Cosmoledo, LLC

CASE SUMMARY: NYC Maison Kayser Operator Cosmoledo Seeks to Run Sale Process With Stalking Horse Bid from MK USA for $3M Cash Plus Credit Bid

Fri 09/11/2020 15:26 PM

Relevant Documents:

Voluntary Petition

Bid Procedures Motion

First Day Declaration

Cash Collateral Motion

Prepetition, MK USA, through affiliate MK Debt LLC, purchased the indebtedness under the debtors’ prepetition secured obligations from Moussechoux Inc., Cosmoledo’s sole equityholder and original secured lender. The stalking horse bidder’s purchase price includes as consideration $3 million in cash, cure costs on any assigned contracts and leases, plus a credit bid of up to the full amount of its secured claim, which the first day declaration pegs at $72.7 million. The proposed sale agreement also contemplates an assignment of the debtors’ PPP loan. The sale would be subject to higher and better offers. The debtors propose a bid deadline of Sept. 23 at 12 p.m. ET and a Sept. 25 auction.

As of the petition date, the debtors say they believe that they have sufficient funds on hand to administer their chapter 11 cases, run the sale process, consummate a sale and file a confirmable plan based on current forecasts. To that end, the debtors have filed a motion seeking to use cash collateral on a consensual basis.

In the bid procedures motion, the debtors say that they “hope to have the 363 Motion approved and the sale contemplated therein quickly and follow a closing with confirmation of a liquidating plan.” To the extent there are assets that are not part of the sale to the purchaser, the debtors say they will take immediate action to reject or abandon them so as to minimize any associated administrative costs.

The first day hearing has yet to be scheduled.

The company reports $10 to $50 million in assets and $50 to $100 million in liabilities. The company’s prepetition capital structure includes:

According to the cash collateral motion, the debtors have approximately $9 million of cash on hand.

On Sept. 10, the debtors’ original secured lender, Moussechoux Inc., sold and assigned all of its rights, title, interests and obligations to and under the prepetition notes to MK Debt LLC, an affiliate of the stalking horse. The value of the cash collateral related to this indebtedness as of the petition date was approximately $3.7 million, and the value of the collateral securing the debt as of the petition date was “in excess of” $5.4 million, according to the first day declaration.

In connection with the sale contemplated, the purchaser may take an assignment of the debtors’ PPP loan, though the necessary consents from the Small Business Administration and Santander Bank have yet to be obtained. In the event such consents are not obtained on or before the closing of a sale, the debtors propose to transfer sufficient cash out of the debtors’ other accounts to cover all amounts owed under the PPP loan and place the amounts in a separate escrow account to be held by the debtors’ counsel. These funds would be held and only released to the purchaser in accordance with the asset purchase agreement. In the event an assignment of the PPP loan is denied or does not take place by Nov. 30, the debtors intend to seek authority from the bankruptcy court to repay the PPP loan.

In April 2015, debtor 688 Bronx Commissary LLC received the Interaudi loan encumbering the premises located at 688 East 135th Street in New York. Cosmoledo is the guarantor of the Interaudi loan, which is to be paid over 25 years with a balloon payment due at the end. As of the petition date, the debtors remain current on all payments due under the Interaudi Bank loan.

The company attributes the bankruptcy filing to the Covid-19 pandemic as well as “a drag on profitability” from locations opened outside of New York in connection with expansion initiatives. In 2019, the debtors retained professionals and formulated a restructuring strategy that included a recapitalization of the company, the reorganization of their production facilities, a reduction of their footprint and a revision to the structure of store level management. This strategy was implemented throughout 2019 and “mostly completed” in the first quarter or 2020, right before the business was “devastated” by the pandemic.

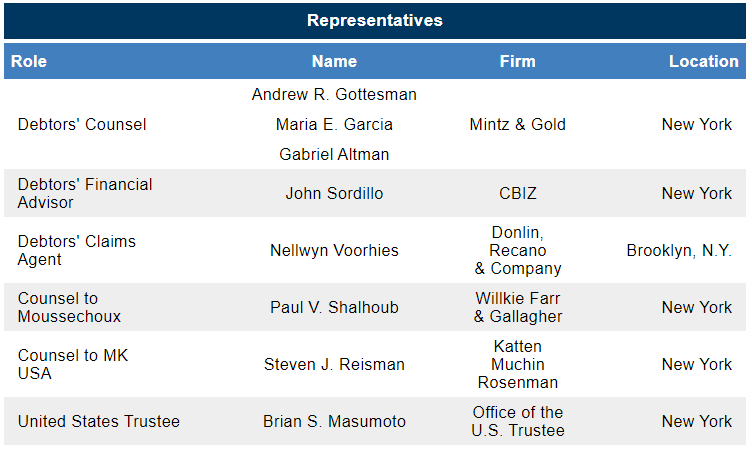

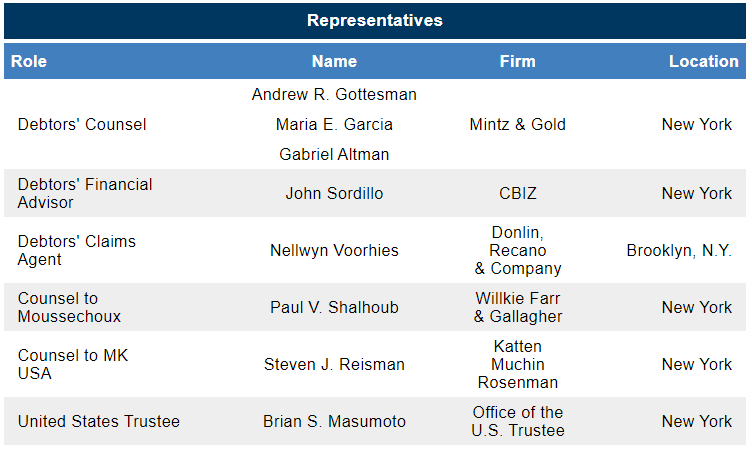

The debtors are represented by Mintz & Gold as counsel and CBIZ as financial advisors, accountants and consultants. The case has been assigned to Judge Michael E. Wiles (case no. 20-12117).

Background

The debtors, founded in 2010, operated 16 Maison Kayser bakery and cafe restaurants in New York. Maison Kayser, a global brand, is an authentic, artisanal French boulangerie initially formed in Paris in 1996. Maison Kayser has approximately 150 shops in over 22 different countries. The company also leases a commissary for consolidated production and owns a piece of fee owned real property located at 668 East 135th Street in the Bronx in New York.

The debtors note that their production and operational costs are historically high because of the nature of their business concept. The company’s trade name derives from its namesake and licensor, Eric Kayser, who the debtors say has been recognized as one of “the most talented artisan bakers of his generation and has built his reputation on his passion for bread, the quality of his products and his incredible skill to combine authenticity and innovation in the world of French artisanal bakeries.” Maintaining these high standards demands the highest quality ingredients, meticulous processes and state of the art equipment, the debtors say.

The company’s original business model contemplated expansion to a national footprint in a relatively short period of time. At its height, the company was making products from scratch in its bakery-equipped stores and two separate 20,000-square-foot and 30,000-square-foot commissaries (one in the Bronx and one in New Jersey). The debtors had also expanded out of New York and opened stores in Washington. According to the first day declaration, in or around early 2019, it became clear that the operational overhead and performance of the out-of-town locations “were too great a drag on the Company’s overall profitability,” leading to 2019 restructuring initiatives.

The debtors have 20 leased premises, which they note have “limited value because of the current state of the dining industry,” with landlords and customers alike “uncertain of their future.” The debtors’ current monthly rent obligations are approximately $933,000. They have not paid rent since March 2020.

As of the petition date, the debtors say that “there is still little prospect of in-Store dining any time soon.” After analyzing the financial impact stemming from the macro economic factors impacting the restaurant industry - the loss of in-store dining revenue and the continued overhead required to sustain even limited take-out and delivery operations - the debtors determined that there was “too great a risk that future operations would fail to generate sufficient capital to repay its obligations in the ordinary course of its business and continue profitable operations.” Consequently, the debtors decided to not reopen their stores and began seeking restructuring alternatives in mid-July.

Aurify Brands, which operates Melt Shop, The Little Beet and Fields Good Chicken brands, along with Five Guys locations in New York, was also the purchaser lined up for the chapter 11 case commenced by PQ NY, Le Pain Quotidien’s United States retail arm.

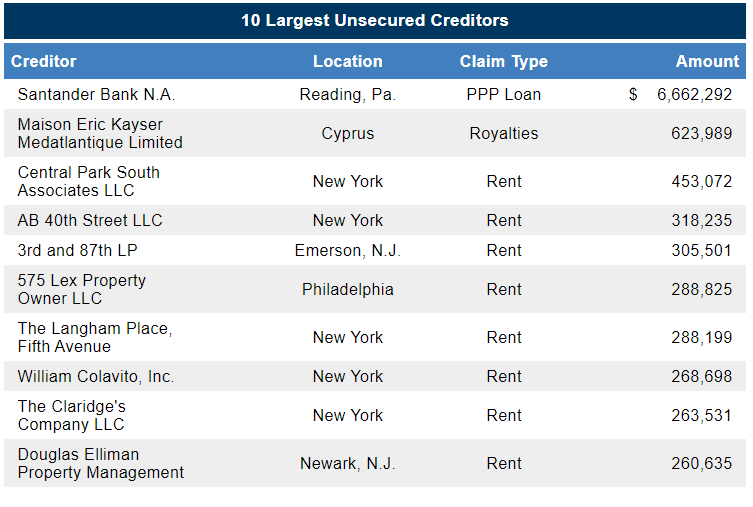

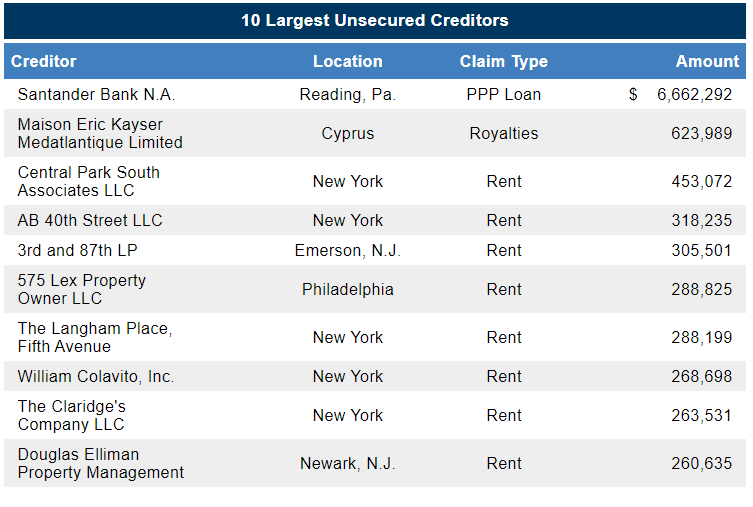

The debtors’ largest unsecured creditors are listed below:

Bid Procedures Motion

The sale agreement contemplates the sale of substantially all of the debtors’ assets to MK USA as stalking horse bidder. The assets include, among other things, (i) the equity of the entity 688 Bronx Commissary LLC, (ii) all furniture, fixtures and equipment, (iii) all acquired claims of the estate against go-forward vendors, parents, affiliates and shareholders, (iv) the debtors’ intellectual property, to the extent transferrable, and (v) the PPP cash. The purchase price for the assets is $3 million cash on the closing date, plus cure costs on any assigned contracts and leases and a credit bid of up to the full amount of MK’s secured claim. The purchaser would not be assuming any liabilities of the debtors other than liabilities arising from and after the closing under any assumed contracts, and other liabilities as may be specifically identified in the sale agreement.

The proposed sale would be subject to higher and better offers. If the debtors receive qualified bids by the Sept. 23 bid deadline, they would conduct an auction on Sept. 25.

The debtors propose, as bid protections for the stalking horse bidder, a breakup fee of 3% of the cash consideration of the purchase price, including any cash collateral, and expense reimbursement, both of which would be entitled to superpriority administrative expense claim status. The proposed purchase price for any qualified bid would be $75,000 over the sum of the stalking horse bid and the bid protections. All bids subsequent to the opening bid at the auction would have to exceed the prior offer by at least $50,000. Qualified bids would require a deposit of at least 20%.

The bidding procedures attached to the motion outline the following sale process timeline:

Cash Collateral Motion

Following good faith and arms’ length negotiations, the debtors and their sole secured creditor have executed a stipulation with respect to the consensual use of cash collateral, which would be used to pay the limited staff retained to continue corporate functions, facilitate a sale and assist in the confirmation of a plan. Absent the requested cash collateral relief, the debtors say that they would be forced to convert their cases to chapter 7 or dismiss the cases and liquidate out of court.

As adequate protection, the debtors propose to provide the secured creditor with first priority replacement liens, superpriority expense claim status and adherence to the budget. The replacement liens and superpriority claims would not attach to avoidance actions or their proceeds under chapter 5 of the bankruptcy code.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carveout for professional fees is $250,000.

The proposed budget for the use of cash collateral is HERE.

Lease Rejection Motion

The debtors seek an order from the court deeming any leases that have not been assumed and assigned or designated for assumption and assignment under the proposed sale agreement, or otherwise assumed and assigned at the sale hearing, rejected as of a sale hearing and the contents thereof abandoned as of that date. A summary of the properties and the property the debtors seek to potentially abandon (consisting primarily of furniture, fixtures and equipment) is HERE.

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

Bid Procedures Motion

First Day Declaration

Cash Collateral Motion

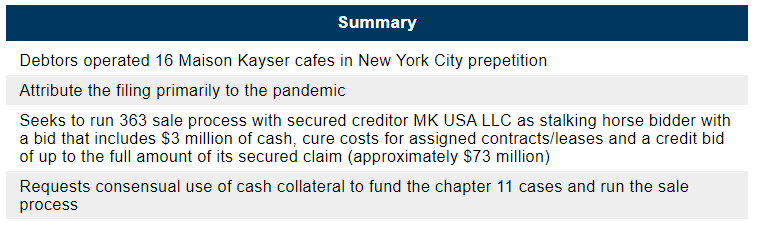

Cosmoledo, LLC, which operated 16 Maison Kayser cafes in New York City prepetition, filed for chapter 11 protection today in the Bankruptcy Court for the Southern District of New York, along with several affiliates. Continue reading for the First Day by Reorg team's comprehensive case summary of the Cosmoledo chapter 11 filing, and request a trial to access our coverage of thousands of other chapter 11 filings across the U.S.

After an almost 60-day marketing process, the debtors have selected MK USA LLC as stalking horse bidder for the sale of substantially all of their assets. MK USA appears to be an affiliate of Aurify Brands based on the board resolutions attached to the petition.

Prepetition, MK USA, through affiliate MK Debt LLC, purchased the indebtedness under the debtors’ prepetition secured obligations from Moussechoux Inc., Cosmoledo’s sole equityholder and original secured lender. The stalking horse bidder’s purchase price includes as consideration $3 million in cash, cure costs on any assigned contracts and leases, plus a credit bid of up to the full amount of its secured claim, which the first day declaration pegs at $72.7 million. The proposed sale agreement also contemplates an assignment of the debtors’ PPP loan. The sale would be subject to higher and better offers. The debtors propose a bid deadline of Sept. 23 at 12 p.m. ET and a Sept. 25 auction.

As of the petition date, the debtors say they believe that they have sufficient funds on hand to administer their chapter 11 cases, run the sale process, consummate a sale and file a confirmable plan based on current forecasts. To that end, the debtors have filed a motion seeking to use cash collateral on a consensual basis.

In the bid procedures motion, the debtors say that they “hope to have the 363 Motion approved and the sale contemplated therein quickly and follow a closing with confirmation of a liquidating plan.” To the extent there are assets that are not part of the sale to the purchaser, the debtors say they will take immediate action to reject or abandon them so as to minimize any associated administrative costs.

The first day hearing has yet to be scheduled.

The company reports $10 to $50 million in assets and $50 to $100 million in liabilities. The company’s prepetition capital structure includes:

- Secured debt:

- MK Debt, LLC notes: $72.7 million

- Unsecured debt:

- Interaudi Bank loan: $1.1 million

- PPP loan: $6.7 million

- Equity: All of the equity of Cosmoledo is held by Moussechoux Inc.

According to the cash collateral motion, the debtors have approximately $9 million of cash on hand.

On Sept. 10, the debtors’ original secured lender, Moussechoux Inc., sold and assigned all of its rights, title, interests and obligations to and under the prepetition notes to MK Debt LLC, an affiliate of the stalking horse. The value of the cash collateral related to this indebtedness as of the petition date was approximately $3.7 million, and the value of the collateral securing the debt as of the petition date was “in excess of” $5.4 million, according to the first day declaration.

In connection with the sale contemplated, the purchaser may take an assignment of the debtors’ PPP loan, though the necessary consents from the Small Business Administration and Santander Bank have yet to be obtained. In the event such consents are not obtained on or before the closing of a sale, the debtors propose to transfer sufficient cash out of the debtors’ other accounts to cover all amounts owed under the PPP loan and place the amounts in a separate escrow account to be held by the debtors’ counsel. These funds would be held and only released to the purchaser in accordance with the asset purchase agreement. In the event an assignment of the PPP loan is denied or does not take place by Nov. 30, the debtors intend to seek authority from the bankruptcy court to repay the PPP loan.

In April 2015, debtor 688 Bronx Commissary LLC received the Interaudi loan encumbering the premises located at 688 East 135th Street in New York. Cosmoledo is the guarantor of the Interaudi loan, which is to be paid over 25 years with a balloon payment due at the end. As of the petition date, the debtors remain current on all payments due under the Interaudi Bank loan.

The company attributes the bankruptcy filing to the Covid-19 pandemic as well as “a drag on profitability” from locations opened outside of New York in connection with expansion initiatives. In 2019, the debtors retained professionals and formulated a restructuring strategy that included a recapitalization of the company, the reorganization of their production facilities, a reduction of their footprint and a revision to the structure of store level management. This strategy was implemented throughout 2019 and “mostly completed” in the first quarter or 2020, right before the business was “devastated” by the pandemic.

The debtors are represented by Mintz & Gold as counsel and CBIZ as financial advisors, accountants and consultants. The case has been assigned to Judge Michael E. Wiles (case no. 20-12117).

Background

The debtors, founded in 2010, operated 16 Maison Kayser bakery and cafe restaurants in New York. Maison Kayser, a global brand, is an authentic, artisanal French boulangerie initially formed in Paris in 1996. Maison Kayser has approximately 150 shops in over 22 different countries. The company also leases a commissary for consolidated production and owns a piece of fee owned real property located at 668 East 135th Street in the Bronx in New York.

The debtors note that their production and operational costs are historically high because of the nature of their business concept. The company’s trade name derives from its namesake and licensor, Eric Kayser, who the debtors say has been recognized as one of “the most talented artisan bakers of his generation and has built his reputation on his passion for bread, the quality of his products and his incredible skill to combine authenticity and innovation in the world of French artisanal bakeries.” Maintaining these high standards demands the highest quality ingredients, meticulous processes and state of the art equipment, the debtors say.

The company’s original business model contemplated expansion to a national footprint in a relatively short period of time. At its height, the company was making products from scratch in its bakery-equipped stores and two separate 20,000-square-foot and 30,000-square-foot commissaries (one in the Bronx and one in New Jersey). The debtors had also expanded out of New York and opened stores in Washington. According to the first day declaration, in or around early 2019, it became clear that the operational overhead and performance of the out-of-town locations “were too great a drag on the Company’s overall profitability,” leading to 2019 restructuring initiatives.

The debtors have 20 leased premises, which they note have “limited value because of the current state of the dining industry,” with landlords and customers alike “uncertain of their future.” The debtors’ current monthly rent obligations are approximately $933,000. They have not paid rent since March 2020.

As of the petition date, the debtors say that “there is still little prospect of in-Store dining any time soon.” After analyzing the financial impact stemming from the macro economic factors impacting the restaurant industry - the loss of in-store dining revenue and the continued overhead required to sustain even limited take-out and delivery operations - the debtors determined that there was “too great a risk that future operations would fail to generate sufficient capital to repay its obligations in the ordinary course of its business and continue profitable operations.” Consequently, the debtors decided to not reopen their stores and began seeking restructuring alternatives in mid-July.

Aurify Brands, which operates Melt Shop, The Little Beet and Fields Good Chicken brands, along with Five Guys locations in New York, was also the purchaser lined up for the chapter 11 case commenced by PQ NY, Le Pain Quotidien’s United States retail arm.

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

Bid Procedures Motion

The sale agreement contemplates the sale of substantially all of the debtors’ assets to MK USA as stalking horse bidder. The assets include, among other things, (i) the equity of the entity 688 Bronx Commissary LLC, (ii) all furniture, fixtures and equipment, (iii) all acquired claims of the estate against go-forward vendors, parents, affiliates and shareholders, (iv) the debtors’ intellectual property, to the extent transferrable, and (v) the PPP cash. The purchase price for the assets is $3 million cash on the closing date, plus cure costs on any assigned contracts and leases and a credit bid of up to the full amount of MK’s secured claim. The purchaser would not be assuming any liabilities of the debtors other than liabilities arising from and after the closing under any assumed contracts, and other liabilities as may be specifically identified in the sale agreement.

The proposed sale would be subject to higher and better offers. If the debtors receive qualified bids by the Sept. 23 bid deadline, they would conduct an auction on Sept. 25.

The debtors propose, as bid protections for the stalking horse bidder, a breakup fee of 3% of the cash consideration of the purchase price, including any cash collateral, and expense reimbursement, both of which would be entitled to superpriority administrative expense claim status. The proposed purchase price for any qualified bid would be $75,000 over the sum of the stalking horse bid and the bid protections. All bids subsequent to the opening bid at the auction would have to exceed the prior offer by at least $50,000. Qualified bids would require a deposit of at least 20%.

The bidding procedures attached to the motion outline the following sale process timeline:

- Bid deadline: Sept. 23 at 12 p.m. ET;

- Auction: Sept. 25 at 10 a.m. ET; and

- Sale hearing: Sept. 30 at 10 a.m. ET.

Cash Collateral Motion

Following good faith and arms’ length negotiations, the debtors and their sole secured creditor have executed a stipulation with respect to the consensual use of cash collateral, which would be used to pay the limited staff retained to continue corporate functions, facilitate a sale and assist in the confirmation of a plan. Absent the requested cash collateral relief, the debtors say that they would be forced to convert their cases to chapter 7 or dismiss the cases and liquidate out of court.

As adequate protection, the debtors propose to provide the secured creditor with first priority replacement liens, superpriority expense claim status and adherence to the budget. The replacement liens and superpriority claims would not attach to avoidance actions or their proceeds under chapter 5 of the bankruptcy code.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carveout for professional fees is $250,000.

The proposed budget for the use of cash collateral is HERE.

Lease Rejection Motion

The debtors seek an order from the court deeming any leases that have not been assumed and assigned or designated for assumption and assignment under the proposed sale agreement, or otherwise assumed and assigned at the sale hearing, rejected as of a sale hearing and the contents thereof abandoned as of that date. A summary of the properties and the property the debtors seek to potentially abandon (consisting primarily of furniture, fixtures and equipment) is HERE.

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case no. 20-12117.

- Motion to pay employee wages and benefits

- The company requests approval to pay up to $10,305 in wage obligations, $4,160 on account of payroll taxes and $14,218 with respect to employee benefits.

- Motion to use cash management system

- The company has bank accounts with Santander Bank and TD Bank.

- Motion to maintain insurance programs

- Motion to provide utilities with adequate assurance

- Motion to extend the schedules/statements filing deadline to Oct. 24

- Motion to file consolidated creditors lists

- Application to employ Mintaz & Gold as counsel

- Application to employ CBIZ as financial advisor

- Application to appoint Donlin Recano as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.