Mariner Seafood, LLC

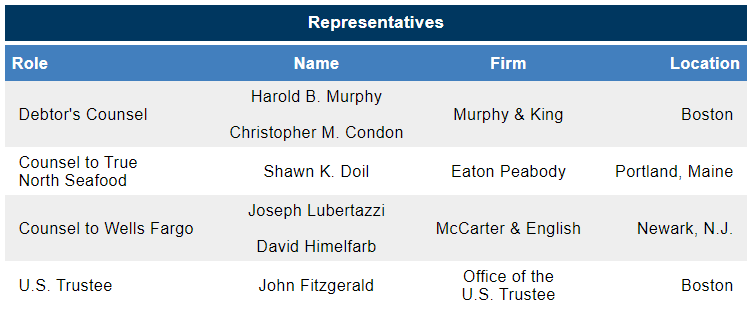

CASE SUMMARY: Cooke Aquaculture Affiliate is Stalking Horse in Mariner Seafood Sale Process Consented to by Prepetition Secured Lender Wells Fargo

Tue 09/15/2020 18:53 PM

Relevant Documents:

Voluntary Petition

20 Largest Unsecured Creditors

First Day Affidavit

Cash Collateral Motion

Sale Motion

First Day Hearing Notice

Mariner Seafood, LLC, a New Bedford, Mass.-based seafood business, filed for chapter 11 protection today in the Bankruptcy Court for the District of Massachusetts. Continue reading for the First Day by Reorg team's comprehensive case summary of the Mariner Seafood bankruptcy filing, and request a trial to follow thousands of other bankruptcy filings across the U.S.

The debtor seeks to run a sale process with True North Seafood, Inc., an affiliate of Cooke Aquaculture Inc., a multinational seafood processor and retailer headquartered in Canada, as stalking horse for a purchase price of the debtor’s accounts receivable up to $2.2 million, plus $150,000, plus $400,000 as a carve-out for professional fees plus certain employee benefit obligations. The debtor’s principal lender, Wells Fargo Bank, which is related to Wells Fargo Equipment Finance, consents to the sale, “notwithstanding that the purchase price for the assets is less than Wells asserts to be owed.” Pursuant to the APA, True North would also assume Mariner’s obligations under the company’s Wells Fargo prepetition term loan and take assignment of certain unexpired leases and executory contracts. The sale is conditioned on an Oct. 16 closing.

The first day hearing is scheduled for tomorrow, Wednesday, Sept. 16 at 11 a.m. ET.

The company reports $10 million to $50 million in both assets and liabilities. The company’s prepetition capital structure includes:

The owners of five cold storage facilities in Massachusetts and Virginia, at which the debtor stores inventory for processing and distribution, also assert that they are owed in the aggregate approximately $61,000 in storage and other charges. The debtor says that these owners may assert warehouseman’s liens, and that they have executed certain landlord waivers, in which each “acknowledges that the security interest of [Wells] in the Collateral is senior and superior to any claim or right in all or any portion thereof which Landlord now has or may have at any time hereafter acquire as so long as ALL storage charges have been paid in full.”

The debtor’s accounts receivable total approximately $2.7 million with approximately $125,000 more than 60 days past due.

Among the reasons for the bankruptcy filing is that after nearly doubling its employees and purchasing new specialized equipment to fulfill a contract with meal kit company Blue Apron, Blue Apron stopped purchasing from Mariner after going public in June 2017. Mariner also hired additional employees and incurred additional expenses in connection with negotiations over a “major” supply contract estimated to total approximately $38 million in annual purchases. However, negotiations with this “national retailer” terminated in the spring of 2019, ultimately resulting in defaults under the revolving and term loans.

The debtor is represented by Murphy & King as counsel. The case has been assigned to Judge Melvin S. Hoffman (case number 20-11870).

Background

Mariner Seafood was founded in 1998 and began by buying and selling seafood inventory from third party importers to domestic and Canadian seafood processors and food service distributors. The company later expanded to importing products from Asia to supply wholesale distributors and processing plants. Mariner thereafter expanded processing activity and sales to include foodservice distributors and began a scallop packing division. The company had revenue of $38.5 million in 2015, and after contracting with Blue Apron in 2015, Mariner’s sales increased to $70 million in 2016. After Blue Apron stopped purchasing from Mariner, Mariner transitioned to processing and selling consumer packaged goods directly to retailers.

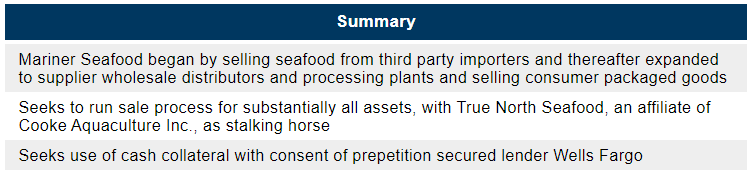

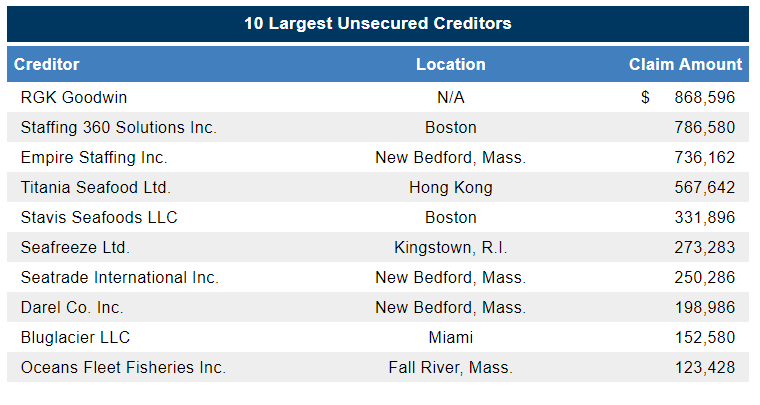

The debtors’ largest unsecured creditors are listed below:

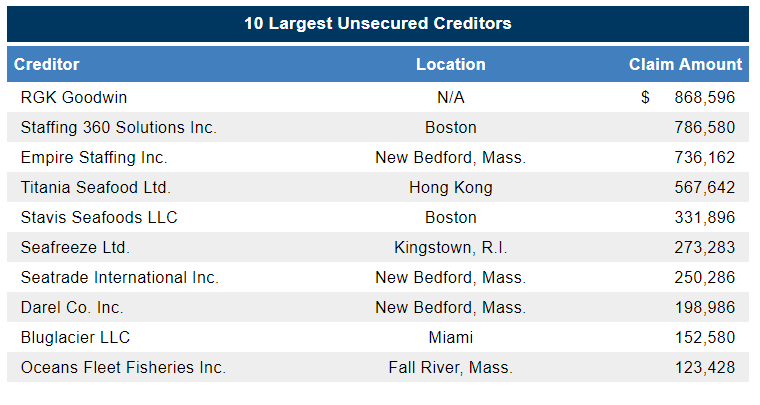

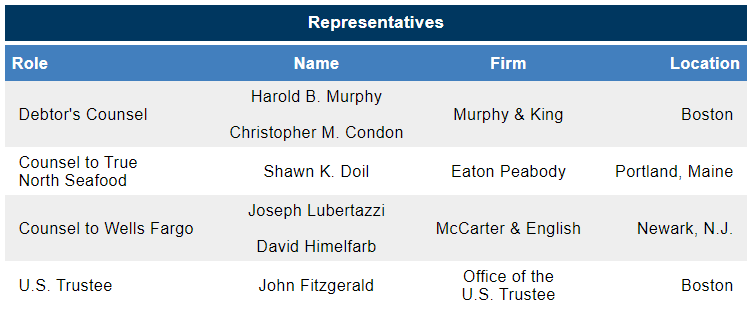

The case representatives are as follows:

Sale Motion

The debtor seeks approval of procedures to sell substantially all of its assets, with True North Seafood, Inc. as stalking horse for a purchase price of: (i) the value of the debtor’s accounts receivable up to $2.2 million, plus (ii) $150,000, plus (iii) $400,000 on account of the fees and expenses of the debtor’s professionals relating to the sale and the administration of the bankruptcy case plus (iv) certain employee benefit obligations. The sale timeline dates are left blank in the motion.

The debtor proposes a 2.5% breakup fee. Initial overbids must exceed True North’s bid by at least 5%.

The stalking horse APA provides for the assumption of the debtor’s obligations under its equipment term loan with Wells Fargo Equipment Finance, Inc. and is taking assignment of the debtor’s real estate leases and certain equipment leases and other designated executory contracts used in the operation the business, with True North responsible for any related cure costs. The debtors would be required to make regular payments under the term loan through the sale closing.

The debtor notes that as Wells is owed approximately $4.2 million under the revolving loan, and that even though “the purchase price under the APA is less than that amount, Wells has agreed to consent to the sale to the Buyer, release its liens on the Debtor’s assets with such liens attaching to the proceeds of the sale, and to carve out from the Debtor’s cash collateral and the proceeds of the sale, the amount of $400,000 to pay the fees and expenses of the Debtor’s professionals associated with the administration of this case and closing the sale to the Buyer.” Upon the sale closing, the debtor’s estate would receive $50,000 of the sale proceeds plus the amount by which the debtor’s accounts receivable under the APA are less than $2.2 million, with the buyer receiving the remaining cash. The estate would retain the $400,000 carve-out to pay allowed chapter 11 fees and expenses.

In the event that the auction results in an increase in the purchase price from the stalking horse bid, then any additional consideration would be paid to Wells less the carve out and less certain other costs and expenses incurred by the debtor or its estate as a result of any increase in such consideration, as agreed to by the buyer and Wells, or as determined by the Bankruptcy Court. If the amount to be paid to Wells from the sale proceeds totals less than $2.35 million, then the difference between such amount and $2.35 million would be paid to Wells by the debtor from cash.

The debtor’s founder and sole equityholder Flynn would be employed as regional director of sales and distribution (Northeast) after sale closing.

In support of the sale motion, the debtor submitted the affidavit of Jon Pratt, a managing director at Duff & Phelps. Pratt says he was originally retained by Mariner in January 2020 while at Tully & Holland, which contacted 46 potential strategic and financial acquirers in the U.S., Canada and other foreign countries. Of these parties, 34 reviewed the opportunity and passed after “high-level” discussion, eight executed confidentiality agreements, five parties subsequently declined “after reviewing the opportunity more closely,” and four parties were provided access to a data room and conducted management meetings, and two parties submitted indications of interest.

Cash Collateral Motion

The debtor seeks the use of cash collateral, with the consent of Wells Fargo Bank and Wells Fargo Equipment Finance, conditioned on a waiver of the estate’s right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and an acknowledgement of the extent, priority and validity of the Wells entities’ liens. The following entities may assert a lien on the cash collateral, the debtor says: Wells Fargo Bank and Wells Fargo Equipment Finance, along with owners of five cold storage facilities in which the debtor stores inventory. The debtor proposes as adequate protection replacement liens and financial reporting, as well as regular debt service payments under the Wells term loan through a sale closing.

The carveout for professional fees is $400,000.

The proposed budget is HERE. The debtor’s aggregate cash collateral increases from approximately $2.782 million (consisting of cash of $220,000 and receivables of $2.6 million) to $2.947 million as of Oct. 30 (consisting of $363,000 of cash and $2.6 million of receivables).

The lien challenge deadline for an official unsecured creditors’ committee is 60 days from appointment.

Other Motions

The debtor also filed various standard first day motions, including the following:

Voluntary Petition

20 Largest Unsecured Creditors

First Day Affidavit

Cash Collateral Motion

Sale Motion

First Day Hearing Notice

Mariner Seafood, LLC, a New Bedford, Mass.-based seafood business, filed for chapter 11 protection today in the Bankruptcy Court for the District of Massachusetts. Continue reading for the First Day by Reorg team's comprehensive case summary of the Mariner Seafood bankruptcy filing, and request a trial to follow thousands of other bankruptcy filings across the U.S.

The debtor seeks to run a sale process with True North Seafood, Inc., an affiliate of Cooke Aquaculture Inc., a multinational seafood processor and retailer headquartered in Canada, as stalking horse for a purchase price of the debtor’s accounts receivable up to $2.2 million, plus $150,000, plus $400,000 as a carve-out for professional fees plus certain employee benefit obligations. The debtor’s principal lender, Wells Fargo Bank, which is related to Wells Fargo Equipment Finance, consents to the sale, “notwithstanding that the purchase price for the assets is less than Wells asserts to be owed.” Pursuant to the APA, True North would also assume Mariner’s obligations under the company’s Wells Fargo prepetition term loan and take assignment of certain unexpired leases and executory contracts. The sale is conditioned on an Oct. 16 closing.

The first day hearing is scheduled for tomorrow, Wednesday, Sept. 16 at 11 a.m. ET.

The company reports $10 million to $50 million in both assets and liabilities. The company’s prepetition capital structure includes:

- Secured debt:

- Wells Fargo:

- Term loan: $550,000

- Revolving loan: $4.2 million

- Leases (Wells Fargo): $100,000

- Wells Fargo:

- Unsecured debt: $7.8 million (including $1.2 million owed to insiders)

- Equity: John Flynn is the founder and owner of 100% of the debtor’s equity.

The owners of five cold storage facilities in Massachusetts and Virginia, at which the debtor stores inventory for processing and distribution, also assert that they are owed in the aggregate approximately $61,000 in storage and other charges. The debtor says that these owners may assert warehouseman’s liens, and that they have executed certain landlord waivers, in which each “acknowledges that the security interest of [Wells] in the Collateral is senior and superior to any claim or right in all or any portion thereof which Landlord now has or may have at any time hereafter acquire as so long as ALL storage charges have been paid in full.”

The debtor’s accounts receivable total approximately $2.7 million with approximately $125,000 more than 60 days past due.

Among the reasons for the bankruptcy filing is that after nearly doubling its employees and purchasing new specialized equipment to fulfill a contract with meal kit company Blue Apron, Blue Apron stopped purchasing from Mariner after going public in June 2017. Mariner also hired additional employees and incurred additional expenses in connection with negotiations over a “major” supply contract estimated to total approximately $38 million in annual purchases. However, negotiations with this “national retailer” terminated in the spring of 2019, ultimately resulting in defaults under the revolving and term loans.

The debtor is represented by Murphy & King as counsel. The case has been assigned to Judge Melvin S. Hoffman (case number 20-11870).

Background

Mariner Seafood was founded in 1998 and began by buying and selling seafood inventory from third party importers to domestic and Canadian seafood processors and food service distributors. The company later expanded to importing products from Asia to supply wholesale distributors and processing plants. Mariner thereafter expanded processing activity and sales to include foodservice distributors and began a scallop packing division. The company had revenue of $38.5 million in 2015, and after contracting with Blue Apron in 2015, Mariner’s sales increased to $70 million in 2016. After Blue Apron stopped purchasing from Mariner, Mariner transitioned to processing and selling consumer packaged goods directly to retailers.

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

Sale Motion

The debtor seeks approval of procedures to sell substantially all of its assets, with True North Seafood, Inc. as stalking horse for a purchase price of: (i) the value of the debtor’s accounts receivable up to $2.2 million, plus (ii) $150,000, plus (iii) $400,000 on account of the fees and expenses of the debtor’s professionals relating to the sale and the administration of the bankruptcy case plus (iv) certain employee benefit obligations. The sale timeline dates are left blank in the motion.

The debtor proposes a 2.5% breakup fee. Initial overbids must exceed True North’s bid by at least 5%.

The stalking horse APA provides for the assumption of the debtor’s obligations under its equipment term loan with Wells Fargo Equipment Finance, Inc. and is taking assignment of the debtor’s real estate leases and certain equipment leases and other designated executory contracts used in the operation the business, with True North responsible for any related cure costs. The debtors would be required to make regular payments under the term loan through the sale closing.

The debtor notes that as Wells is owed approximately $4.2 million under the revolving loan, and that even though “the purchase price under the APA is less than that amount, Wells has agreed to consent to the sale to the Buyer, release its liens on the Debtor’s assets with such liens attaching to the proceeds of the sale, and to carve out from the Debtor’s cash collateral and the proceeds of the sale, the amount of $400,000 to pay the fees and expenses of the Debtor’s professionals associated with the administration of this case and closing the sale to the Buyer.” Upon the sale closing, the debtor’s estate would receive $50,000 of the sale proceeds plus the amount by which the debtor’s accounts receivable under the APA are less than $2.2 million, with the buyer receiving the remaining cash. The estate would retain the $400,000 carve-out to pay allowed chapter 11 fees and expenses.

In the event that the auction results in an increase in the purchase price from the stalking horse bid, then any additional consideration would be paid to Wells less the carve out and less certain other costs and expenses incurred by the debtor or its estate as a result of any increase in such consideration, as agreed to by the buyer and Wells, or as determined by the Bankruptcy Court. If the amount to be paid to Wells from the sale proceeds totals less than $2.35 million, then the difference between such amount and $2.35 million would be paid to Wells by the debtor from cash.

The debtor’s founder and sole equityholder Flynn would be employed as regional director of sales and distribution (Northeast) after sale closing.

In support of the sale motion, the debtor submitted the affidavit of Jon Pratt, a managing director at Duff & Phelps. Pratt says he was originally retained by Mariner in January 2020 while at Tully & Holland, which contacted 46 potential strategic and financial acquirers in the U.S., Canada and other foreign countries. Of these parties, 34 reviewed the opportunity and passed after “high-level” discussion, eight executed confidentiality agreements, five parties subsequently declined “after reviewing the opportunity more closely,” and four parties were provided access to a data room and conducted management meetings, and two parties submitted indications of interest.

Cash Collateral Motion

The debtor seeks the use of cash collateral, with the consent of Wells Fargo Bank and Wells Fargo Equipment Finance, conditioned on a waiver of the estate’s right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and an acknowledgement of the extent, priority and validity of the Wells entities’ liens. The following entities may assert a lien on the cash collateral, the debtor says: Wells Fargo Bank and Wells Fargo Equipment Finance, along with owners of five cold storage facilities in which the debtor stores inventory. The debtor proposes as adequate protection replacement liens and financial reporting, as well as regular debt service payments under the Wells term loan through a sale closing.

The carveout for professional fees is $400,000.

The proposed budget is HERE. The debtor’s aggregate cash collateral increases from approximately $2.782 million (consisting of cash of $220,000 and receivables of $2.6 million) to $2.947 million as of Oct. 30 (consisting of $363,000 of cash and $2.6 million of receivables).

The lien challenge deadline for an official unsecured creditors’ committee is 60 days from appointment.

Other Motions

The debtor also filed various standard first day motions, including the following:

- Motion to pay employee wages and benefits

- The debtor owes $22,000 in prepetition wages.

- Motion to use cash management system

- The company has a bank account with Wells Fargo Bank.

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.