Advisor Fees – TMA / Credit Cloud

Reorg tracks nearly every aspect of medium and large sized chapter 11 bankruptcies, from our editorial content covering case developments in real time to our robust data offerings tracking important case details over time. In particular, our Advisor Fee data set, found exclusively on Credit Cloud, captures an enormous amount of data on advisor engagements and fees.

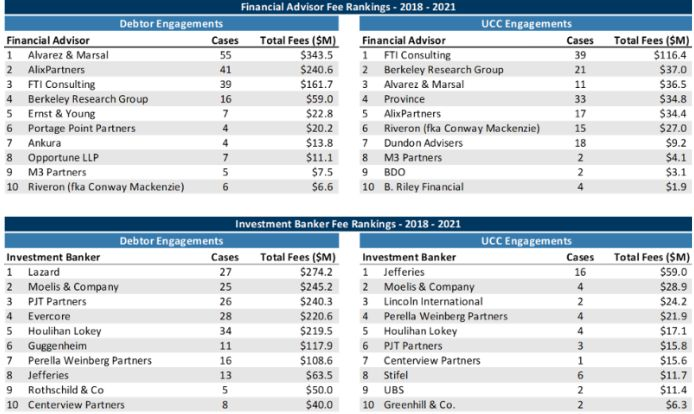

In this story we aggregate and share some of our advisor fee data for the first time, highlighting trends in financial advisor and investment banker engagements in medium to large chapter 11 cases (generally $100 million in liabilities or more). Specifically, the data captures court-approved fees earned for debtor and UCC-side investment bankers and financial advisors across Reorg’s middle market and core credit universe for chapter 11s filed between 2018 and 2021 where final fee applications have been filed and approved.

Across this data set of medium and large cases, the tables below show top earners from 2018 through 2021, ranked by aggregate final fees, for both debtor and official committee of unsecured creditor engagements. The results are broken out between financial advisors and investment bankers:

As would be expected, UCC engagements – while lucrative – usually involve lower aggregate fee amounts than debtor engagements. UCC engagements are also more centralized in top firms: Jefferies on the investment banking side and FTI on the financial advisor side. The tables above also show the amount of engagements won by each listed firm. While generally correlative, the number of engagements won by a firm does not always equate to the firm’s position in our ranking of aggregate fees. This is because the amount of fees earned can vary tremendously depending on the nature and length of a particular case

Read more.

Request a Trial.