, 2019, the debtors generated revenue of approximately $1.05 billion, of which approximately $812 million was derived from North American operations.

Additionally, the debtors produce structural products for electric vehicles, such as charger boxes, control boxes, motor housings, battery covers, battery box trays and battery box rails.

As of March 31, Shiloh Industries Inc. and its debtor and nondebtor affiliates employed approximately 3,400 individuals throughout Asia, Europe and North America, approximately 1,920 of which were employed domestically by the debtors. The debtors have agreements with two labor unions, whose members represent approximately 15% of the debtors’ domestic hourly employees.

The debtors say they work closely with “the world's leading” OEM and tier 1 suppliers and have over 200 customers globally, including Bayerische Motoren Werke AG, Daimler, Faurecia, Fiat Chrysler Automobiles, Ford Motor Co., General Motors Co., Hendrickson International, Honda Motor Co., Jaguar Land Rover, SAIC Motor, Scania, Tesla Inc., Volvo AB, Volvo Car Corp. and ZF Friedrichshafen AG. Of the debtors' customers, General Motors and Fiat Chrysler Automobiles each account for more than 10% of the company’s gross revenue in the last three fiscal years and in the current year.

The debtors say that as a direct result of the pandemic, more than half of their plants were shuttered starting in early April and continuing into May. In addition to the closures, from early April through May, no open plant operated at above 50% utilization, and only three plants were operating at above 25% utilization. “Nevertheless, as of the date hereof, the Debtors' operations have largely ramped up towards normal production levels,” the debtors say. Despite these cost-saving measures, costs and disruptions related to the pandemic “significantly impacted” the debtors' profitability during the second quarter of 2020, during which the debtors had an adjusted operating income loss of approximately $29 million compared with the same quarter in the prior year.

The debtors also faced issues with respect to certain acquisitions and program launches, including the acquisition of the “distressed” European Brabant Alucast businesses, which was meant to complement the debtors' global footprint with expanded aluminum and magnesium casting capabilities while providing capacity for growth but has incurred several quarters of negative cash flows, “largely driven by key customer declines, loss making programs, and excess or unutilized capacity.” Net losses at the debtors’ Brabant facility in Verres, Italy, are projected to be $4.7 million in 2020 and another $10 million over the next three fiscal years. Program launches at Shiloh’s Pierceton, Ind., and Clarksville, Tenn., facilities also disappointed expectations, with each of the programs described by the debtors as “troubled from the outset, plagued by continuous delays and costly and time-consuming tooling redesigns.”

In addition, several labor unions in North America, including the International Union, United Automobile and Aerospace and Agricultural Implement Workers of America, went on strike against the debtors' “largest customer,” resulting in lower vehicle production from that customer.

The debtors’ corporate organizational structure is HERE.

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

DIP Financing Motion

The debtors request approval of DIP financing in the form of a senior secured superpriority revolving facility up to $123.5 million ($18.1 million on an interim basis) from the debtors’ prepetition lenders, with Bank of America as agent. Bank of America is also listed as a lender. On a final basis, the debtors propose a rollup of $100 million of the prepetition secured debt.

The DIP financing bears interest at L+10% or the base rate plus 9%, with 2% added for the default rate, and matures on the earliest of four months after the petition date, 30 days after entry of the interim order if the final order has yet to be entered or other customary events.

To secure the DIP financing, the debtors propose a lien on avoidance action proceeds subject to the final order.

The facility includes various fees, including a 0.5% commitment fee and payment of professional fees.

The company proposes the following adequate protection to its prepetition lenders: replacement liens, allowed superpriority administrative expense claims, payment of professionals’ fees, access to the debtors’ management and investment banker and financial reporting. The DIP lenders and prepetition lenders would also have the right to credit bid. In addition, subject to the final order, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b). The carve-out for professional fees is $300,000 (excluding for investment bankers).

The proposed budget for the use of the DIP facility is HERE.

In support of the DIP financing, the debtors submitted the declaration of Jeffrey Lewis of Houlihan Lokey, who describes a prepetition marketing process focused on a refinancing of the prepetition credit agreement or a sale of substantially all of the debtors’ assets, through which 125 parties were contacted, of which 64 signed confidentiality agreements and 17 submitted indications of interest. Of the 17 nonbinding initial indications of interest, 12 were offers to purchase the company “in some form” and five were for financing/recapitalization (of which none offered financing fully junior to the prepetition secured lenders). “Based on the Indications of Interest for the purchase of the Debtors' assets, Houlihan in consultation with the Debtors and their other advisors determined in July 2020 that a sale of substantially all of the Debtors' assets pursuant to section 363 of the Bankruptcy Code would allow the Debtors to receive more value for their assets than an out-of-court sale.” As the debtors did not have enough cash on hand to fund a chapter 11 sale process, the debtors pursued DIP financing.

The DIP financing is subject to the following milestones:

The lien challenge deadline is 75 days from entry of the interim order for parties in interest and 60 days from formation for an official committee of unsecured creditors. The UCC lien investigation budget is $50,000.

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Shiloh Industries Inc., a Valley City, Ohio-based lightweighting technologies-focused producer of automobile components, and several affiliates filed for chapter 11 protection on Sunday in the Bankruptcy Court for the District of Delaware. The debtors enter chapter 11 with a $218 million bid for their assets from MiddleGround Capital Partners, through its affiliate Grouper Holdings LLC, as the stalking horse bidder pursuant to a stock and asset purchase agreement for substantially all of Shiloh’s assets, including the equity interests of certain of the company’s direct and indirect subsidiaries. The purchase price is “subject to certain price adjustments and mechanisms.”

“Importantly, MiddleGround intends to continue operation of the Debtors' business as a going-concern,” Ernst & Young’s Jeffrey Ficks writes in the first day declaration.

The debtors are requesting DIP financing from their prepetition lenders, with Bank of America as agent, totaling $123.5 million, including $23.5 million of new money and a rollup of $100 million of prepetition obligations upon entry of a final order. In addition, upon a sale of substantially all of the debtors' assets that is approved by certain required prepetition lenders and DIP lenders, the required prepetition lenders would fund $14.1 million of wind-down expenses. The DIP financing is subject to sale milestones requiring the filing of a bid procedures motion within three days of the petition date, with an Oct. 29 auction and sale closing by Dec. 15.

In May, “with continued uncertainty in the operating environment and increasingly stressed liquidity,” the debtors engaged Houlihan Lokey, which ran a marketing process for both (a) financing proposals that would enable the debtors to execute on their business plan and potentially pay down all or a portion of the revolving credit facility and (b) bids for the sale of all or a portion of the debtors' business. Although the company received both financing and sale proposals by a June 29 nonbinding indication of interest deadline, the debtors and their prepetition lenders determined that the sale proposals represented the only viable path forward, and the marketing process was narrowed to focus exclusively on a sale of substantially all of the debtors’ assets. Three parties decided to move forward with the sale process and provided the debtors with letters of intent and draft asset purchase agreements. The debtors ultimately selected the MiddleGround $218 million bid.

Shiloh issued a press release quoting John Stewart, a partner at MiddleGround, saying that “Shiloh has a unique and attractive portfolio of innovative, lightweighting products and technologies that enable OEMs to reduce on-vehicle weight without compromising strength, safety or performance.” Stewart adds, “Despite recent market conditions, we see tremendous value in Shiloh’s business and differentiated product solutions serving the automotive sector. We look forward to working with the Shiloh team in this new chapter for the Company.”

The first day hearing has yet to be scheduled.

The company reports $664.2 million in consolidated assets and $563.4 million in consolidated liabilities. The company’s prepetition capital structure includes:

- Secured debt:

- Revolving credit facility (with parent Shiloh Industries Inc. and nondebtor foreign subsidiary Shiloh Holdings Netherlands BV as borrowers and Bank of America as agent): $341.3 million (consisting of $268.5 million under the U.S. revolving facility, $68 million under the Dutch revolving facility and $4.8 million in issued letters of credit and other obligations).

- Unsecured trade debt: $53 million (including $31.3 million owed to steel vendors, $7.6 million to aluminum/magnesium suppliers and $14.1 million for third-party goods and services).

- Pension underfunding obligations: $22.6 million.

- Lease obligations: $13.4 million plus $9.3 million of other lease obligations relating primarily to equipment.

- Equity: Only three shareholders own more than 5% of the Parent's shares: Oak Tree Holdings LLC, with approximately 30% of the parent's outstanding shares, Dimensional Fund Advisors, with approximately 6.3%, and Alan W. Weber (Investment Management), with approximately 5.7%, all as of shortly before the petition date.

There was approximately $8.7 million in unused commitments under the prepetition credit agreement as of the petition date, including approximately $4.8 million in issued letters of credit.

The company attributes the bankruptcy filing to recent trends in the global automotive markets, “coupled with escalating trade wars and the economic standstill precipitated by the COVID-19 Pandemic,” which have “stretched the Debtors beyond their financial limits.” According to the company, citing “industry statistics,” production volumes in Asia, Europe and North America dropped 12.2%, 4.3% and 3.4% respectively, from Oct. 31, 2018, to Oct. 31, 2019, resulting in “nearly 5 million less vehicles being produced” year over year. These initial headwinds began in the Asian markets, the debtors say, “which appears to have been precipitated by the trade dispute between China and the United States, as well as increasing emissions standards and tightening credit markets in China generally.” These trends have “eroded” consumer confidence and/or altered consumer decision-making related to the purchase of vehicles, the debtors assert.

Compounding these negative economic trends, in late 2019, the Covid-19 pandemic emerged, resulting in travel restrictions, border closures and business slowdowns or shutdowns in affected areas. “The impact of COVID-19 developments and uncertainty with respect to the economic effects of the pandemic has introduced significant volatility in the financial markets and is having a widespread adverse effect on the automotive industry, including reductions in consumer demand and OEM automotive production,” the debtors say.

In response to these trends, the debtors undertook various cost-saving measures in late 2018 and in 2019, including a “realignment” of manufacturing processes, headcount reductions, consolidation of administrative functions and “general process improvements.” While these initiatives were expected to result in efficiency-driven profitability, the debtors say that they have not realized the anticipated benefits “largely due” to the emergence of coronavirus.

The debtors have engaged Jones Day, Richards, Layton & Finger, Ernst & Young and Houlihan Lokey Capital Inc. Prime Clerk is the claims agent. The case has been assigned to Judge Laurie Selber Silverstein (case No. 20-12024).

Background

The debtors focus on lightweighting technologies that provide environmental and safety benefits to the mobility market. Shiloh has a global network of manufacturing operations and technical centers in Asia, Europe and North America. The debtors produce components primarily for body structure, chassis and propulsion systems of vehicles, with solution materials including aluminum, magnesium, steel, high-strength steel alloys and ShilohCore acoustic laminates, which they deliver to original equipment manufacturers, or OEMs, and tier 1 suppliers in the automotive and commercial vehicle markets. For the 12 months ended Oct. 31, 2019, the debtors generated revenue of approximately $1.05 billion, of which approximately $812 million was derived from North American operations.

Additionally, the debtors produce structural products for electric vehicles, such as charger boxes, control boxes, motor housings, battery covers, battery box trays and battery box rails.

As of March 31, Shiloh Industries Inc. and its debtor and nondebtor affiliates employed approximately 3,400 individuals throughout Asia, Europe and North America, approximately 1,920 of which were employed domestically by the debtors. The debtors have agreements with two labor unions, whose members represent approximately 15% of the debtors’ domestic hourly employees.

The debtors say they work closely with “the world's leading” OEM and tier 1 suppliers and have over 200 customers globally, including Bayerische Motoren Werke AG, Daimler, Faurecia, Fiat Chrysler Automobiles, Ford Motor Co., General Motors Co., Hendrickson International, Honda Motor Co., Jaguar Land Rover, SAIC Motor, Scania, Tesla Inc., Volvo AB, Volvo Car Corp. and ZF Friedrichshafen AG. Of the debtors' customers, General Motors and Fiat Chrysler Automobiles each account for more than 10% of the company’s gross revenue in the last three fiscal years and in the current year.

The debtors say that as a direct result of the pandemic, more than half of their plants were shuttered starting in early April and continuing into May. In addition to the closures, from early April through May, no open plant operated at above 50% utilization, and only three plants were operating at above 25% utilization. “Nevertheless, as of the date hereof, the Debtors' operations have largely ramped up towards normal production levels,” the debtors say. Despite these cost-saving measures, costs and disruptions related to the pandemic “significantly impacted” the debtors' profitability during the second quarter of 2020, during which the debtors had an adjusted operating income loss of approximately $29 million compared with the same quarter in the prior year.

The debtors also faced issues with respect to certain acquisitions and program launches, including the acquisition of the “distressed” European Brabant Alucast businesses, which was meant to complement the debtors' global footprint with expanded aluminum and magnesium casting capabilities while providing capacity for growth but has incurred several quarters of negative cash flows, “largely driven by key customer declines, loss making programs, and excess or unutilized capacity.” Net losses at the debtors’ Brabant facility in Verres, Italy, are projected to be $4.7 million in 2020 and another $10 million over the next three fiscal years. Program launches at Shiloh’s Pierceton, Ind., and Clarksville, Tenn., facilities also disappointed expectations, with each of the programs described by the debtors as “troubled from the outset, plagued by continuous delays and costly and time-consuming tooling redesigns.”

In addition, several labor unions in North America, including the International Union, United Automobile and Aerospace and Agricultural Implement Workers of America, went on strike against the debtors' “largest customer,” resulting in lower vehicle production from that customer.

The debtors’ corporate organizational structure is HERE.

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

DIP Financing Motion

The debtors request approval of DIP financing in the form of a senior secured superpriority revolving facility up to $123.5 million ($18.1 million on an interim basis) from the debtors’ prepetition lenders, with Bank of America as agent. Bank of America is also listed as a lender. On a final basis, the debtors propose a rollup of $100 million of the prepetition secured debt.

The DIP financing bears interest at L+10% or the base rate plus 9%, with 2% added for the default rate, and matures on the earliest of four months after the petition date, 30 days after entry of the interim order if the final order has yet to be entered or other customary events.

To secure the DIP financing, the debtors propose a lien on avoidance action proceeds subject to the final order.

The facility includes various fees, including a 0.5% commitment fee and payment of professional fees.

The company proposes the following adequate protection to its prepetition lenders: replacement liens, allowed superpriority administrative expense claims, payment of professionals’ fees, access to the debtors’ management and investment banker and financial reporting. The DIP lenders and prepetition lenders would also have the right to credit bid. In addition, subject to the final order, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b). The carve-out for professional fees is $300,000 (excluding for investment bankers).

The proposed budget for the use of the DIP facility is HERE.

In support of the DIP financing, the debtors submitted the declaration of Jeffrey Lewis of Houlihan Lokey, who describes a prepetition marketing process focused on a refinancing of the prepetition credit agreement or a sale of substantially all of the debtors’ assets, through which 125 parties were contacted, of which 64 signed confidentiality agreements and 17 submitted indications of interest. Of the 17 nonbinding initial indications of interest, 12 were offers to purchase the company “in some form” and five were for financing/recapitalization (of which none offered financing fully junior to the prepetition secured lenders). “Based on the Indications of Interest for the purchase of the Debtors' assets, Houlihan in consultation with the Debtors and their other advisors determined in July 2020 that a sale of substantially all of the Debtors' assets pursuant to section 363 of the Bankruptcy Code would allow the Debtors to receive more value for their assets than an out-of-court sale.” As the debtors did not have enough cash on hand to fund a chapter 11 sale process, the debtors pursued DIP financing.

The DIP financing is subject to the following milestones:

- Three business days after petition date: Filing of bid procedures motion with stalking horse bidder reasonably acceptable to required lenders;

- Sept. 28: Deadline to obtain entry of bid procedures order and approval of stalking horse bidder;

- Oct. 26: Bid deadline;

- Oct. 29: Auction;

- Nov. 19: Sale hearing; and

- Dec. 15: Sale consummation.

The lien challenge deadline is 75 days from entry of the interim order for parties in interest and 60 days from formation for an official committee of unsecured creditors. The UCC lien investigation budget is $50,000.

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case No. 20-12024.

- Motion to establish trading procedures

- Shiloh seeks to establish trading procedures for its common stock, to be able to object to and prevent transfers if necessary to preserve net operating losses. As of Oct. 31, 2019 (the close of the debtors' prior fiscal year), the debtors estimate that they have federal NOLs of approximately $35 million. As of the petition date, the debtors estimate that they have generated approximately $50 million of losses for federal income tax purposes in the current fiscal year, and the debtors expect to generate additional tax losses during the course of these cases. Additionally, the debtors also have other beneficial federal and state tax attributes, such as state net operating losses, carryforwards of disallowed business interest expense and research and development credits (estimated at approximately $59.6 million, $5.2 million and $6.1 million, respectively, as of Oct. 31, 2019).

- Motion to pay essential suppliers

- The debtors seek approval to pay essential supplier claims up to $27.6 million on an interim basis and up to $35.6 million on a final basis. The motion says that the debtors believe that certain of the essential suppliers may be entitled to administrative priority pursuant to section 503(b)(9) of the Bankruptcy Code.

- Motion to pay lien claimants

- Shiloh requests authority to pay up to $7.9 million to lienholder claimants, including shipping and warehousing claimants, scrap, tooling and outside processor claimants, on an interim basis, with up to $10.8 million in total payment sought on a final basis.

- Motion to pay foreign vendors

- The debtors seek to pay up to $900,000 on account of foreign vendor claims.

- Motion to pay employee wages and benefits

- On an interim basis, the debtors request authorization to pay up to $13.3 million on account of employee obligations, including compensation, business expenses, benefits and processing costs.

- Motion to use cash management system

- The company has bank accounts with CIBC US, Bank of America and BMO Harris Bank.

- Motion to maintain insurance programs

- Motion to pay taxes and fees

- On an interim basis, the debtors seek to pay up to $375,000 on account of prepetition taxes.

- Motion to provide utilities with adequate assurance

- Motion to honor customer programs

- Motion to waive certain procedural requirements related to creditors lists

- Application to appoint Prime Clerk as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.