Denbury Resources Inc.

Denbury Resources Bankruptcy Filing Case Summary & Prepackaged Plan

Fri 07/31/2020 07:52 AM

Relevant Documents:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Disclosure Statement

Plan of Reorganization

8-K

The above Related Documents link to content that is only available to current Americas Core Credit by Reorg clients and trialists. Please request access to view the documents.

As expected, Denbury Resources Inc., a Plano, Texas-based hydrocarbon exploration company, and several affiliates filed petitions on Thursday evening, reporting between $1 and $10 billion in both assets and liabilities as of July 30. The case has been assigned to Judge David Jones (case No. 20-33801). Continue reading for the Americas Core Credit by Reorg team's analysis of the company's bankruptcy filing.

The debtors are pursuing a prepackaged plan pursuant to a restructuring support agreement which according to the disclosure statement is supported by holders of 100% of loans outstanding under the secured revolver, approximately 67.2% of the second lien notes and 70.8% of convertible notes. Key terms of the plan include:

The company’s prepetition capital structure is as follows:

The pipeline lease is with Genesis NEJD Pipeline LLC, as lessor. The pipeline lease is guaranteed by Denbury and secured by (i) the NEJD Pipeline, (ii) all proceeds from the sale of the NEJD Pipeline and (iii) all rents, income or related fees for transportation of CO2 or any other substance through the NEJD Pipeline.

As of July 30, the debtors also have derivative contracts which represent a net asset of approximately $40 million on a mark-to-market basis. The debtors seek authorization to maintain their prepetition hedge contracts and enter into postpetition hedges in the ordinary course of business.

The first day hearing has been scheduled for today, Friday, July 31 at 8:30 a.m. ET. The debtors propose the following confirmation schedule, including a combined DS and confirmation hearing on Sept. 3:

The company attributes the bankruptcy filing to “prolonged market decline and industry- specific challenges.” According to the first day declaration of CEO Chris Kendall, the company had avoided chapter 11 bankruptcy during the 2015-2016 downturn in oil prices by “aggressively” undertaking a “variety of liability management efforts, including reducing debt, raising capital, optimizing operations and reducing expenses.” Although it ended 2019 with zero drawn on its revolver and entered 2020 with cash flow positive operations, the “one-two punch” in March 2018 of the Covid-19 pandemic and the Russia/OPEC price war caused prices to plummet. As a result, Kendall states, “Denbury came to the conclusion that incremental liquidity management strategies alone would not suffice and that a comprehensive balance sheet restructuring was required to enable the Company to endure over the long term.”

An organization chart is as follows:

The petition lists the following funds and entities as owners of 5% or more of the voting securities of the debtor:

The debtors are represented by Kirkland & Ellis LLP and Jackson Walker LLP as co-counsel, Evercore as financial advisor and Alvarez & Marsal as restructuring advisor. KPMG and PricewaterhouseCoopers are tax advisors to the debtors. Epiq is claims agent. According to the RSA, the second lien ad hoc committee is represented by Paul Weiss as legal advisor and PJT as investment banker. The convertible notes ad hoc group is represented by Akin Gump, and consenting RBL lenders are represented by Vinson & Elkins as counsel and Opportune as financial advisor.

Background

Denbury, initially a Canadian company, moved its corporate domicile to the U.S. in 1999 as a Delaware corporation. Denbury Offshore LLC, a Delaware limited liability company, became the primary operating entity in December 2003 and today holds the majority of the debtors’ assets and employees, according to CEO Kendall’s first day declaration. Its operations are focused on the development of oil fields in regions in the U.S. - the Rocky Mountains and the Gulf Coast. Kendall’s declaration states that Denbury’s oil and gas assets are primarily “mature, liquids-rich oil fields,” consisting of approximately 2,956 gross (2,197 net) producing wells, with 951,711 gross (510,602 net) total acres under lease. As of Dec. 31, 2019, the debtors had estimated proved developed reserves of approximately 206.9 MMboe of oil and condensate, natural gas and NGLs (based on SEC parameters). In 2019, Kendall states, the debtors’ total production was 21,248 Mboe and adjusted EBITDAX was $607 million. A map illustrating Denbury’s assets is below:

Kendall states that the debtors’ primary focus is on CO2-enhanced oil recovery (CO2 EOR), which is an “efficient means of tertiary recovery that can result in the recovery of crude oil volumes rivaling primary and secondary recovery, and which generates the majority of the Debtors’ oil production revenue.” CO2 enhanced oil recovery, Kendall explains, “involves injecting CO2 into underground rock formations to act somewhat like a solvent for oil, removing it from the oil-bearing formation as the CO2 travels through the reservoir rock. This process can recover, on average, an additional 10% to 20% of the original oil in place.” The debtors’ properties that use EOR include interests in 14 Gulf Coast fields and three in the Rocky Mountains, including the development of a new CO2 flood at the Cedar Creek Anticline oilfield, which the debtors anticipate could be ready for injections in 2023. The debtors’ vision, Kendall states, “is to be recognized as the world leader in CO2 Enhanced Oil Recovery.”

In the wake of the oil price collapse that began in late 2014, the debtors, beginning in 2016, “completed a number of deleveraging transactions to manage their liabilities in a sustained low oil price environment, issuing $450 million of new notes to facilitate an RBL extension, and conducting numerous open-market repurchase transactions to reduce leverage and extend runway,” according to Kendall, with eight “significant’ transactions in 2018 and 2019, as depicted below:

The debtors intended to continue such liability management and liquidity enhancement efforts through 2020 to further right-size their capital structure, Kendall states: “Indeed, in late 2019 and early 2020, the Company and its legal and financial advisors were exploring several potential opportunities to address the Company’s balance sheet out of court.” However, crude oil prices plunged in the wake of the Covid-19 pandemic and the price war between OPEC nations and Russia, with West Texas intermediate on April 20 falling more than 300% to below zero for the first time in his history. While oil prices have “partially” rebounded from these record lows and are “hovering” around $41/bbl, this level is still some 30% below average oil prices for the preceding 24 months, Kendall states. These low oil prices and volatility are likely to continue over the near and long term, he states, noting that an alliance of OPEC nations led by Saudi Arabia have agreed to increase oil production starting in August.

The debtors significantly cut planned 2020 capex in March and in May implemented a reduction in force, including furloughing certain employees for several months. However, Kendall states, “the Company’s leverage remains elevated and the Debtors face a substantial maturity wall in 2021, with the need to address approximately $636 million in maturities for certain Second Lien Notes and Senior Subordinated Notes. The yields on the Company’s notes indicate that a regular-way refinancing is unlikely without dramatic improvements in oil prices. If current market conditions persist, the Debtors will not be able to continue to service their $165 million in aggregate interest payments due annually under the Company’s notes.”

In March, Kendall states, “recognizing the need for a long term solution,” the debtors directed their advisors Kirkland & Ellis and Evercore to explore strategic alternatives that included a comprehensive restructuring, and in May they retained Alvarez & Marsal as restructuring advisor.

Included in cleansing materials filed on July 29, Denbury provides the following projections based on the following commodity price curves:

The company estimates EBITDAX, using strip prices, to decline to $231 million in 2021 and then increasing to $249 million by 2024. Additionally, because of slowly increasing capital spending to $188 million by 2023, unlevered free cash flow is projected to fall each year until reaching $49 million in 2023.

Under the higher Bloomberg consensus price scenario in which oil prices reach $50 by 2022 and rise to $60.75 by 2024, Denbury accelerates capital spending to $331 million by 2022. Denbury states that the Bloomberg case assumes that development of its CCA CO2 pipeline starts in March 2022. Denbury says that its Cedar Creek Anticline development would require development capital of $150 million and a $150 million CO2 pipeline.

The company shows its reserves summary under strip pricing with a PV-10 of $1.15 billion and a PV-15 of $966 million. Under the Bloomberg case, Denbury’s PV-10 is $2.1 billion, and its PV-15 is $1.7 billion.

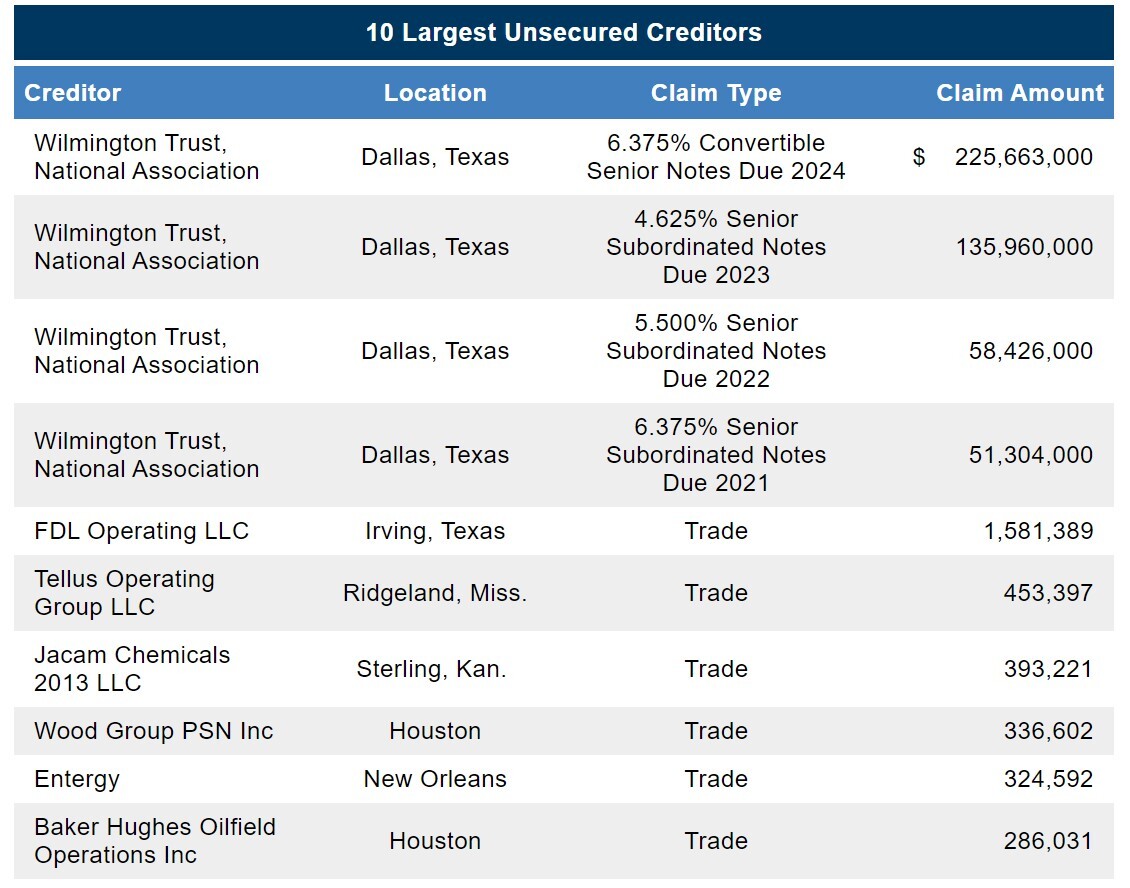

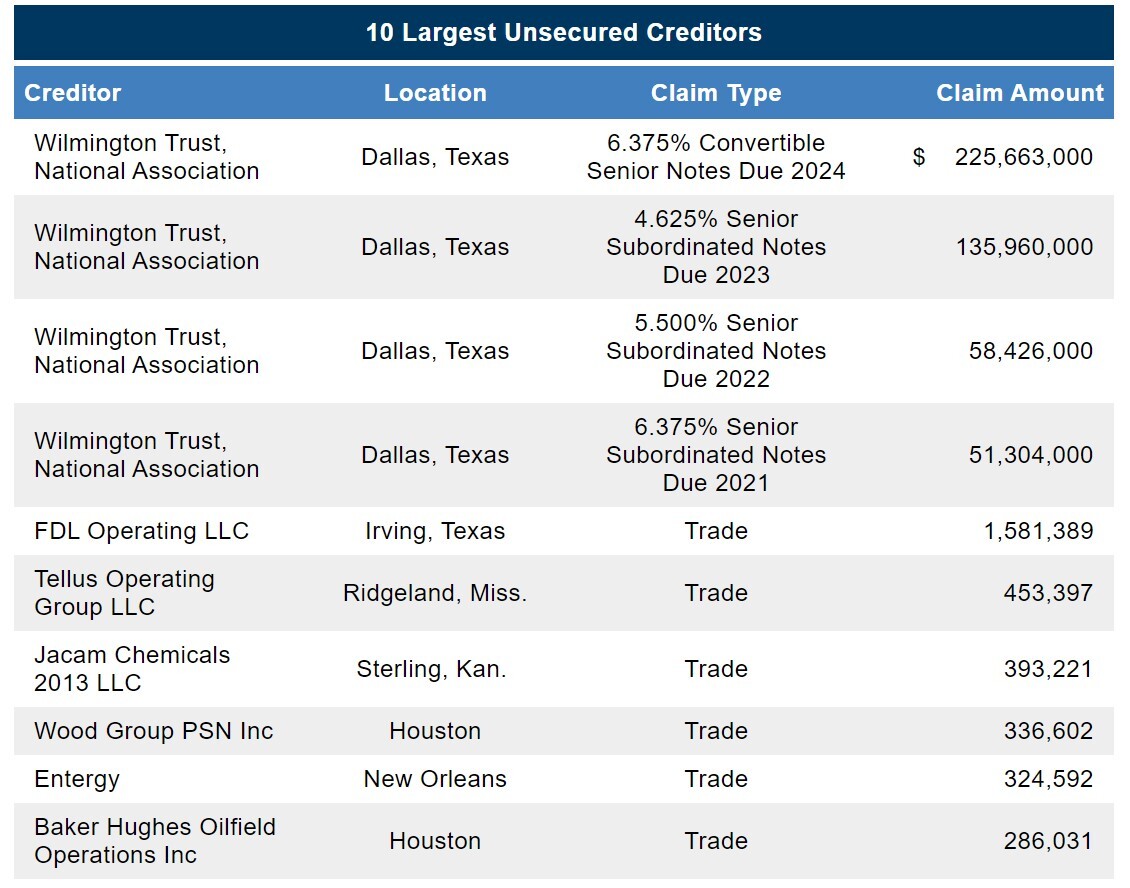

The debtors’ largest unsecured creditors are listed below:

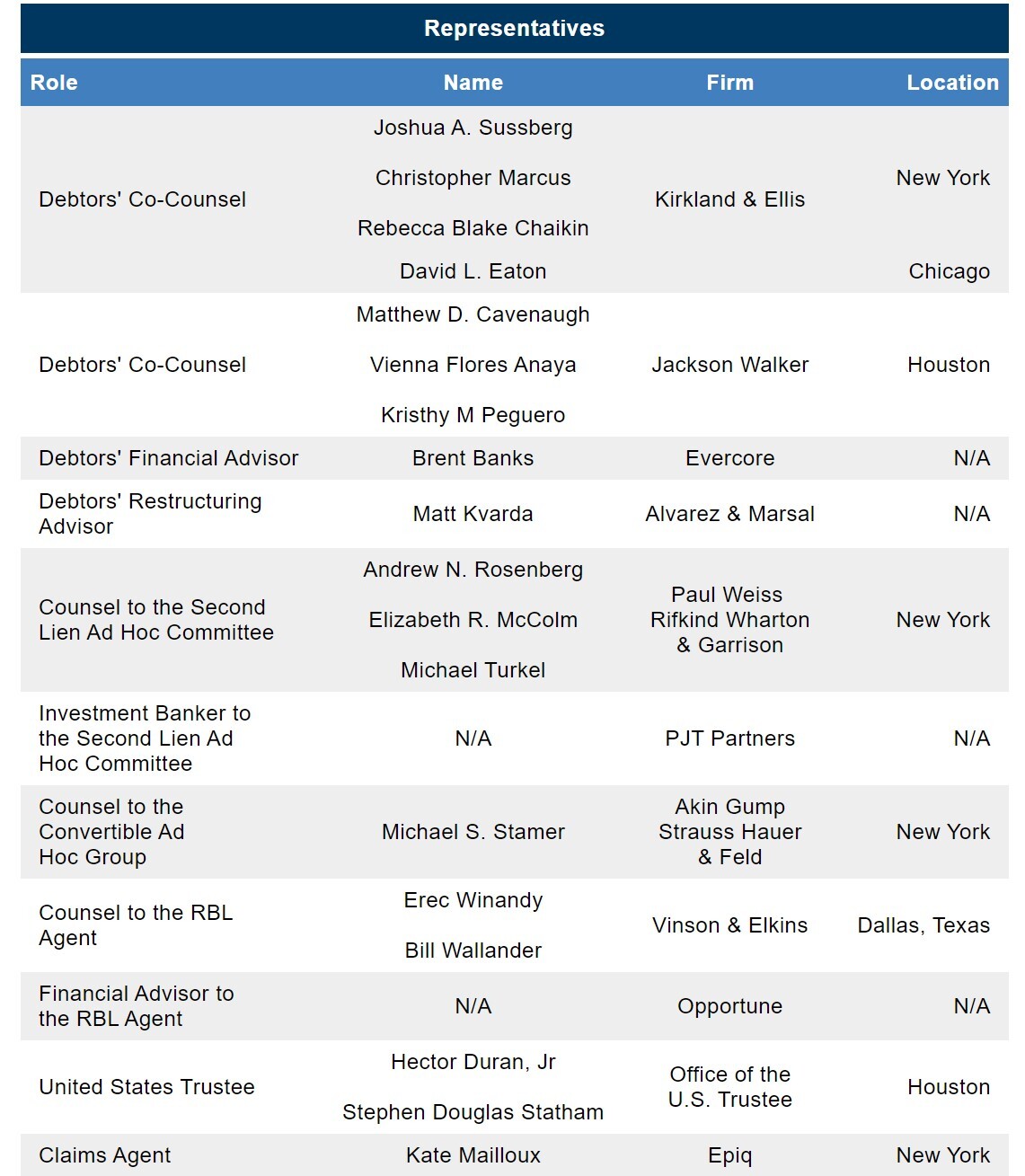

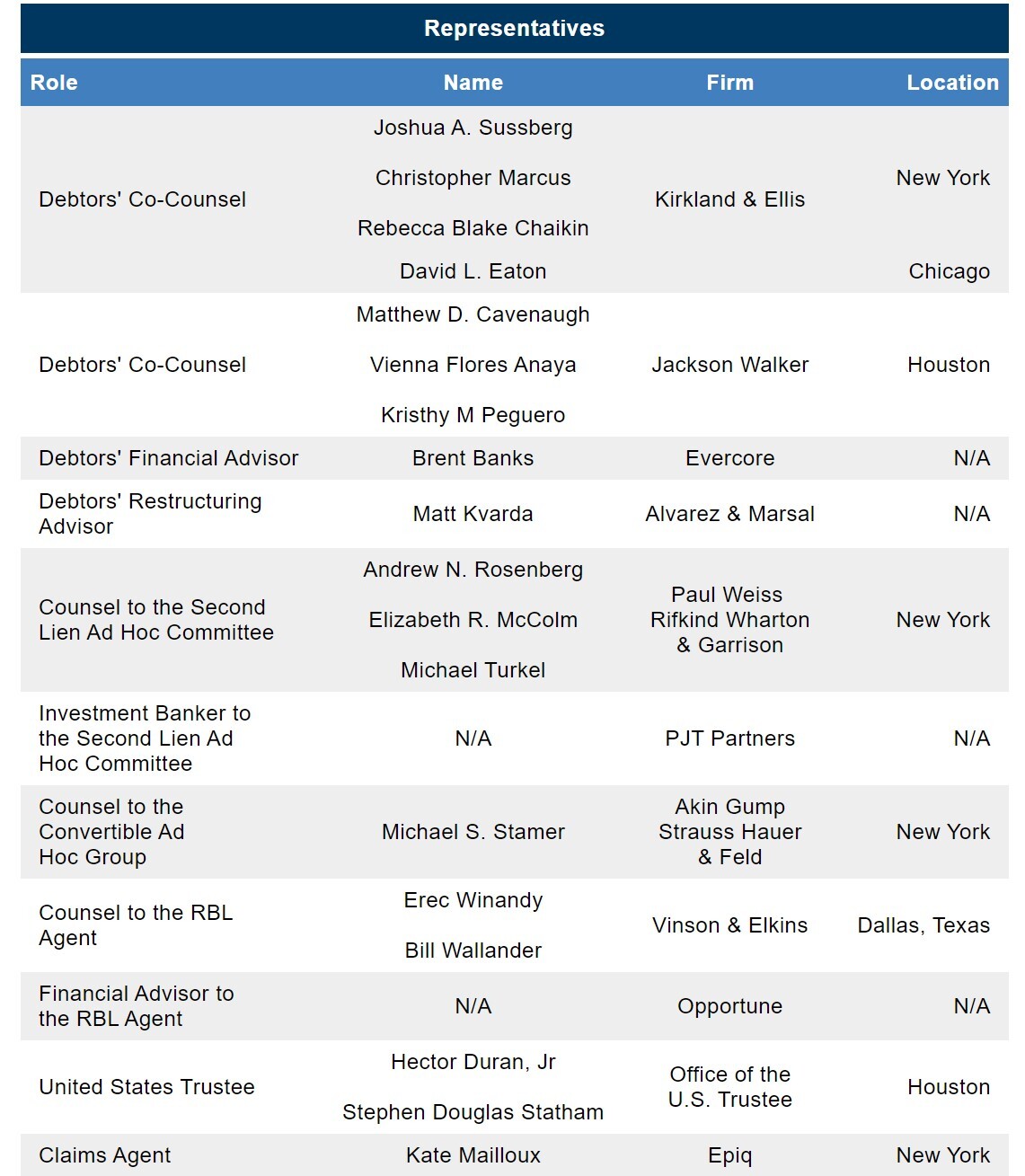

The case representatives are as follows:

Plan of Reorganization

Classification and Treatment of Claims and Interests

The RSA plan includes the following summary of the classification of claims and voting rights:

The DS provides the following expected recoveries for each class:

The plan provides for the following treatment for each class of claims or interests:

Warrants

The Series A warrants would entitle holders to purchase up to 5% of reorganized equity, and the Series B warrants would entitle holders to purchase up to 3%. The strike price for the Series A warrants would be equal to the par value plus accrued and unpaid interest on the second lien notes as of July 30, less an $8 million prepayment of accrued and unpaid interest. For the Series B warrants, the strike price would be the value of all common shares issued pursuant to the plan and the Series A warrants plus accrued and unpaid interest for each of the second lien notes and the convertible notes as of July 30. The Series A warrants would expire in five years and the Series B warrants in three years.

Management Incentive Plan

Under the plan, the reorganized debtors would reserve up to 10% of reorganized equity for participants in a management incentive plan. The MIP would dilute all reorganized equity equally. A portion of the equity pool would be granted no later than 60 days following the effective date, with the remainder available for future grants on terms to be determined by the new board in consultation with the CEO and CFO.

Corporate Governance

Under the plan, the reorganized debtors would have an initial board of directors consisting of:

Each board member other than the CEO would satisfy the independence requirements of the New York Stock Exchange, according to the corporate governance term sheet.

Other Plan Provisions

The plan includes typical release and exculpation provisions in favor of the debtors, RBL lenders and agent, second lien noteholders and trustee, convertible noteholders and trustee, subordinated noteholders and trustee, ad hoc committees, DIP and exit facility lenders and agents and their respective representatives and professionals.

DIP Facility and Cash Collateral Motion

The $615 million “DIP-to-Exit Facility” includes new-money commitments and a rollup of existing prepetition loans and $100 million of letter of credit capacity during the pendency of the chapter 11 cases. The new-money commitment would be the difference between $614 million and the rollup amount. Upon entry of the interim DIP order, the debtors seek to “roll up” $185 million of the prepetition RBL facility and all prepetition letters of credit. In addition the debtors would have access to an incremental $25 million of new-money commitments. Upon entry of the Final DIP Order, the remaining principal amount of all outstanding prepetition loans under the RBL Facility (other than $1 million) shall be deemed to be refinanced under the DIP Facility. The remaining prepetition loans would be rolled up upon entry of the final order. Available letter of credit capacity would be $100 million.

The DIP would mature on July 30, 2021, and pay interest based on LIBOR, subject to a 1% floor, plus 3% to 4%, or using the alternate base rate, as defined in the term sheet, plus 2% to 3%. The DIP lenders would also receive a stepped commitment fee, as set forth below:

The DIP provides for a 2% default premium.

The borrowing base would be set at $615 million as of the closing date based on the Dec. 31, 2019, reserve report, with redeterminations to occur on Jan. 1, 2021, and July 1, 2021.

The DIP proceeds would be used to pay fees, interest and expenses associated with the DIP facility, provide for the ongoing working capital and capital expenditure needs of the debtors, fund any approved adequate protection payments, fund administrative expenses and roll up the prepetition secured indebtedness. The DIP provides for a post-default carve-out of $2.75 million for professional fees and $50,000 for the fees of the Office of the U.S. Trustee.

As adequate protection, the prepetition lenders would receive replacement liens and security interests in the DIP collateral junior to the DIP liens, payment of fees and costs and superpriority administrative expense claims.

The debtors filed declarations by Brent Banks, managing director of Evercore, and Matt Kvarda, managing director of Alvarez & Marsal, in support of the DIP motion.

The debtors filed the attached DIP budget which can be found HERE.

Exit Facility

On July 28, the company entered into an exit commitment letter with consenting RBL lenders under which the RBL lenders have agreed to provide an exit facility of up to $615 million (subject to an initial borrowing base redetermination at the closing) that would refinance the DIP facility on a dollar-for-dollar basis. The exit facility would include $100 million in letter of credit availability. All outstanding DIP letters of credit would be deemed issued under the exit facility, and all outstanding DIP hedges would be deemed included in the exit facility.

The exit facility lenders consist of JPMorgan, Bank of America, Wells Fargo Bank, Capital One, Credit Suisse, RBC, ABN Amro Capital USA, Comerica Bank, Canadian Imperial Bank of Commerce, ING Capital, Truist Bank, KeyBank, Fifth Third Bank and Goldman Sachs.

The exit revolving facility would mature 42 months after the petition date and would bear interest based on LIBOR, subject to a 1% floor, plus 3% to 4%, following the same methodology on usage based on the borrowing base as the DIP, or using the alternate base rate, as defined in the term sheet, plus 2% to 3%. The exit facility also contemplates the following stepped commitment fee structure:

The exit revolving facility would provide for a default premium of 2%.

Financial covenants for exit facility include:

RSA Milestones

The RSA includes the following milestones:

Other Motions

The debtor[s] also filed various standard first day motions, including the following:

Voluntary Petition

Press Release

First Day Declaration

DIP Financing Motion

Disclosure Statement

Plan of Reorganization

8-K

The above Related Documents link to content that is only available to current Americas Core Credit by Reorg clients and trialists. Please request access to view the documents.

As expected, Denbury Resources Inc., a Plano, Texas-based hydrocarbon exploration company, and several affiliates filed petitions on Thursday evening, reporting between $1 and $10 billion in both assets and liabilities as of July 30. The case has been assigned to Judge David Jones (case No. 20-33801). Continue reading for the Americas Core Credit by Reorg team's analysis of the company's bankruptcy filing.

The debtors are pursuing a prepackaged plan pursuant to a restructuring support agreement which according to the disclosure statement is supported by holders of 100% of loans outstanding under the secured revolver, approximately 67.2% of the second lien notes and 70.8% of convertible notes. Key terms of the plan include:

- The RBL facility would be rolled up into a postpetition revolver and, upon emergence, into a new, fully committed reserve-based revolving exit facility with initial availability of up to $615 million.

- Second lien noteholders would receive 95% of reorganized equity (subject to dilution by warrants and a management incentive plan of up to 10% of reorganized equity).

- Convertible noteholders would receive 5% of reorganized equity (subject to dilution by warrants and the MIP) and 100% of the Series A warrants.

- Subordinated noteholders would receive 54.55% of the Series B warrants if the class of subordinated notes claims votes to accept the plan.

- General unsecured claims would receive cash or other treatment sufficient to render their claims unimpaired.

- Existing equityholders would receive 45.45% of the Series B warrants if subordinated noteholders and equityholders vote to accept the plan.

The company’s prepetition capital structure is as follows:

The pipeline lease is with Genesis NEJD Pipeline LLC, as lessor. The pipeline lease is guaranteed by Denbury and secured by (i) the NEJD Pipeline, (ii) all proceeds from the sale of the NEJD Pipeline and (iii) all rents, income or related fees for transportation of CO2 or any other substance through the NEJD Pipeline.

As of July 30, the debtors also have derivative contracts which represent a net asset of approximately $40 million on a mark-to-market basis. The debtors seek authorization to maintain their prepetition hedge contracts and enter into postpetition hedges in the ordinary course of business.

The first day hearing has been scheduled for today, Friday, July 31 at 8:30 a.m. ET. The debtors propose the following confirmation schedule, including a combined DS and confirmation hearing on Sept. 3:

The company attributes the bankruptcy filing to “prolonged market decline and industry- specific challenges.” According to the first day declaration of CEO Chris Kendall, the company had avoided chapter 11 bankruptcy during the 2015-2016 downturn in oil prices by “aggressively” undertaking a “variety of liability management efforts, including reducing debt, raising capital, optimizing operations and reducing expenses.” Although it ended 2019 with zero drawn on its revolver and entered 2020 with cash flow positive operations, the “one-two punch” in March 2018 of the Covid-19 pandemic and the Russia/OPEC price war caused prices to plummet. As a result, Kendall states, “Denbury came to the conclusion that incremental liquidity management strategies alone would not suffice and that a comprehensive balance sheet restructuring was required to enable the Company to endure over the long term.”

An organization chart is as follows:

The petition lists the following funds and entities as owners of 5% or more of the voting securities of the debtor:

The debtors are represented by Kirkland & Ellis LLP and Jackson Walker LLP as co-counsel, Evercore as financial advisor and Alvarez & Marsal as restructuring advisor. KPMG and PricewaterhouseCoopers are tax advisors to the debtors. Epiq is claims agent. According to the RSA, the second lien ad hoc committee is represented by Paul Weiss as legal advisor and PJT as investment banker. The convertible notes ad hoc group is represented by Akin Gump, and consenting RBL lenders are represented by Vinson & Elkins as counsel and Opportune as financial advisor.

Background

Denbury, initially a Canadian company, moved its corporate domicile to the U.S. in 1999 as a Delaware corporation. Denbury Offshore LLC, a Delaware limited liability company, became the primary operating entity in December 2003 and today holds the majority of the debtors’ assets and employees, according to CEO Kendall’s first day declaration. Its operations are focused on the development of oil fields in regions in the U.S. - the Rocky Mountains and the Gulf Coast. Kendall’s declaration states that Denbury’s oil and gas assets are primarily “mature, liquids-rich oil fields,” consisting of approximately 2,956 gross (2,197 net) producing wells, with 951,711 gross (510,602 net) total acres under lease. As of Dec. 31, 2019, the debtors had estimated proved developed reserves of approximately 206.9 MMboe of oil and condensate, natural gas and NGLs (based on SEC parameters). In 2019, Kendall states, the debtors’ total production was 21,248 Mboe and adjusted EBITDAX was $607 million. A map illustrating Denbury’s assets is below:

Kendall states that the debtors’ primary focus is on CO2-enhanced oil recovery (CO2 EOR), which is an “efficient means of tertiary recovery that can result in the recovery of crude oil volumes rivaling primary and secondary recovery, and which generates the majority of the Debtors’ oil production revenue.” CO2 enhanced oil recovery, Kendall explains, “involves injecting CO2 into underground rock formations to act somewhat like a solvent for oil, removing it from the oil-bearing formation as the CO2 travels through the reservoir rock. This process can recover, on average, an additional 10% to 20% of the original oil in place.” The debtors’ properties that use EOR include interests in 14 Gulf Coast fields and three in the Rocky Mountains, including the development of a new CO2 flood at the Cedar Creek Anticline oilfield, which the debtors anticipate could be ready for injections in 2023. The debtors’ vision, Kendall states, “is to be recognized as the world leader in CO2 Enhanced Oil Recovery.”

In the wake of the oil price collapse that began in late 2014, the debtors, beginning in 2016, “completed a number of deleveraging transactions to manage their liabilities in a sustained low oil price environment, issuing $450 million of new notes to facilitate an RBL extension, and conducting numerous open-market repurchase transactions to reduce leverage and extend runway,” according to Kendall, with eight “significant’ transactions in 2018 and 2019, as depicted below:

The debtors intended to continue such liability management and liquidity enhancement efforts through 2020 to further right-size their capital structure, Kendall states: “Indeed, in late 2019 and early 2020, the Company and its legal and financial advisors were exploring several potential opportunities to address the Company’s balance sheet out of court.” However, crude oil prices plunged in the wake of the Covid-19 pandemic and the price war between OPEC nations and Russia, with West Texas intermediate on April 20 falling more than 300% to below zero for the first time in his history. While oil prices have “partially” rebounded from these record lows and are “hovering” around $41/bbl, this level is still some 30% below average oil prices for the preceding 24 months, Kendall states. These low oil prices and volatility are likely to continue over the near and long term, he states, noting that an alliance of OPEC nations led by Saudi Arabia have agreed to increase oil production starting in August.

The debtors significantly cut planned 2020 capex in March and in May implemented a reduction in force, including furloughing certain employees for several months. However, Kendall states, “the Company’s leverage remains elevated and the Debtors face a substantial maturity wall in 2021, with the need to address approximately $636 million in maturities for certain Second Lien Notes and Senior Subordinated Notes. The yields on the Company’s notes indicate that a regular-way refinancing is unlikely without dramatic improvements in oil prices. If current market conditions persist, the Debtors will not be able to continue to service their $165 million in aggregate interest payments due annually under the Company’s notes.”

In March, Kendall states, “recognizing the need for a long term solution,” the debtors directed their advisors Kirkland & Ellis and Evercore to explore strategic alternatives that included a comprehensive restructuring, and in May they retained Alvarez & Marsal as restructuring advisor.

Included in cleansing materials filed on July 29, Denbury provides the following projections based on the following commodity price curves:

The company estimates EBITDAX, using strip prices, to decline to $231 million in 2021 and then increasing to $249 million by 2024. Additionally, because of slowly increasing capital spending to $188 million by 2023, unlevered free cash flow is projected to fall each year until reaching $49 million in 2023.

Under the higher Bloomberg consensus price scenario in which oil prices reach $50 by 2022 and rise to $60.75 by 2024, Denbury accelerates capital spending to $331 million by 2022. Denbury states that the Bloomberg case assumes that development of its CCA CO2 pipeline starts in March 2022. Denbury says that its Cedar Creek Anticline development would require development capital of $150 million and a $150 million CO2 pipeline.

The company shows its reserves summary under strip pricing with a PV-10 of $1.15 billion and a PV-15 of $966 million. Under the Bloomberg case, Denbury’s PV-10 is $2.1 billion, and its PV-15 is $1.7 billion.

(Click HERE to enlarge.)

The debtors’ largest unsecured creditors are listed below:

The case representatives are as follows:

Plan of Reorganization

Classification and Treatment of Claims and Interests

The RSA plan includes the following summary of the classification of claims and voting rights:

The DS provides the following expected recoveries for each class:

The plan provides for the following treatment for each class of claims or interests:

- Class 1 - Other secured claims: Each holder of an allowed other secured claim would receive, at the debtors’ option, either payment in full in cash, return of the collateral securing its claim, reinstatement of its claim or such other treatment that renders its claim unimpaired.

- Class 2 - Other priority claims: Each holder of an allowed other priority claim would receive, at the debtors’ option, either payment in full in cash or such other treatment that renders its claim unimpaired.

- Class 3 - Pipeline lease claims: Each holder of an allowed pipeline lease claim would receive, at the debtors’ option, either payment in full in cash, return of the collateral securing its claim, reinstatement of its claim or such other treatment that renders its claim unimpaired.

- Class 4 - RBL claims and hedge claims: Each holder of an allowed RBL claim or allowed hedge claim would receive payment in full in cash or such other treatment renders its claim unimpaired.

- On the effective date, RBL claims would be allowed “in the aggregate principal amount of not less than [*], plus any accrued and unpaid interest while hedge claims will be allowed in the aggregate principal amount of not less than [*], plus any unpaid fees and expenses.”

- Class 5 - Second lien notes claims: Each holder of an allowed second lien notes claim would receive a pro rata share of 95% of reorganized equity, subject to dilution by the warrants and the MIP.

- On the effective date, second lien notes claims would be allowed “in the aggregate principal amount of not less than [$1,592,839,000] plus any accrued and unpaid interest.”

- Class 6 - Convertible notes claims: Each holder of an allowed convertible notes claim would receive its pro rata share of 5% of reorganized equity, subject to dilution by the warrants and MIP, plus 100% of the Series A warrants.

- On the effective date, convertible notes claims would be allowed “in the aggregate principal amount of not less than [$225,663,000] plus any accrued and unpaid interest.”

- Class 7 - Subordinated notes claims: If this class votes to accept the plan, each holder of an allowed subordinated notes claim would receive its pro rata share of 54.55% of the Series B warrants.

- If the class votes to reject the plan, holders of subordinated notes claims would not receive any distribution, and such claims would be canceled.

- On the effective date, subordinated notes claims would be allowed “in the aggregate principal amount of not less than [$245,690,000], plus any accrued and unpaid interest.”

- Class 8 - General unsecured claims: Each holder of an allowed general unsecured claim would receive, at the debtors’ option, either payment in full in cash, reinstatement or such other treatment that renders its claim unimpaired.

- Class 9 - Intercompany claims: Each allowed intercompany claim would be, at the debtors’ option, either reinstated, canceled, released and extinguished or otherwise addressed at the option of each applicable debtor, such that holders of such claims will not receive any distribution on account of such claims.

- Class 10 - Intercompany interests: On the effective date, each intercompany interest would be reinstated or canceled, with no distribution made on account of such interest.

- Class 11 - Existing equity interests: If this class and Class 7 (subordinated notes claims) vote to accept the plan, each holder of an existing equity interest would receive its pro rata share of 45.45% of the Series B warrants.

- If either this class or Class 7 vote to reject the plan, holders of equity interests would not receive any distribution, and such interests would be canceled.

Warrants

The Series A warrants would entitle holders to purchase up to 5% of reorganized equity, and the Series B warrants would entitle holders to purchase up to 3%. The strike price for the Series A warrants would be equal to the par value plus accrued and unpaid interest on the second lien notes as of July 30, less an $8 million prepayment of accrued and unpaid interest. For the Series B warrants, the strike price would be the value of all common shares issued pursuant to the plan and the Series A warrants plus accrued and unpaid interest for each of the second lien notes and the convertible notes as of July 30. The Series A warrants would expire in five years and the Series B warrants in three years.

Management Incentive Plan

Under the plan, the reorganized debtors would reserve up to 10% of reorganized equity for participants in a management incentive plan. The MIP would dilute all reorganized equity equally. A portion of the equity pool would be granted no later than 60 days following the effective date, with the remainder available for future grants on terms to be determined by the new board in consultation with the CEO and CFO.

Corporate Governance

Under the plan, the reorganized debtors would have an initial board of directors consisting of:

- The CEO;

- Two directors selected by Fidelity;

- One director selected by GoldenTree Asset Management; and

- Three directors “or such other number” to be determined by the required consenting second lien noteholders, to be selected by the second lien ad hoc committee.

Each board member other than the CEO would satisfy the independence requirements of the New York Stock Exchange, according to the corporate governance term sheet.

Other Plan Provisions

The plan includes typical release and exculpation provisions in favor of the debtors, RBL lenders and agent, second lien noteholders and trustee, convertible noteholders and trustee, subordinated noteholders and trustee, ad hoc committees, DIP and exit facility lenders and agents and their respective representatives and professionals.

DIP Facility and Cash Collateral Motion

The $615 million “DIP-to-Exit Facility” includes new-money commitments and a rollup of existing prepetition loans and $100 million of letter of credit capacity during the pendency of the chapter 11 cases. The new-money commitment would be the difference between $614 million and the rollup amount. Upon entry of the interim DIP order, the debtors seek to “roll up” $185 million of the prepetition RBL facility and all prepetition letters of credit. In addition the debtors would have access to an incremental $25 million of new-money commitments. Upon entry of the Final DIP Order, the remaining principal amount of all outstanding prepetition loans under the RBL Facility (other than $1 million) shall be deemed to be refinanced under the DIP Facility. The remaining prepetition loans would be rolled up upon entry of the final order. Available letter of credit capacity would be $100 million.

The DIP would mature on July 30, 2021, and pay interest based on LIBOR, subject to a 1% floor, plus 3% to 4%, or using the alternate base rate, as defined in the term sheet, plus 2% to 3%. The DIP lenders would also receive a stepped commitment fee, as set forth below:

The DIP provides for a 2% default premium.

The borrowing base would be set at $615 million as of the closing date based on the Dec. 31, 2019, reserve report, with redeterminations to occur on Jan. 1, 2021, and July 1, 2021.

The DIP proceeds would be used to pay fees, interest and expenses associated with the DIP facility, provide for the ongoing working capital and capital expenditure needs of the debtors, fund any approved adequate protection payments, fund administrative expenses and roll up the prepetition secured indebtedness. The DIP provides for a post-default carve-out of $2.75 million for professional fees and $50,000 for the fees of the Office of the U.S. Trustee.

As adequate protection, the prepetition lenders would receive replacement liens and security interests in the DIP collateral junior to the DIP liens, payment of fees and costs and superpriority administrative expense claims.

The debtors filed declarations by Brent Banks, managing director of Evercore, and Matt Kvarda, managing director of Alvarez & Marsal, in support of the DIP motion.

The debtors filed the attached DIP budget which can be found HERE.

Exit Facility

On July 28, the company entered into an exit commitment letter with consenting RBL lenders under which the RBL lenders have agreed to provide an exit facility of up to $615 million (subject to an initial borrowing base redetermination at the closing) that would refinance the DIP facility on a dollar-for-dollar basis. The exit facility would include $100 million in letter of credit availability. All outstanding DIP letters of credit would be deemed issued under the exit facility, and all outstanding DIP hedges would be deemed included in the exit facility.

The exit facility lenders consist of JPMorgan, Bank of America, Wells Fargo Bank, Capital One, Credit Suisse, RBC, ABN Amro Capital USA, Comerica Bank, Canadian Imperial Bank of Commerce, ING Capital, Truist Bank, KeyBank, Fifth Third Bank and Goldman Sachs.

The exit revolving facility would mature 42 months after the petition date and would bear interest based on LIBOR, subject to a 1% floor, plus 3% to 4%, following the same methodology on usage based on the borrowing base as the DIP, or using the alternate base rate, as defined in the term sheet, plus 2% to 3%. The exit facility also contemplates the following stepped commitment fee structure:

The exit revolving facility would provide for a default premium of 2%.

Financial covenants for exit facility include:

- A maximum ratio of consolidated total debt to consolidated EBITDAX for the most recently completed four fiscal quarter period not to exceed 3.5 to 1; and

- A minimum ratio of consolidated current assets to consolidated current liabilities as of the most recently completed fiscal quarter of 1 to 1.

RSA Milestones

The RSA includes the following milestones:

- July 29: Commencement of solicitation on the plan;

- July 30: Deadline to file plan and disclosure statement;

- Aug. 1: Deadline for interim DIP approval;

- Sept. 6: Deadline for approval of the disclosure statement and confirmation of the plan;

- Earlier of entry of the confirmation order or 35 days from petition date: Deadline for final approval of DIP facility; and

- 14 days after confirmation: Deadline for plan to go effective.

Other Motions

The debtor[s] also filed various standard first day motions, including the following:

- Motion for Joint Administration

- The cases will be jointly administered under case No. 20-33801.

- Motion to Pay Specified Lienholder and Trade Claims

- Denbury seeks authority to pay approximately $40 million of undisputed, prepetition oil and gas operating expenses as they become due in the ordinary course “and to continue paying [such expenses] in the ordinary course of business on a postpetition basis.”

- Motion to Establish Trading Procedures

- The debtors seek to establish trading procedures for its common stock, to be able to object to and prevent transfers if necessary to preserve net operating losses. As of Dec. 31, 2019, the debtors estimate that they have state NOLs and credits of approximately $52.9 million, credit carryforwards of approximately $77.5 million, business interest carryforwards under section 163(j) of the IRC of approximately $24.5 million and tax basis in the debtors’ assets of $2 billion.

- Motion to Pay Employee Wages and Benefits

- As of the petition date, the debtors believe that there are approximately $810,000 in accrued but unpaid wages outstanding and approximately $5 million on account of services rendered by the independent contractors and temporary workers prior to the petition date that the debtors intend to pay in the ordinary course of business. Among other obligations, the debtors also estimate that as of the petition date, there are approximately $1.8 million, including fees owed to UHC, Express Scripts, and Teladoc, in outstanding obligations on account of the medical and dental plans and pharmacy benefits.

- Motion to Use Cash Management System

- The company has bank accounts with JPMorgan, Wells Fargo NA, Bank of America NA, Merrill Lynch and Arden Trust Co.

- Motion to Maintain Insurance Programs

- As of the petition date, the debtors estimate that there are no accrued but unpaid obligations on account of the insurance premiums.

- Motion to Pay Taxes and Fees

- As of the petition date, the debtors estimate that there are approximately $25.9 million of obligations on account of accrued and unpaid taxes and fees that will become due and payable in the ordinary course postpetition or in connection with certain audits.

- Motion to Provide Utilities With Adequate Assurance

- To provide additional assurance of payment, the debtors propose to deposit into a segregated account $3.3 million, which represents an amount equal to approximately one-half of the Debtors’ average monthly cost of utility services, calculated on the basis of the debtors’ average utility expenses for the 12-month period ended June 30, 2020, net of any prepetition deposits provided to the Utility Providers in the ordinary course of business.

- Application to Appoint Epiq as Claims Agent / Order Appoint Epiq as Claims Agent

- Motion to Pay Mineral Payments and Working Interest Disbursements

- Motion to Continue Surety Bond Program

- Motion to Perform Under, Postpetition Hedges

Editors' Note: This story has been revised to include a list of professionals working in the cases and top unsecured creditors.

This article is an example of the content you may receive if you subscribe to a product of Reorg Research, Inc. or one of its affiliates (collectively, “Reorg”). The information contained herein should not be construed as legal, investment, accounting or other professional services advice on any subject. Reorg, its affiliates, officers, directors, partners and employees expressly disclaim all liability in respect to actions taken or not taken based on any or all the contents of this publication. Copyright © 2024 Reorg Research, Inc. All rights reserved.