Ruby Tuesday Inc

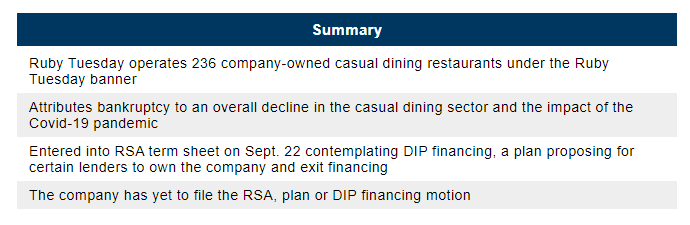

CASE SUMMARY: Ruby Tuesday Enters Chapter 11 With RSA Term Sheet With Secured Lenders Providing for ‘Certain Members of Its Lender Group’ to Own Company

Wed 10/07/2020 14:00 PM

Relevant Documents:

Voluntary Petition

Press Release

First Day Declaration

First Day Hearing Agenda

Ruby Tuesday, an Atlanta-based developer, operator and franchisor of casual dining restaurants in the United States, Guam and five foreign countries under the Ruby Tuesday brand, filed for chapter 11 protection on Wednesday morning in the Bankruptcy Court for the District of Delaware. The company entered into a restructuring support agreement term sheet on Sept. 22 with their prepetition secured lenders, contemplating DIP financing, formulation of a business plan “for the future of Ruby Tuesday,” a plan of reorganization providing for “certain members of its lender group” owning the company, and exit financing. Continue reading for the First Day and Americas Middle Market by Reorg teams' update on the Ruby Tuesday chapter 11 filing, and request a trial to access our coverage of thousands of other chapter 11 filings.

The company has also retained FocalPoint Partners “to design the appropriate process to solicit interest in, and contact various potential strategic and financial counterparties for the purpose of exploring, transactions to address the Company’s liquidity concerns and support its contemplated forward operations.” The debtors have yet to file any papers relating to the RSA or DIP financing.

Since NRD Capital’s acquisition of Ruby Tuesday in 2017 (after which Ruby Tuesday’s common stock ceased trading on the NYSE), at which time the company operated about 541 restaurants, it has “struggled in an increasingly competitive and challenging business environment” that was only exacerbated by the Covid-19 pandemic. To address these challenges, the company has closed underperforming locations and sold and leased back 189 restaurants, and as of the petition date, there were more than 250 Ruby Tuesday restaurants worldwide. The debtors say that they do not intend to reopen 185 of their restaurants closed during the pandemic.

“This announcement does not mean ‘Goodbye, Ruby Tuesday’,” says Ruby Tuesday’s CEO, Shawn Lederman, in a press release, adding that the bankruptcy filing “will allow us an opportunity to reposition the company for long-term stability as we recover from the unprecedented impact of COVID-19.”

The first day hearing is scheduled for Thursday, Oct. 8, at 2 p.m. ET.

The company reports $100 million to $500 million in both assets and liabilities, and its prepetition capital structure includes:

The prepetition secured credit facility, with Goldman Sachs Specialty Lending Group LP as administrative agent and Goldman Sachs Bank USA as issuing bank, was amended several times prepetition, including a Sept. 22 amendment providing for $2 million in funding to support the company’s operations through the petition date. The facility is secured by “(a) a guarantee by each of the Debtors of the obligations of each of the other Debtors, (b) a first priority security interest in substantially all the assets of the Debtors, (c) a first priority pledge on 100% of the equity securities of each domestic subsidiary of the Debtors and 65% of the equity securities of each foreign subsidiary of the Debtors, and (d) a mortgage on certain owned real properties of the Debtors.”

The debtors have $4 million in unrestricted cash as of the petition date. The company also has liquor licenses valued at $13.9 million.

In connection with the merger with NRD, Ruby Tuesday entered into sale-leaseback transactions. An affiliate of NRD, SFI, purchased 178 real properties from Ruby Tuesday for approximately $242.2 million and then sold the properties to five strategic buyers that leased the properties back to Ruby Tuesday. As a result of the transactions, the debtors received net sale proceeds of approximately $240.8 million. The debtors entered into additional sale-leaseback transactions for net proceeds of $6 million in 2019 and $11.4 million in 2020. The debtors own developed and undeveloped property in Alabama, Connecticut, Florida, Indiana, Kentucky, Maryland, Michigan, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Texas and Virginia and also have a ground lease that expires in 2070 on which they operate the Morningside Inn, a hotel and dining room used for special events.

In connection with sale-leaseback transactions related to the merger, SFI agreed to pay Ruby Tuesday $239.8 million under a note that matures on Dec. 31, 2037, and accrues interest at 4.5%. RTI Holding Co. also entered into an unsecured floating-rate bond payable to SFI under which RTI Holding Co. agreed to pay SFI $230.8 million in connection with the transaction. As of the petition date, $230.8 million is due under the note and the balance of the bond is $239.8 million. SFI also contributed $10 million to RTI Holding Co. in exchange for 10 million units of preferred membership interests with priority distribution rights from RTI Holding Co.

The debtors are represented by Pachulski Stang Ziehl & Jones as counsel, CR3 Partners as financial advisor, FocalPoint Securities as investment banker and Hilco Real Estate as lease restructuring advisor. Epiq is the claims agent. The case has been assigned to Judge John T. Dorsey (case No. 20-12456).

Background

Ruby Tuesday is a developer, operator and franchisor of casual dining restaurants in the United States, Guam and five foreign countries under the Ruby Tuesday banner. To date, there are more than 250 Ruby Tuesday restaurants worldwide, “offering a wide variety of menu options, including burgers, signature baby-back ribs, steaks, seafood, chicken, and appetizers, and an extensive Garden Bar.” The debtors have 236 company-owned locations. The restaurants serve customers primarily through a full-service concept and separate bar and also offer RubyTueGo curbside service, delivery via third-party companies and a catering program for businesses, organizations and group events at both company-owned and franchised restaurants.

The debtors have 7,300 employees, none of whom are covered by collective bargaining agreements. Due to Covid-19-induced restaurant closures, the company furloughed approximately 7,000 employees, who are not paid but remain covered under Ruby Tuesday’s health benefits programs. “The Company hopes to invite many of these employees to return to active status, to the extent they have not already, as sales levels return,” the debtors say.

The first Ruby Tuesday restaurant opened in Knoxville, Tenn., in 1972 near the University of Tennessee campus before the brand “quickly became known as a ‘go to’ location for casual dining fare.” With 16 restaurants, the brand was acquired by Morrison Restaurants Inc. in 1982. During the following years, Morrison expanded the concept to more than 300 restaurants and changed its name to Ruby Tuesday Inc. The company began its franchise program in 1997, opening one domestic and two international franchised Ruby Tuesday restaurants. To date, the debtors have franchise arrangements with 10 groups that operate Ruby Tuesday restaurants in eight states, Guam and five foreign countries.

Domestic Ruby Tuesday franchisees are generally required to pay a royalty fee of 4% and a marketing and purchasing fee of 1.5% of monthly gross sales. The franchisees also pay a national advertising fee of up to 1.5% of monthly gross sales to cover their pro rata portion of the costs associated with the company’s national advertising campaigns.

The company sponsors three “top hat,” nonqualified, unfunded, deferred compensation plans: an executive supplemental pension plan, a management retirement plan and a deferred compensation plan. The executive supplemental plan and the management retirement plan are funded by company-owned life insurance policies with an aggregate surrender value as of Sept. 15 of $22.4 million and about $111,700 in cash. The deferred compensation plan holds interests in various funds, with an aggregate vested balance of approximately $5.2 million as of Sept. 24. Title to these assets is held in “rabbi” trusts, and the executive supplemental plan, management retirement plan and a prior deferred compensation plan have all been frozen. Regions bank, the trustee of the rabbi trust associated with the executive supplemental plan and the management retirement plan filed an interpleader complaint in the U.S. District Court for the Northern District of Alabama seeking a determination of rights in the assets held in the rabbi trusts.

The NRD acquisition has also precipitated a dissenting shareholder’s appraisal action commenced in April 2018 in Georgia state court, stemming from Ruby Tuesday Inc. shareholders opposing the merger and refusing offers to acquire their shares for $2.40 per share. A trial date has yet to be set in the action, which is designed for the court to appraise the fair market value of the Ruby Tuesday Inc. shares as of Dec. 21, 2017.

The debtors’ organizational structure is shown below:

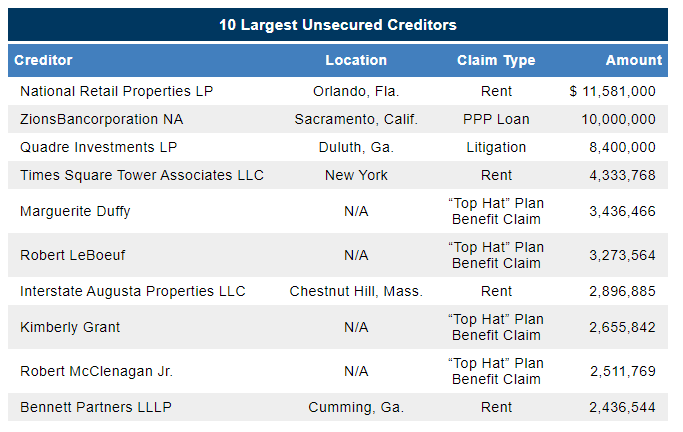

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

Events Leading to the Bankruptcy Filing

Ruby Tuesday attributes the bankruptcy to “an increasingly competitive and challenging business environment” - including shifts in consumer spending away from traditional casual dining concepts in favor of quick service and fast-casual restaurants, declining shopping mall traffic, the proliferation of alternative delivery methods and at-home meal kits - and an inability to overcome the difficulties sparked by the Covid-19 pandemic, which has exacerbated “the overall decline in the casual dining sector.”

The declining market conditions threw the debtors out of compliance with respect to certain financial covenants under the prepetition credit facility in 2018 and 2019. In May 2019, the debtors entered into a limited waiver and amendment to the prepetition credit facility. The company also paid approximately $43 million of principal under the prepetition credit facility, of which more than $37 million were prepayments, primarily using the proceeds from the sale of real estate and the sale-leaseback transactions.

In response to these challenges, the company closed underperforming locations, sold and leased-back 189 restaurants, reduced annual corporate overhead by more than 45%, and accelerated to-go and online ordering. With these changes, Ruby Tuesday dissolved 20 subsidiary entities that served no ongoing purpose, to alleviate the administrative burden of maintaining the separate corporate existence for these entities. Any outstanding assets at any such entities were distributed to Ruby Tuesday as part of the wind down of such entities. “Despite these significant operational improvements,” the debtors lament, “the industry pressures mounted, the Debtors continued to experience negative operating results and were again in covenant default under the Prepetition Credit Agreement for the fiscal quarters ending December 3, 2019, and March 3, 2020.”

In response to the pandemic, the debtors immediately expanded the availability of third-party delivery and off-premise services, and established new third-party relationships. The company then introduced a “virtual kitchen” initiative, through which it utilizes excess capacity to offer other brands via third-party delivery. The debtors also implemented a “Ruby’s Pantry” option that allows customers to purchase uncooked food, groceries and other essentials through Ruby’s website. The benefits of these changes were “significant,” the debtors say, noting third-party delivery growth of more than 450% from 2019 to 2020. Ruby’s to-go business also grew by more than 93% in the same period. The debtors say that these initiatives “are expected to contribute to a recovery as economies reopen and the Company leaves behind the impact of COVID-19.”

The company negotiated several concessions from its prepetition lenders, including permitting the company to obtain PPP loans, deferring payments of certain fees and allowing the debtors to conduct certain sales. As of September, the company had negotiated more than 200 lease modifications resulting in over $1.5 million in rent abatement and $5.1 million in rent deferrals. Several leases were terminated as well, involving future lease obligations of approximately $17.3 million. The debtors say that they continue to work with landlords to assess the impact of government restrictions and negotiate rental market obligations.

First Day Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

Press Release

First Day Declaration

First Day Hearing Agenda

Ruby Tuesday, an Atlanta-based developer, operator and franchisor of casual dining restaurants in the United States, Guam and five foreign countries under the Ruby Tuesday brand, filed for chapter 11 protection on Wednesday morning in the Bankruptcy Court for the District of Delaware. The company entered into a restructuring support agreement term sheet on Sept. 22 with their prepetition secured lenders, contemplating DIP financing, formulation of a business plan “for the future of Ruby Tuesday,” a plan of reorganization providing for “certain members of its lender group” owning the company, and exit financing. Continue reading for the First Day and Americas Middle Market by Reorg teams' update on the Ruby Tuesday chapter 11 filing, and request a trial to access our coverage of thousands of other chapter 11 filings.

The company has also retained FocalPoint Partners “to design the appropriate process to solicit interest in, and contact various potential strategic and financial counterparties for the purpose of exploring, transactions to address the Company’s liquidity concerns and support its contemplated forward operations.” The debtors have yet to file any papers relating to the RSA or DIP financing.

Since NRD Capital’s acquisition of Ruby Tuesday in 2017 (after which Ruby Tuesday’s common stock ceased trading on the NYSE), at which time the company operated about 541 restaurants, it has “struggled in an increasingly competitive and challenging business environment” that was only exacerbated by the Covid-19 pandemic. To address these challenges, the company has closed underperforming locations and sold and leased back 189 restaurants, and as of the petition date, there were more than 250 Ruby Tuesday restaurants worldwide. The debtors say that they do not intend to reopen 185 of their restaurants closed during the pandemic.

“This announcement does not mean ‘Goodbye, Ruby Tuesday’,” says Ruby Tuesday’s CEO, Shawn Lederman, in a press release, adding that the bankruptcy filing “will allow us an opportunity to reposition the company for long-term stability as we recover from the unprecedented impact of COVID-19.”

The first day hearing is scheduled for Thursday, Oct. 8, at 2 p.m. ET.

The company reports $100 million to $500 million in both assets and liabilities, and its prepetition capital structure includes:

- Secured debt:

- Prepetition credit facility:

- Term loan: $30.9 million

- Letters of credit: $11.8 million

- Prepetition credit facility:

- Unsecured debt:

- Accounts payable: $18.8 million (landlords, utilities, employees, taxing authorities, third-party vendors, insurance premiums and other service providers)

- PPP loan: $10 million

- Equity: Ruby Tuesday Inc. was publicly traded on the New York Stock Exchange from 1996 to 2017 and delisted when it entered into a merger agreement with affiliates of NRD Partners II LP, through which Ruby Tuesday survived the merger as a wholly owned subsidiary of RTI Holding Co. LLC. RTI Holding Co.’s equity is held by the following affiliates of NRD Partners II: RTI Investment Co. LLC, Strategic Financial Intermediation II LLC and NRD RT Holdings LLC. All debtors, other than RTI Holding Co., are direct or indirect wholly owned subsidiaries of Ruby Tuesday Inc., which is a wholly owned subsidiary of RTI Holding Co.

The prepetition secured credit facility, with Goldman Sachs Specialty Lending Group LP as administrative agent and Goldman Sachs Bank USA as issuing bank, was amended several times prepetition, including a Sept. 22 amendment providing for $2 million in funding to support the company’s operations through the petition date. The facility is secured by “(a) a guarantee by each of the Debtors of the obligations of each of the other Debtors, (b) a first priority security interest in substantially all the assets of the Debtors, (c) a first priority pledge on 100% of the equity securities of each domestic subsidiary of the Debtors and 65% of the equity securities of each foreign subsidiary of the Debtors, and (d) a mortgage on certain owned real properties of the Debtors.”

The debtors have $4 million in unrestricted cash as of the petition date. The company also has liquor licenses valued at $13.9 million.

In connection with the merger with NRD, Ruby Tuesday entered into sale-leaseback transactions. An affiliate of NRD, SFI, purchased 178 real properties from Ruby Tuesday for approximately $242.2 million and then sold the properties to five strategic buyers that leased the properties back to Ruby Tuesday. As a result of the transactions, the debtors received net sale proceeds of approximately $240.8 million. The debtors entered into additional sale-leaseback transactions for net proceeds of $6 million in 2019 and $11.4 million in 2020. The debtors own developed and undeveloped property in Alabama, Connecticut, Florida, Indiana, Kentucky, Maryland, Michigan, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Texas and Virginia and also have a ground lease that expires in 2070 on which they operate the Morningside Inn, a hotel and dining room used for special events.

In connection with sale-leaseback transactions related to the merger, SFI agreed to pay Ruby Tuesday $239.8 million under a note that matures on Dec. 31, 2037, and accrues interest at 4.5%. RTI Holding Co. also entered into an unsecured floating-rate bond payable to SFI under which RTI Holding Co. agreed to pay SFI $230.8 million in connection with the transaction. As of the petition date, $230.8 million is due under the note and the balance of the bond is $239.8 million. SFI also contributed $10 million to RTI Holding Co. in exchange for 10 million units of preferred membership interests with priority distribution rights from RTI Holding Co.

The debtors are represented by Pachulski Stang Ziehl & Jones as counsel, CR3 Partners as financial advisor, FocalPoint Securities as investment banker and Hilco Real Estate as lease restructuring advisor. Epiq is the claims agent. The case has been assigned to Judge John T. Dorsey (case No. 20-12456).

Background

Ruby Tuesday is a developer, operator and franchisor of casual dining restaurants in the United States, Guam and five foreign countries under the Ruby Tuesday banner. To date, there are more than 250 Ruby Tuesday restaurants worldwide, “offering a wide variety of menu options, including burgers, signature baby-back ribs, steaks, seafood, chicken, and appetizers, and an extensive Garden Bar.” The debtors have 236 company-owned locations. The restaurants serve customers primarily through a full-service concept and separate bar and also offer RubyTueGo curbside service, delivery via third-party companies and a catering program for businesses, organizations and group events at both company-owned and franchised restaurants.

The debtors have 7,300 employees, none of whom are covered by collective bargaining agreements. Due to Covid-19-induced restaurant closures, the company furloughed approximately 7,000 employees, who are not paid but remain covered under Ruby Tuesday’s health benefits programs. “The Company hopes to invite many of these employees to return to active status, to the extent they have not already, as sales levels return,” the debtors say.

The first Ruby Tuesday restaurant opened in Knoxville, Tenn., in 1972 near the University of Tennessee campus before the brand “quickly became known as a ‘go to’ location for casual dining fare.” With 16 restaurants, the brand was acquired by Morrison Restaurants Inc. in 1982. During the following years, Morrison expanded the concept to more than 300 restaurants and changed its name to Ruby Tuesday Inc. The company began its franchise program in 1997, opening one domestic and two international franchised Ruby Tuesday restaurants. To date, the debtors have franchise arrangements with 10 groups that operate Ruby Tuesday restaurants in eight states, Guam and five foreign countries.

Domestic Ruby Tuesday franchisees are generally required to pay a royalty fee of 4% and a marketing and purchasing fee of 1.5% of monthly gross sales. The franchisees also pay a national advertising fee of up to 1.5% of monthly gross sales to cover their pro rata portion of the costs associated with the company’s national advertising campaigns.

The company sponsors three “top hat,” nonqualified, unfunded, deferred compensation plans: an executive supplemental pension plan, a management retirement plan and a deferred compensation plan. The executive supplemental plan and the management retirement plan are funded by company-owned life insurance policies with an aggregate surrender value as of Sept. 15 of $22.4 million and about $111,700 in cash. The deferred compensation plan holds interests in various funds, with an aggregate vested balance of approximately $5.2 million as of Sept. 24. Title to these assets is held in “rabbi” trusts, and the executive supplemental plan, management retirement plan and a prior deferred compensation plan have all been frozen. Regions bank, the trustee of the rabbi trust associated with the executive supplemental plan and the management retirement plan filed an interpleader complaint in the U.S. District Court for the Northern District of Alabama seeking a determination of rights in the assets held in the rabbi trusts.

The NRD acquisition has also precipitated a dissenting shareholder’s appraisal action commenced in April 2018 in Georgia state court, stemming from Ruby Tuesday Inc. shareholders opposing the merger and refusing offers to acquire their shares for $2.40 per share. A trial date has yet to be set in the action, which is designed for the court to appraise the fair market value of the Ruby Tuesday Inc. shares as of Dec. 21, 2017.

The debtors’ organizational structure is shown below:

(Click HERE to enlarge.)

The debtors' largest unsecured creditors are listed below:

The case representatives are as follows:

Events Leading to the Bankruptcy Filing

Ruby Tuesday attributes the bankruptcy to “an increasingly competitive and challenging business environment” - including shifts in consumer spending away from traditional casual dining concepts in favor of quick service and fast-casual restaurants, declining shopping mall traffic, the proliferation of alternative delivery methods and at-home meal kits - and an inability to overcome the difficulties sparked by the Covid-19 pandemic, which has exacerbated “the overall decline in the casual dining sector.”

The declining market conditions threw the debtors out of compliance with respect to certain financial covenants under the prepetition credit facility in 2018 and 2019. In May 2019, the debtors entered into a limited waiver and amendment to the prepetition credit facility. The company also paid approximately $43 million of principal under the prepetition credit facility, of which more than $37 million were prepayments, primarily using the proceeds from the sale of real estate and the sale-leaseback transactions.

In response to these challenges, the company closed underperforming locations, sold and leased-back 189 restaurants, reduced annual corporate overhead by more than 45%, and accelerated to-go and online ordering. With these changes, Ruby Tuesday dissolved 20 subsidiary entities that served no ongoing purpose, to alleviate the administrative burden of maintaining the separate corporate existence for these entities. Any outstanding assets at any such entities were distributed to Ruby Tuesday as part of the wind down of such entities. “Despite these significant operational improvements,” the debtors lament, “the industry pressures mounted, the Debtors continued to experience negative operating results and were again in covenant default under the Prepetition Credit Agreement for the fiscal quarters ending December 3, 2019, and March 3, 2020.”

In response to the pandemic, the debtors immediately expanded the availability of third-party delivery and off-premise services, and established new third-party relationships. The company then introduced a “virtual kitchen” initiative, through which it utilizes excess capacity to offer other brands via third-party delivery. The debtors also implemented a “Ruby’s Pantry” option that allows customers to purchase uncooked food, groceries and other essentials through Ruby’s website. The benefits of these changes were “significant,” the debtors say, noting third-party delivery growth of more than 450% from 2019 to 2020. Ruby’s to-go business also grew by more than 93% in the same period. The debtors say that these initiatives “are expected to contribute to a recovery as economies reopen and the Company leaves behind the impact of COVID-19.”

The company negotiated several concessions from its prepetition lenders, including permitting the company to obtain PPP loans, deferring payments of certain fees and allowing the debtors to conduct certain sales. As of September, the company had negotiated more than 200 lease modifications resulting in over $1.5 million in rent abatement and $5.1 million in rent deferrals. Several leases were terminated as well, involving future lease obligations of approximately $17.3 million. The debtors say that they continue to work with landlords to assess the impact of government restrictions and negotiate rental market obligations.

First Day Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case No. 20-12456.

- Motion to pay employee wages and benefits

- The debtors employee obligations are summarized below:

- Motion to use cash management system

- The company has bank accounts with Regions Financial Corporation, Wells Fargo Bank NA, First National Bank of Litchfield, Bank of America, BB&T, Park National Bank (Century National Bank), Chemung Canal Trust Co., Fifth Third Bank, First Commonwealth Bank, South State Bank, U.S. Bank, PNC Bank, COLI Trust, Pinnacle Financial Partners, and California Bank & Trust.

- Motion to pay PACA claims, critical vendors and 503(b)(9) claims

- On an interim basis, the debtors seek authority to pay PACA claims, critical vendor claims and 503(b)(9) claims in the respective amounts of $400,000, $1.3 million and $350,000. On a final basis, the debtors seek to pay a total of $500,000 in PACA claims, $1.6 million in critical vendor claims and $500,000 in 503(b)(9) claims.

- Motion to maintain insurance programs

- Motion to pay taxes and fees

- The debtors estimate that they owe approximately $2.3 million in taxes and fees.

- Motion to continue customer programs

- Motion to provide utilities with adequate assurance

- Motion to file a consolidated list of creditors

- Application to appoint Epiq as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.