Century 21 Department Stores LLC

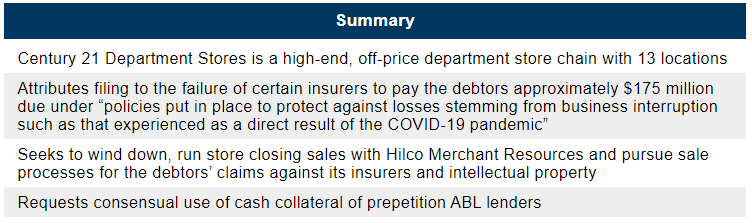

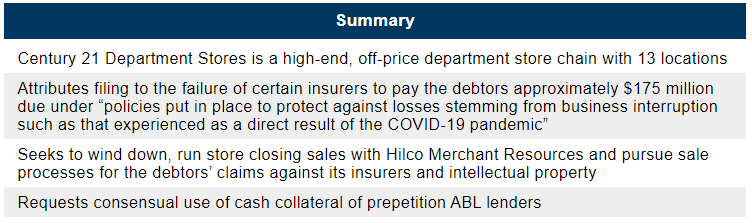

CASE SUMMARY: Century 21 Seeks to Wind Down Through Store Closing Sales, Blames Bankruptcy Filing on Insurers’ Failure to Honor $175 Million for ‘Business Interruption’ as a Result of Covid-19

Thu 09/10/2020 17:05 PM

Relevant Documents:

Voluntary Petition

First Day Declaration

Cash Collateral Motion

Store Closing Sales Motion

Press Release

First Day Hearing Agenda

Century 21 Department Stores, a New York-based high-end, off-price department store chain, filed for chapter 11 protection today in the Bankruptcy Court for the Southern District of New York, along with several affiliates. In a press release this morning the company announced its plans to wind down its retail operations through chapter 11 and conduct going out of business sales at its 13 stores across New York, New Jersey, Pennsylvania and Florida “after serving customers for nearly 60 years.” The company pins the decision to wind down on its insurance providers failing to pay the debtors approximately $175 million due under “policies put in place to protect against losses stemming from business interruption such as that experienced as a direct result of the COVID-19 pandemic.”

The company filed a state court lawsuit against Starr Surplus Lines Insurance Co. on July 8 in the Supreme Court of the State of New York that (i) alleges breach of the relevant insurance policies as a result of the insurers’ failure to compensate the debtors for their losses under the policies and (ii) seeks damages of over $175 million for the March - May 31 period and reserving rights to seek additional amounts for later time periods, “as their losses mount.” To-date, no answer has been filed by the insurance providers and no orders (substantive or otherwise) have been entered by the state court.

The debtors have determined that filing chapter 11, utilizing cash collateral with the consent of their secured lenders and pursuing the insurance action in an expedited fashion while also commencing an orderly liquidation of their assets is their “best available option.”

The debtors filed a motion to assume a consulting agreement with Hilco Merchant Resources to continue conducting store closing sales, which began on Sept. 3. The debtors say they anticipate that the closing sales will take three months to complete. “By moving expediently, the Debtors hope to maximize overall recovery for the estates while minimizing the Debtors’ liabilities,” the first day declaration says.

The cash collateral motion includes milestones with respect to the (i) sale of the debtors’ claims against their insurance providers for property damage, business interruption and other situations that would prevent the public from entering the debtors’ stores and (ii) with respect to the sale of intellectual property.

The first day hearing has been scheduled for today, Thursday, Sept. 10, at 5:30 p.m. ET.

The company reports $100 million to $500 million in both assets and liabilities. The company’s prepetition capital structure includes:

According to the list of the five largest secured claims, JPMorgan owns $27 million of the credit facility, Bank of America owns $18 million and Bank Hapoalim owns $11.2 million.

For “nearly three months,” ABL agent JPMorgan Chase Bank and other ABL parties have supported the debtors by lending on a discretionary basis despite certain prepetition defaults, funding the appointment of an independent director and appointment of a chief restructuring officer, the exploration of restructuring alternatives and the pursuit of claims against the insurers. Commencing in August, the debtors began evaluating an in-court liquidation in earnest and commenced negotiations with the ABL parties regarding consensual use of cash collateral. These efforts culminated in the ABL parties’ consent to the debtors’ use of cash collateral and provided flexibility to pursue an orderly liquidation of all assets.

The debtors say that the pandemic has had a “profound impact on the U.S. economy and, like almost all other retailers, has fundamentally derailed the Debtors’ business and accelerated liquidity constraints.” The company planned for this circumstance, the first day filings say, noting that, through careful insurance planning, the company obtained over $350 million in coverage to protect their businesses against “this very eventuality.” To-date, however, the debtors’ insurance providers have “not materially paid on the subject Insurance Policies.” Although Century 21’s losses are “clearly covered by the Insurance Policies, the insurance providers delayed in responding to their insureds’ claims, repeatedly requested irrelevant or duplicative materials and refused to make any meaningful payments.” By July 2020, it became clear that the insurers would not honor the majority of their obligations under the insurance policies, sparking the state court action.

Further, as a result of the Covid-19-related closures of their stores and inability to access insurance proceeds, the debtors have been in default of their ABL facility for several months. Without proceeds of the insurance policies available to them and with mounting losses due to sustained store closures and lower demand, the debtors determined that they needed significant new capital, “which proved unavailable to continue to effectively operate their business.” Prior to the pandemic, the debtors were planning to open three new brick-and-mortar locations, including a premier location at the American Dream Mall in New Jersey. As a result of retail industry headwinds, the debtors retained Moelis & Company prepetition in connection with a potential strategic transaction for the debtors. However, the recent economic impact of the pandemic, including the required closure in mid-March of all of Century 21 locations proved to be too much of a strain on the debtors’ business and any previously-contemplated transactions.

In June 2020, with the support of their secured lenders, the debtors retained Berkeley Research Group to provide financial advice to the debtors and facilitate discussions with certain of the debtors’ constituents. The debtors also asked their equity owners to consider infusing additional capital, but their equity owners ultimately declined to do so.

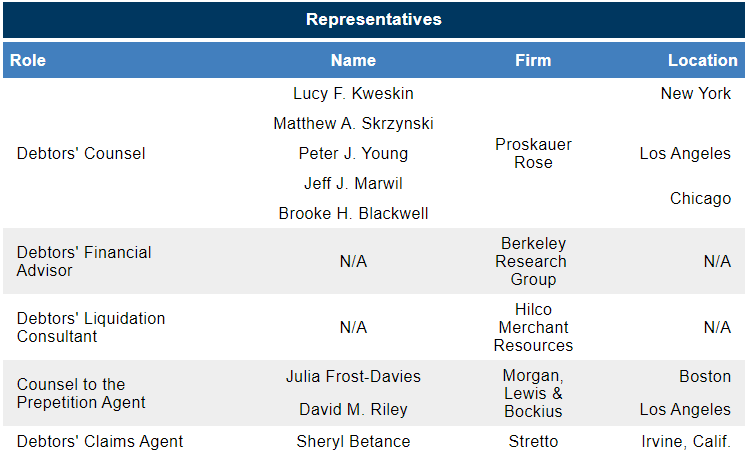

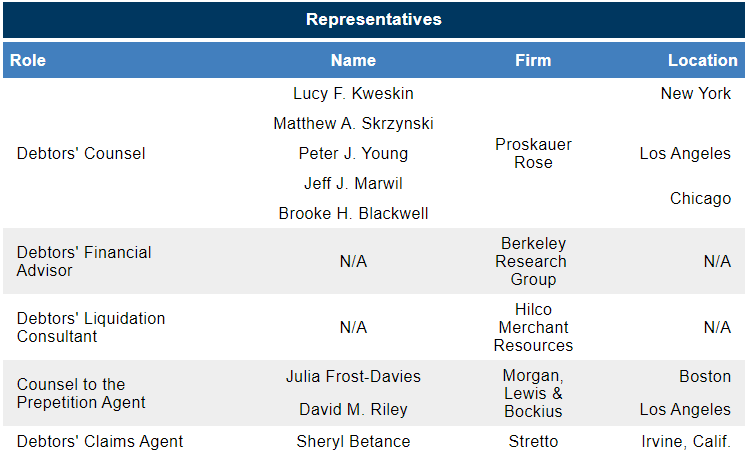

The debtors are represented by Proskauer Rose in New York as counsel and are working with Berkeley Research Group as financial advisor and Hilco Merchant Resources as liquidation consultant. Stretto is the claims agent. The case has been assigned to Judge Shelley C. Chapman (case no. 20-12097).

Background

Century 21 operates 13 retail stores across New York, New Jersey, Pennsylvania and Florida, along with an e-commerce platform. In fiscal year 2019, the company generated approximately $747 million of revenue.

The debtors have approximately 1,390 employees, of which approximately 1,205 are full-time. Approximately 985 employees (approximately 71% of the workforce) are represented by UFCW Local 888 pursuant to a collective bargaining agreement. With the pandemic forcing the closure of Century 21’s stores, almost all retail employees were furloughed, shortly followed by half of their corporate and support staff. As stores reopened, many employees returned to work, though employees who have salaries greater than $150,000 per year experienced 20% pay cuts beginning in July.

The company’s stores are stand-alone or located in shopping centers or traditional shopping malls. The debtors do not own any real estate but lease property for their retail space, distribution centers and two corporate locations. Approximately 23 of the leases are with third-party landlords, and approximately 17 of the leases are with certain non-debtor affiliates, including subsidiaries of Century 21, Inc. The company’s aggregate rental expenses total approximately $65 million per year.

The debtors historically maintained a supply chain of more than 1,400 vendors to ensure the uninterrupted flow of new merchandise to their brick-and-mortar locations and to their e-commerce customers. The debtors’ greatest expense has been its merchandise, on which they historically have spent approximately $400 million annually. The debtors say that their profitability has been highly dependent on maintaining strong relationships and favorable trade terms with key vendors, including many highly-regarded brands and their financing factors. The debtors do not manufacture any merchandise.

Due to the cessation of retail operations and insufficient liquidity, the debtors did not pay their rent in full for the months of April through August as they and their owners sought concessions from various landlords. During this time, the debtors also significantly curtailed payments to the majority of their vendors. As a result, several vendors held deliveries of merchandise and ultimately conditioned deliveries on cash in advance or provided the debtors with otherwise “unworkable” payment terms, the debtors say. As of the petition date, several of the debtors’ landlords have sent Century 21 default notices and threatened eviction, which, without the commencement of these chapter 11 cases, “undoubtedly would continue.”

Century 21’s corporate organizational structure is shown below:

The debtors’ largest unsecured creditors are listed below:

Cash Collateral Motion

The debtors request the consensual use of cash collateral of the ABL parties to fund working capital and pay their operating expenses, stressing that they need immediate access to the cash collateral to satisfy the day-to-day needs of their business operations and liquidation sales. The motion proposes payment of a $50,000 weekly consent fee to the ABL parties.

With respect to adequate protection, the debtors propose to provide the ABL parties with (i) replacement liens, (ii) superpriority administrative expense claims (iii) payment of the ABL parties’ professionals and certain other fees, (iv) payment of monthly interest owed under the ABL obligations at the applicable default rate, (v) financial reporting and (vi) the achievement of certain milestones. Commencing on Friday, Sept. 11, the motion also authorizes the ABL agent to transfer to the ABL agent 50% of all cash then on deposit in the debtors’ deposit accounts (after funding in full a pre-carve-out trigger reserve through such week and all other amounts set forth in the budget through such week, including any outstanding checks) in excess of $9 million, with such these excess proceeds to be applied in permanent reduction and repayment of the ABL obligations in accordance with the terms of the ABL lan documents and the interim cash collateral order. Any of these payments made on account of any ABL obligations would be in addition to scheduled paydowns of the ABL obligations set forth in the budget.

If the ABL agent and other ABL parties have not received payment in full on or before Sept. 11, then the debtors would repay all unpaid secured obligations that are or may come due and payable pursuant to the ABL loan documents, in each case on a daily basis from the net sale proceeds generated from any sales, dispositions or proceeds of any or all ABL collateral outside the ordinary course of the debtors’ business until all ABL prepetition obligations are paid in full; provided that proceeds from any sales or dispositions of ABL collateral with respect to all “going out of business” sales, “store closing sales” and all other “ordinary course of business” sales of inventory shall not be subject to such payments.

Upon the payment in cash to the ABL agent in the amount of all then outstanding ABL obligations, the cash collateral motion authorizes and direct the debtors to pay to the ABL agent, for the benefit of the ABL parties, $250,000 into a non-interest bearing account maintained at JPMorgan Chase Bank, N.A. to secure contingent indemnification, reimbursement or similar continuing obligations arising under or related to the ABL loan document.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carveout for professional fees is $500,000.

The proposed budget for the use of cash collateral is HERE.

The proposed cash collateral use is subject to the following milestones:

In addition, the cash collateral motion includes milestones with respect to the sale of the debtors’ claims against their insurance providers for property damage, business interruption and other situations that would prevent the public from entering the debtors’ stores:

The motion also includes milestones with respect to the sale of intellectual property:

Store Closing Sales Motion

The debtors seek to assume the store closing sales consulting agreement with Hilco Merchant Resources and Gordon Brothers Retail Partners and to continue conducting store closing sales at each of its 13 store locations and, “if requested by the Debtors,” through Century 21’s e-commerce platform. The motion also requests (i) approval of proposed dispute resolution procedures to resolve any disputes with governmental units regarding certain applicable non-bankruptcy laws that regulate liquidation and similar-themed sales, (ii) authority to provide customary bonuses to non-insider employees who remain employed for the duration of the applicable closing sales and (iii) approval of the debtors’ strategic plan in connection with the closure of each of their retail locations.

The debtors negotiated the terms and conditions of the store closing agreement in good faith and at arms’ length and entered into the agreement on Sept. 1. “In order to avoid, among other potential negative outcomes, a disorganized ‘self-liquidation’ scenario, i.e., a scenario in which more desirable items sell faster than items with a slower turnover, the Closing Sales began on September 3, 2020,” the motion says. The debtors say that they anticipate moving "expediently so to maximize overall recovery for the estates while minimizing the Debtors’ liabilities, with each of the Closing Sales to be completed as soon as possible and, in all cases, in no longer than three months.”

The proposed sale termination date is Nov. 30. To the extent that closing sales are delayed or interrupted by laws or regulations implemented on behalf of Covid-19 concerns, (i) the sale termination date as to the affected store would be extended by the time period for which that sale was delayed or interrupted, and/or (ii) the debtors and consultant may mutually agree on the transfer of the merchandise in the affected closing store to another closing store.

The agreement proposes a weekly merchandise fee paid to the consultants equal to 1% of gross proceeds (the tier 1 fee). In addition, the consultant may also earn a tier 2 fee and tier 3 fee equal to the aggregate sum of the percentages shown in the table below based on the following thresholds of net recovery percentage:

On September 4, the debtors provided an advance payment in the amount of $525,000 for costs and expenses to be held by the consultants and applied to any unpaid obligation owing by the debtors under the agreement.

The motion proposes that the consultants would pay the debtors an amount equal to 5% of the gross proceeds from the sale of additional goods supplemented by the consultants in an aggregate amount of not less than $1 million.

The total aggregate cost of the proposed store closing bonus plan would not be more than $1,013,000, assuming 100% of the eligible employees remain employed through the duration of the closing sales.

The locations for which store closing sales are proposed to be conducted are listed below:

Other Motions

The debtors also filed various standard first day motions, including the following:

Voluntary Petition

First Day Declaration

Cash Collateral Motion

Store Closing Sales Motion

Press Release

First Day Hearing Agenda

Century 21 Department Stores, a New York-based high-end, off-price department store chain, filed for chapter 11 protection today in the Bankruptcy Court for the Southern District of New York, along with several affiliates. In a press release this morning the company announced its plans to wind down its retail operations through chapter 11 and conduct going out of business sales at its 13 stores across New York, New Jersey, Pennsylvania and Florida “after serving customers for nearly 60 years.” The company pins the decision to wind down on its insurance providers failing to pay the debtors approximately $175 million due under “policies put in place to protect against losses stemming from business interruption such as that experienced as a direct result of the COVID-19 pandemic.”

The company filed a state court lawsuit against Starr Surplus Lines Insurance Co. on July 8 in the Supreme Court of the State of New York that (i) alleges breach of the relevant insurance policies as a result of the insurers’ failure to compensate the debtors for their losses under the policies and (ii) seeks damages of over $175 million for the March - May 31 period and reserving rights to seek additional amounts for later time periods, “as their losses mount.” To-date, no answer has been filed by the insurance providers and no orders (substantive or otherwise) have been entered by the state court.

The debtors have determined that filing chapter 11, utilizing cash collateral with the consent of their secured lenders and pursuing the insurance action in an expedited fashion while also commencing an orderly liquidation of their assets is their “best available option.”

The debtors filed a motion to assume a consulting agreement with Hilco Merchant Resources to continue conducting store closing sales, which began on Sept. 3. The debtors say they anticipate that the closing sales will take three months to complete. “By moving expediently, the Debtors hope to maximize overall recovery for the estates while minimizing the Debtors’ liabilities,” the first day declaration says.

The cash collateral motion includes milestones with respect to the (i) sale of the debtors’ claims against their insurance providers for property damage, business interruption and other situations that would prevent the public from entering the debtors’ stores and (ii) with respect to the sale of intellectual property.

The first day hearing has been scheduled for today, Thursday, Sept. 10, at 5:30 p.m. ET.

The company reports $100 million to $500 million in both assets and liabilities. The company’s prepetition capital structure includes:

- Secured debt:

- ABL facility: $56.3 million in principal, inclusive of letters of credit

- Unsecured debt:

- General unsecured creditors: “in excess of” $100 million

According to the list of the five largest secured claims, JPMorgan owns $27 million of the credit facility, Bank of America owns $18 million and Bank Hapoalim owns $11.2 million.

For “nearly three months,” ABL agent JPMorgan Chase Bank and other ABL parties have supported the debtors by lending on a discretionary basis despite certain prepetition defaults, funding the appointment of an independent director and appointment of a chief restructuring officer, the exploration of restructuring alternatives and the pursuit of claims against the insurers. Commencing in August, the debtors began evaluating an in-court liquidation in earnest and commenced negotiations with the ABL parties regarding consensual use of cash collateral. These efforts culminated in the ABL parties’ consent to the debtors’ use of cash collateral and provided flexibility to pursue an orderly liquidation of all assets.

The debtors say that the pandemic has had a “profound impact on the U.S. economy and, like almost all other retailers, has fundamentally derailed the Debtors’ business and accelerated liquidity constraints.” The company planned for this circumstance, the first day filings say, noting that, through careful insurance planning, the company obtained over $350 million in coverage to protect their businesses against “this very eventuality.” To-date, however, the debtors’ insurance providers have “not materially paid on the subject Insurance Policies.” Although Century 21’s losses are “clearly covered by the Insurance Policies, the insurance providers delayed in responding to their insureds’ claims, repeatedly requested irrelevant or duplicative materials and refused to make any meaningful payments.” By July 2020, it became clear that the insurers would not honor the majority of their obligations under the insurance policies, sparking the state court action.

Further, as a result of the Covid-19-related closures of their stores and inability to access insurance proceeds, the debtors have been in default of their ABL facility for several months. Without proceeds of the insurance policies available to them and with mounting losses due to sustained store closures and lower demand, the debtors determined that they needed significant new capital, “which proved unavailable to continue to effectively operate their business.” Prior to the pandemic, the debtors were planning to open three new brick-and-mortar locations, including a premier location at the American Dream Mall in New Jersey. As a result of retail industry headwinds, the debtors retained Moelis & Company prepetition in connection with a potential strategic transaction for the debtors. However, the recent economic impact of the pandemic, including the required closure in mid-March of all of Century 21 locations proved to be too much of a strain on the debtors’ business and any previously-contemplated transactions.

In June 2020, with the support of their secured lenders, the debtors retained Berkeley Research Group to provide financial advice to the debtors and facilitate discussions with certain of the debtors’ constituents. The debtors also asked their equity owners to consider infusing additional capital, but their equity owners ultimately declined to do so.

The debtors are represented by Proskauer Rose in New York as counsel and are working with Berkeley Research Group as financial advisor and Hilco Merchant Resources as liquidation consultant. Stretto is the claims agent. The case has been assigned to Judge Shelley C. Chapman (case no. 20-12097).

Background

Century 21 operates 13 retail stores across New York, New Jersey, Pennsylvania and Florida, along with an e-commerce platform. In fiscal year 2019, the company generated approximately $747 million of revenue.

The debtors have approximately 1,390 employees, of which approximately 1,205 are full-time. Approximately 985 employees (approximately 71% of the workforce) are represented by UFCW Local 888 pursuant to a collective bargaining agreement. With the pandemic forcing the closure of Century 21’s stores, almost all retail employees were furloughed, shortly followed by half of their corporate and support staff. As stores reopened, many employees returned to work, though employees who have salaries greater than $150,000 per year experienced 20% pay cuts beginning in July.

The company’s stores are stand-alone or located in shopping centers or traditional shopping malls. The debtors do not own any real estate but lease property for their retail space, distribution centers and two corporate locations. Approximately 23 of the leases are with third-party landlords, and approximately 17 of the leases are with certain non-debtor affiliates, including subsidiaries of Century 21, Inc. The company’s aggregate rental expenses total approximately $65 million per year.

The debtors historically maintained a supply chain of more than 1,400 vendors to ensure the uninterrupted flow of new merchandise to their brick-and-mortar locations and to their e-commerce customers. The debtors’ greatest expense has been its merchandise, on which they historically have spent approximately $400 million annually. The debtors say that their profitability has been highly dependent on maintaining strong relationships and favorable trade terms with key vendors, including many highly-regarded brands and their financing factors. The debtors do not manufacture any merchandise.

Due to the cessation of retail operations and insufficient liquidity, the debtors did not pay their rent in full for the months of April through August as they and their owners sought concessions from various landlords. During this time, the debtors also significantly curtailed payments to the majority of their vendors. As a result, several vendors held deliveries of merchandise and ultimately conditioned deliveries on cash in advance or provided the debtors with otherwise “unworkable” payment terms, the debtors say. As of the petition date, several of the debtors’ landlords have sent Century 21 default notices and threatened eviction, which, without the commencement of these chapter 11 cases, “undoubtedly would continue.”

Century 21’s corporate organizational structure is shown below:

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

Cash Collateral Motion

The debtors request the consensual use of cash collateral of the ABL parties to fund working capital and pay their operating expenses, stressing that they need immediate access to the cash collateral to satisfy the day-to-day needs of their business operations and liquidation sales. The motion proposes payment of a $50,000 weekly consent fee to the ABL parties.

With respect to adequate protection, the debtors propose to provide the ABL parties with (i) replacement liens, (ii) superpriority administrative expense claims (iii) payment of the ABL parties’ professionals and certain other fees, (iv) payment of monthly interest owed under the ABL obligations at the applicable default rate, (v) financial reporting and (vi) the achievement of certain milestones. Commencing on Friday, Sept. 11, the motion also authorizes the ABL agent to transfer to the ABL agent 50% of all cash then on deposit in the debtors’ deposit accounts (after funding in full a pre-carve-out trigger reserve through such week and all other amounts set forth in the budget through such week, including any outstanding checks) in excess of $9 million, with such these excess proceeds to be applied in permanent reduction and repayment of the ABL obligations in accordance with the terms of the ABL lan documents and the interim cash collateral order. Any of these payments made on account of any ABL obligations would be in addition to scheduled paydowns of the ABL obligations set forth in the budget.

If the ABL agent and other ABL parties have not received payment in full on or before Sept. 11, then the debtors would repay all unpaid secured obligations that are or may come due and payable pursuant to the ABL loan documents, in each case on a daily basis from the net sale proceeds generated from any sales, dispositions or proceeds of any or all ABL collateral outside the ordinary course of the debtors’ business until all ABL prepetition obligations are paid in full; provided that proceeds from any sales or dispositions of ABL collateral with respect to all “going out of business” sales, “store closing sales” and all other “ordinary course of business” sales of inventory shall not be subject to such payments.

Upon the payment in cash to the ABL agent in the amount of all then outstanding ABL obligations, the cash collateral motion authorizes and direct the debtors to pay to the ABL agent, for the benefit of the ABL parties, $250,000 into a non-interest bearing account maintained at JPMorgan Chase Bank, N.A. to secure contingent indemnification, reimbursement or similar continuing obligations arising under or related to the ABL loan document.

In addition, the debtors propose a waiver of the estates’ right to seek to surcharge its collateral pursuant to Bankruptcy Code section 506(c) and the “equities of the case” exception under section 552(b).

The carveout for professional fees is $500,000.

The proposed budget for the use of cash collateral is HERE.

The proposed cash collateral use is subject to the following milestones:

- Interim orders with respect to the cash collateral, cash management and store closing sales motions: within three business days of the petition date

- Store closing sales commencement: within five days of the petition date

- Final orders with respect to the cash collateral, cash management and store closing sales motions: within 30 days of the petition date

- Payment in full of ABL obligations: within 90 days of the petition date

In addition, the cash collateral motion includes milestones with respect to the sale of the debtors’ claims against their insurance providers for property damage, business interruption and other situations that would prevent the public from entering the debtors’ stores:

- Bid procedures motion: filed within 21 days of the petition date

- Bid deadline: within 50 days of the petition date

- Auction deadline: within 70 days of the petition date

- Asset purchase agreement: entered into with 72 days of the petition date

- Insurance claims sale order: entered within 82 days of the petition date

- Insurance claims APA consummation: within 90 days of the petition date

The motion also includes milestones with respect to the sale of intellectual property:

- Bid procedures motion: filed within 21 days of the petition date

- Appraisal deadline: obtained within 30 days of the petition date

- Bid deadline: within 50 days of the petition date

- Auction deadline: within 70 days of the petition date

- Asset purchase agreement: entered into within 72 days of the petition date

- Intellectual property sale order: entered within 82 days of the petition date

- Intellectual property APA sale consummation: within 90 days of the petition date

Store Closing Sales Motion

The debtors seek to assume the store closing sales consulting agreement with Hilco Merchant Resources and Gordon Brothers Retail Partners and to continue conducting store closing sales at each of its 13 store locations and, “if requested by the Debtors,” through Century 21’s e-commerce platform. The motion also requests (i) approval of proposed dispute resolution procedures to resolve any disputes with governmental units regarding certain applicable non-bankruptcy laws that regulate liquidation and similar-themed sales, (ii) authority to provide customary bonuses to non-insider employees who remain employed for the duration of the applicable closing sales and (iii) approval of the debtors’ strategic plan in connection with the closure of each of their retail locations.

The debtors negotiated the terms and conditions of the store closing agreement in good faith and at arms’ length and entered into the agreement on Sept. 1. “In order to avoid, among other potential negative outcomes, a disorganized ‘self-liquidation’ scenario, i.e., a scenario in which more desirable items sell faster than items with a slower turnover, the Closing Sales began on September 3, 2020,” the motion says. The debtors say that they anticipate moving "expediently so to maximize overall recovery for the estates while minimizing the Debtors’ liabilities, with each of the Closing Sales to be completed as soon as possible and, in all cases, in no longer than three months.”

The proposed sale termination date is Nov. 30. To the extent that closing sales are delayed or interrupted by laws or regulations implemented on behalf of Covid-19 concerns, (i) the sale termination date as to the affected store would be extended by the time period for which that sale was delayed or interrupted, and/or (ii) the debtors and consultant may mutually agree on the transfer of the merchandise in the affected closing store to another closing store.

The agreement proposes a weekly merchandise fee paid to the consultants equal to 1% of gross proceeds (the tier 1 fee). In addition, the consultant may also earn a tier 2 fee and tier 3 fee equal to the aggregate sum of the percentages shown in the table below based on the following thresholds of net recovery percentage:

On September 4, the debtors provided an advance payment in the amount of $525,000 for costs and expenses to be held by the consultants and applied to any unpaid obligation owing by the debtors under the agreement.

The motion proposes that the consultants would pay the debtors an amount equal to 5% of the gross proceeds from the sale of additional goods supplemented by the consultants in an aggregate amount of not less than $1 million.

The total aggregate cost of the proposed store closing bonus plan would not be more than $1,013,000, assuming 100% of the eligible employees remain employed through the duration of the closing sales.

The locations for which store closing sales are proposed to be conducted are listed below:

Other Motions

The debtors also filed various standard first day motions, including the following:

- Motion for joint administration

- The cases will be jointly administered under case no. 20-12097.

- Motion to pay employee wages and benefits

- The debtors’ employee compensation obligations are summarized below:

- Motion to use cash management system

- The company has bank accounts with JPMorgan Chase Bank.

- Motion to maintain insurance programs

- Motion to pay taxes and fees

- The debtors owe approximately $1.3 million in sales and use taxes, of which $1.1 million will become due and payable within 21 days of the petition date.

- Motion to provide utilities with adequate assurance

- Motion to file consolidated creditors lists

- Motion to extend the schedules/statements filing deadline to Oct. 20

- Application to appoint Stretto as claims agent

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.